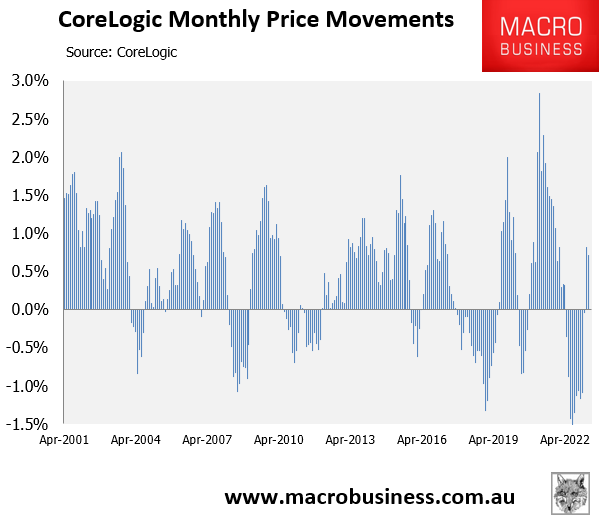

CoreLogic’s daily dwelling values index for April is out with values across the five major Australian capital city markets rising by 0.8% over the month – the second consecutive monthly increase:

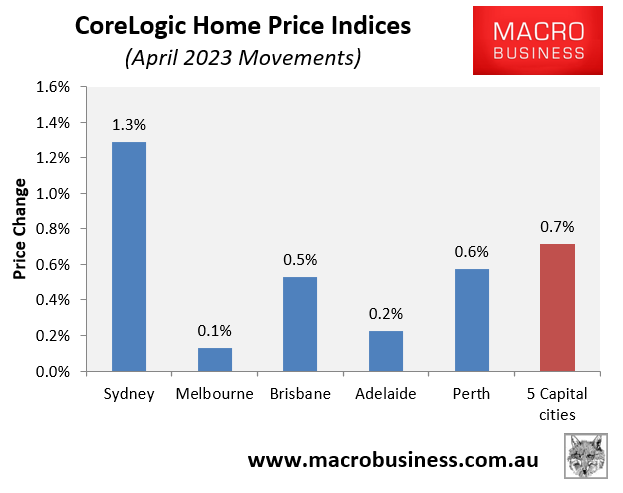

The increase in values was overwhelmingly driven by Sydney, where values jumped by 1.3% over April.

Melbourne (+0.1%), Brisbane (+0.5%), Adelaide (+0.2%) and Perth (+0.6%) also recorded rises over the month:

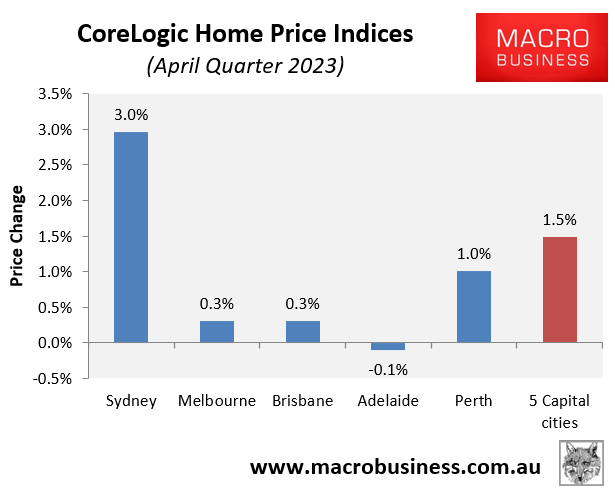

Over the April quarter, dwelling values rose by 1.5% at the 5-city aggregate level. This rise was again driven by Sydney, where values surged by 3.0%.

Dwelling values also rose over the quarter across Melbourne (+0.3%), Brisbane (+0.3%) and Perth (1.0%), whereas Adelaide home values fell slightly (-0.1%):

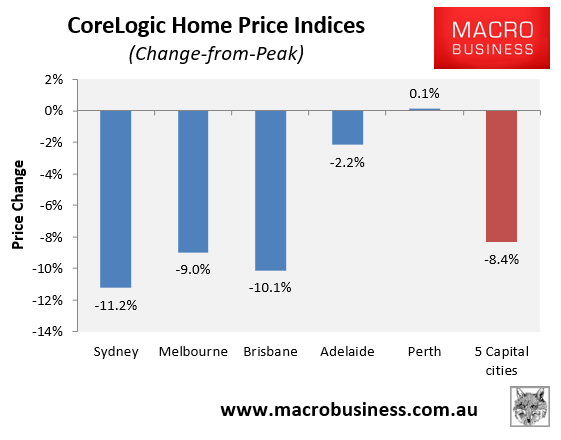

The next chart plots the decline from peak across the five major capital city markets:

Despite the latest bounce, values are still down 8.4% from their April 2022 peak at the 5-city aggregate level, driven by heavy falls across Sydney (-11.2%), Brisbane (-10.1%) and Melbourne (-9.0%).

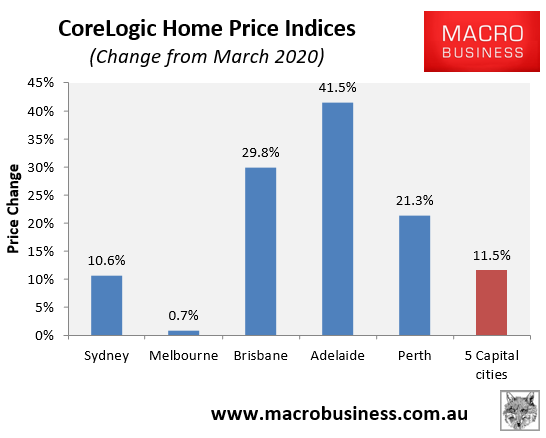

However, dwelling values are 11.5% higher than their pre-pandemic (March 2020) level at the 5-city level.

Brisbane (+29.8%), Adelaide (+41.5%) and Perth (+21.3%) have recorded exceptionally strong price gains since the pandemic began, whereas Sydney (+10.6%) has recorded sold growth and Melbourne values (+0.7%) are broadly flat:

My expectation is that Australian home values will continue to rise from here with value growth to accelerate into 2024 as the Reserve Bank of Australia begins cutting interest rates late in the year and APRA then reduces its 3% mortgage serviceability buffer.

By then, the ‘Fear of Missing Out’ (FOMO) created by unprecedented net overseas migration and a record tight rental market will coincide with rising borrowing capacity from falling interest rates and the lower mortgage serviceability buffer.

It will be a “perfect storm” for the housing market that will see values rise strongly in 2024, and will make Australia’s housing affordability crisis worse.