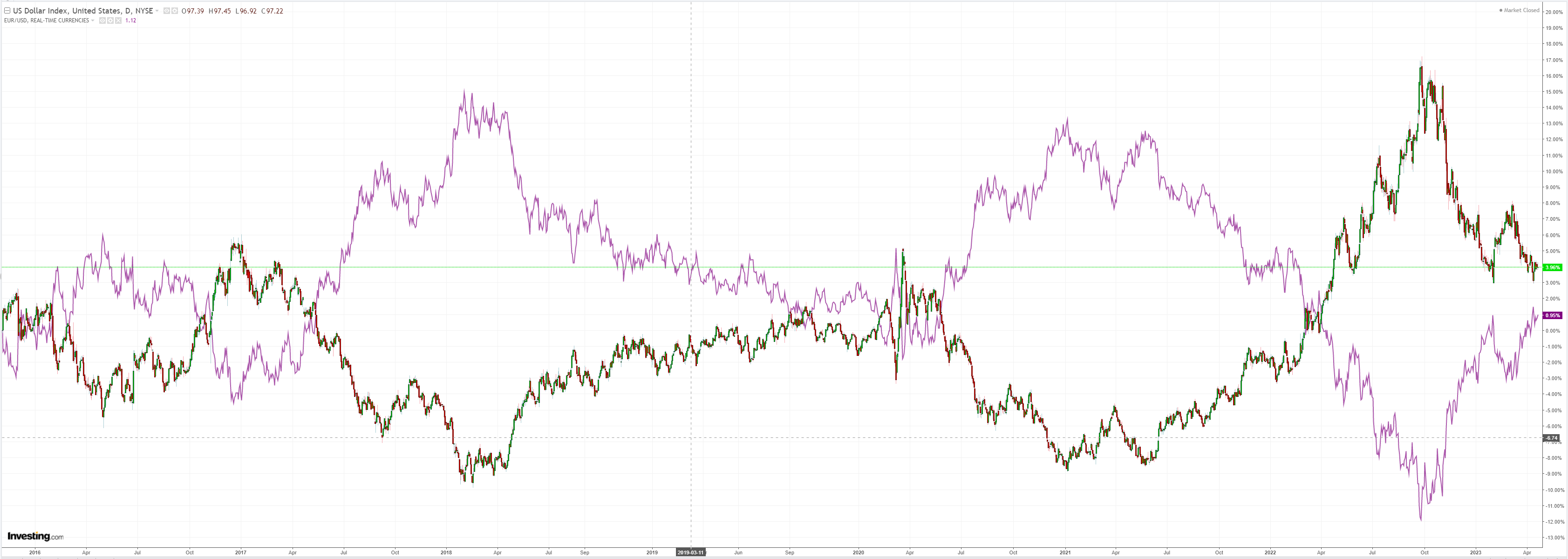

DXY was soft Friday night:

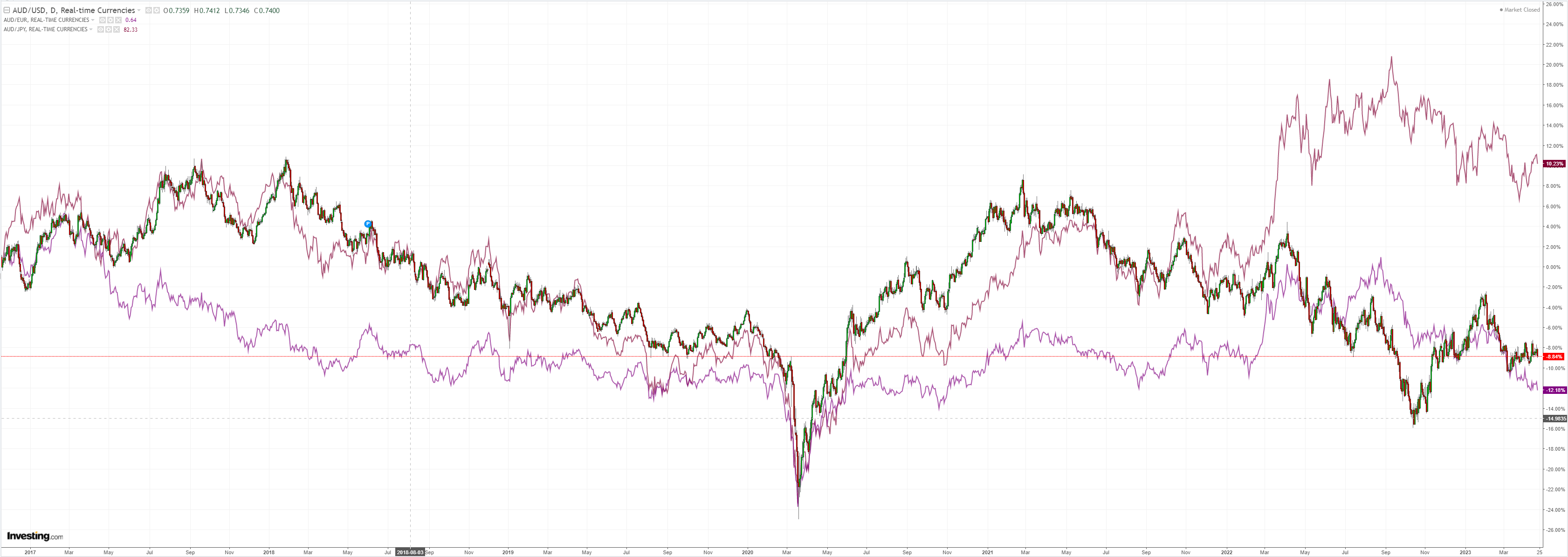

AUD was thumped across the board:

Oil confirmed global recession is the base case. Gold tired:

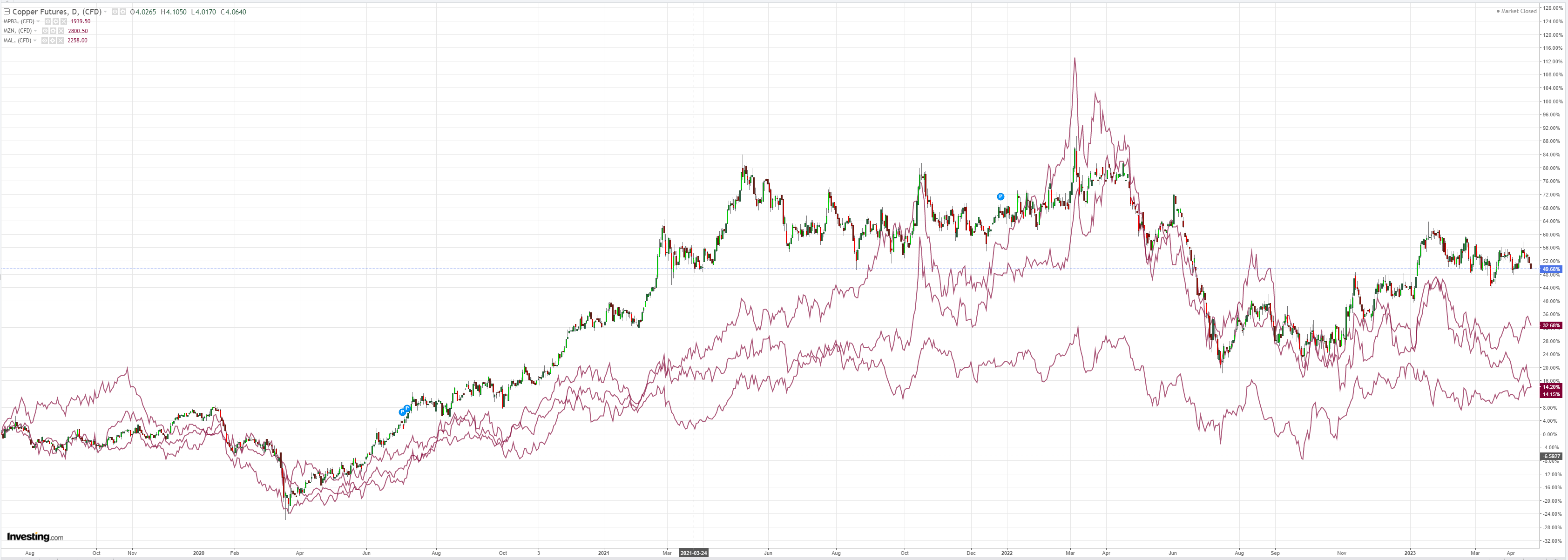

Dirt is weakening:

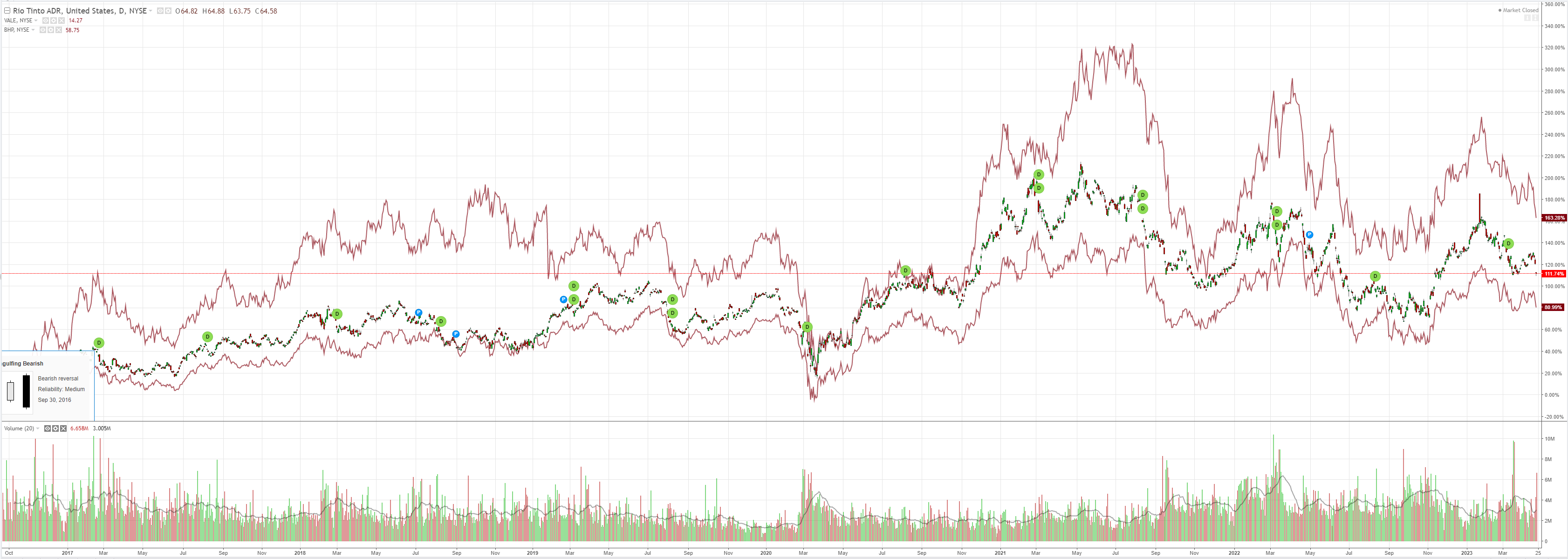

Free falling big miners are at critical support:

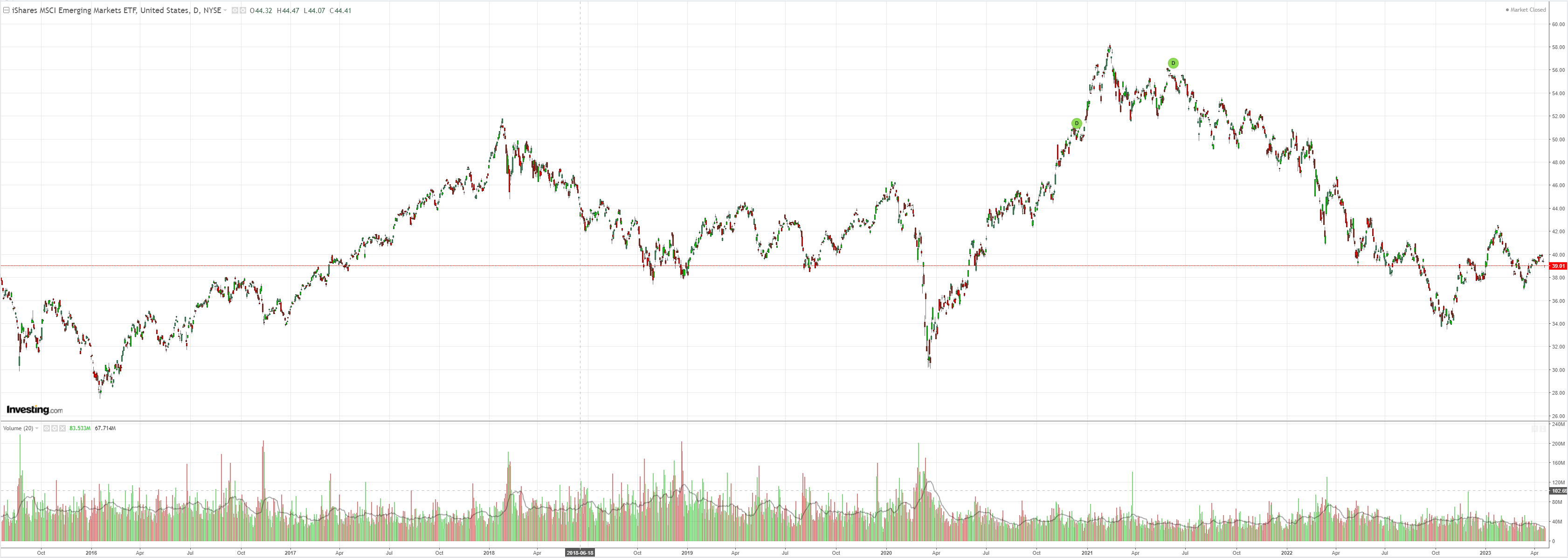

EM stocks don’t look well either:

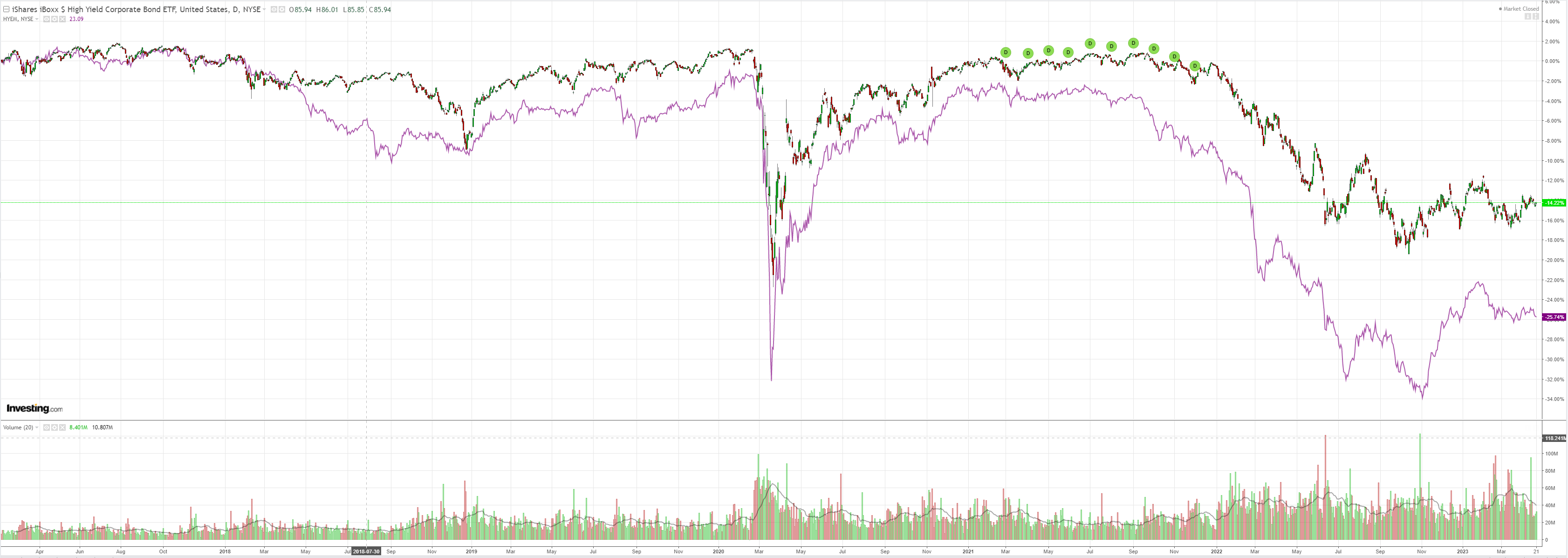

Junk faded:

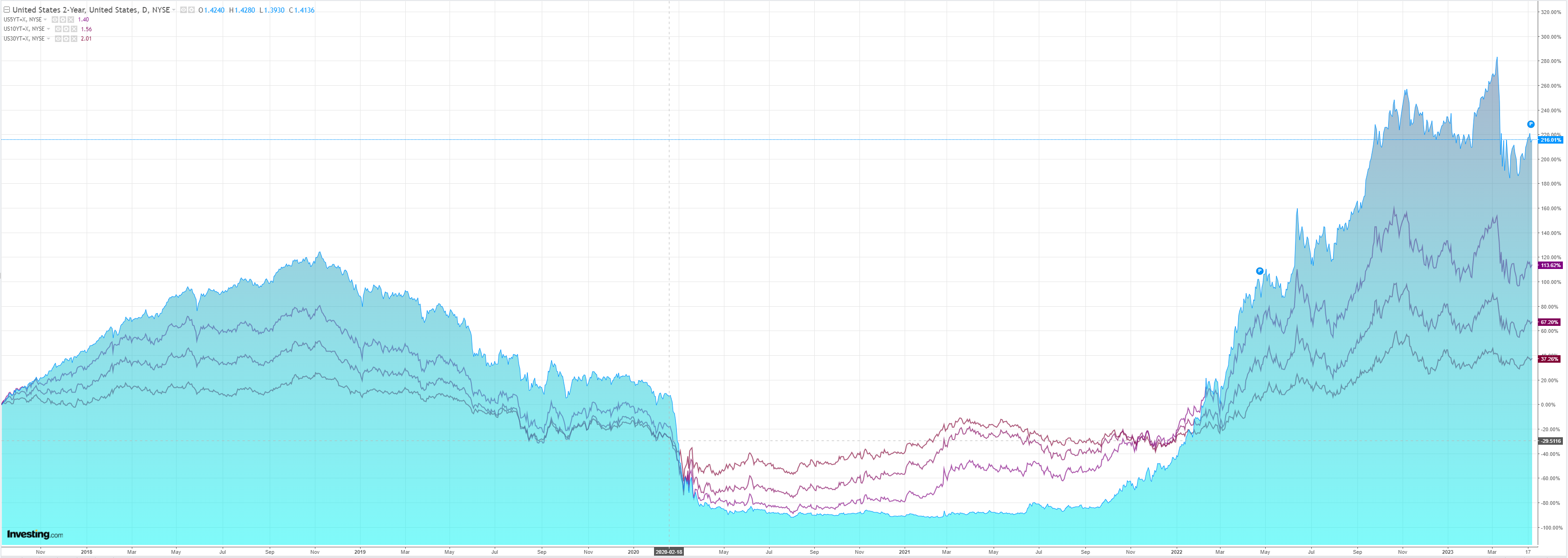

Yields firmed:

Stock fell except in Europe where they only go up:

Credit Agricole wraps the building nerves.

USD: the debt is the ceiling

After the end of the US tax season on 18 April, the FX markets should get more clarity in coming days on the timing of the so-called ‘date-x’ when the US Treasury would run out of money to service its financial obligations and thus force the US Congress to decide on whether to raise or suspend the debt ceiling. According to earlier estimates, ‘date-x’ was expected to come in July/August but the latest refund data could potentially bring that forward to June. The recent jump in the 3M

T-Bills yield has signalled the growing market uncertainty, especially given that the Democrats and the Republicans still seem to be at odds about a potential resolution, with the latter pushing for fresh fiscal austerity measures in exchange for a bipartisan debt ceiling deal. We continue to expect that a compromise would be found but worry that it could come after further negotiations and even a potential government shutdown that could fuel political uncertainty and thus market volatility.

Historically, the months preceding a debt ceiling resolution have been negative for both the USD and risk sentiment, leaving the likes of XAU, CHF and JPY as the best performers. That being said, we also note that when debt ceiling debacles coincided with persistent US data weakness and even a US recession, the USD has emerged as the best performing currency. These considerations make us maintain our broadly constructive outlook on the USD for the next three months.

US recession fears and the safe-haven USD

The USD has been following US rates and yields of late, trading range-boundacross the board. In turn, this reflected the fact that abating concerns about the US

banking sector have given the currency a rate boost earlier in the week before weak US data (eg, yesterday’s Leading economic index for March) brought it under renewed pressure more recently. It is worth highlighting in that, however, that the weak US data further weighed on global stocks, suggesting that growing market recession fears could start boosting the safe-haven appeal of the USD. On the day, focus will be on the US PMI data for April as well as speeches by the Fed’s Patrick Harker and Lisa Cook. Potential data disappointments today could weigh on both US yields and global stocks and thus weigh on the USD mainly vs safe-haven currency while supporting it vs the risk-correlated G10 currencies. Furthermore, we also think that evidence that the Fed remains committed to its hawkish policy stance despite the softer US data of late could weigh on risk sentiment in a boost to the safe-haven USD.

Can Europe decouple from a US recession?

Yesterday’s release of the US Economic leading index for March was the clearest signal yet that the US economy is sliding into a recession. One key question concerning the EUR/USD and GBP/USD outlook is whether Europe can decouple from a cyclical downturn on the other side of Atlantic. Recent history does not seem to support that view, suggesting instead that over the last 40 years, most US recessions either coincided with European recessions (1980, 1981, 2008 and 2020) or they preceded an economic contraction in Europe (1990). The exception was the 2001 US recession that coincided with stagnation in the Eurozone and an

expansion in the UK. A look at the FX performance around the past US recessions would further suggest that the EUR and GBP weakened by c.-1% on average in the early stages of the US recessions. We also note that the US outperformance has been more pronounced when a US recession coincided with growing fears about a debt ceiling crisis in the US Congress, as has been the case during the 2008 recession.

Nothing I disagree with there.