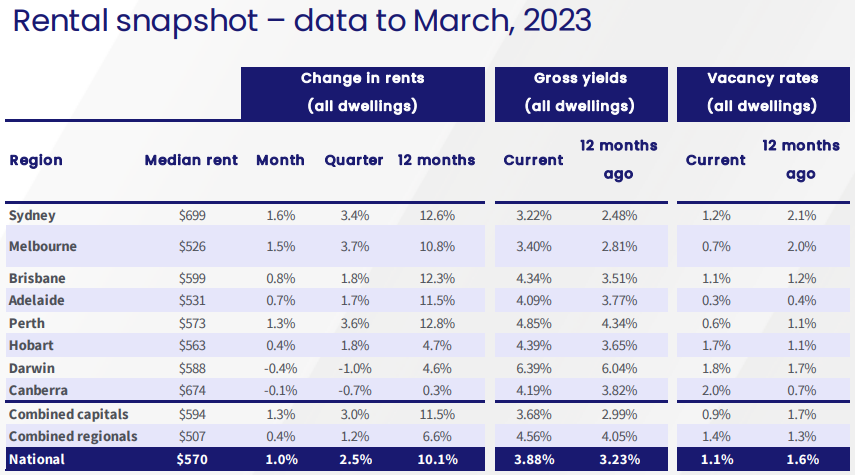

CoreLogic’s latest rental snapshot shows that capital city rents soared by 11.5% in the year to March, with double-digit rental growth recorded across each of the five major capitals:

The surge in rents has occurred on the back of a sharp fall in the vacancy rate to just 0.9%, which is around half the level of a year earlier (1.7%).

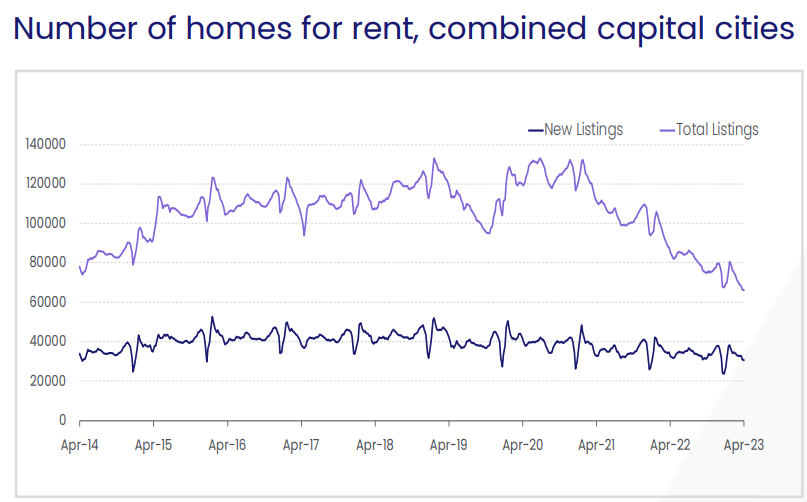

In line with the plunging vacancy rate, CoreLogic also reported that total rental listings across the combined capitals have fallen to at least a decade low:

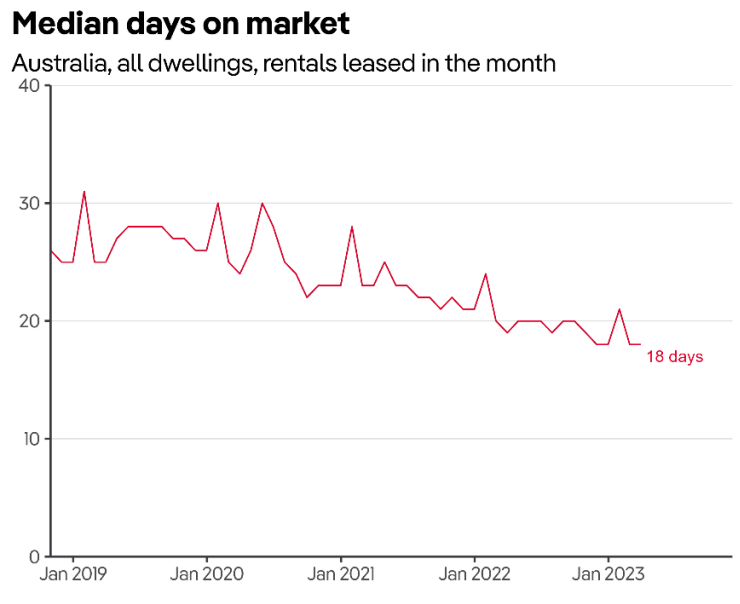

CoreLogic’s findings have been confirmed by new data from PropTrack, which shows that the median time a rental property was listed on realestate.com.au before being rented fell to just 18 days in March, an equal record low:

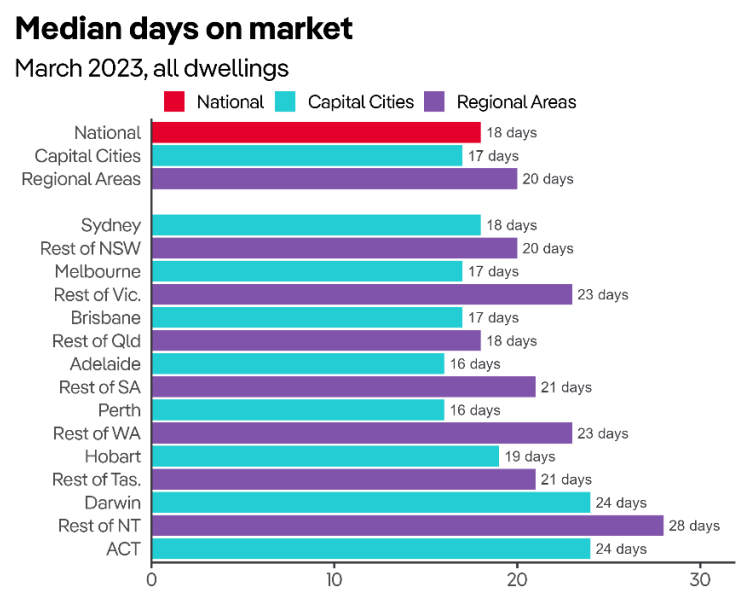

Days on market is significantly lower across the combined capital cities (17 days) than the regions (20 days), with the five largest capitals showing the most severe tightness:

In particular, rental markets in Melbourne and Sydney – which were weaker than other parts of the country during the pandemic – have tightened significantly in the past year, falling by 6 days in Melbourne and 4 days in Sydney.

With vacancy rates sitting at extremely low levels and rents growing rapidly, PropTrack “expect rentals will continue to be speedily snapped up this year, as renters compete for limited stock”.

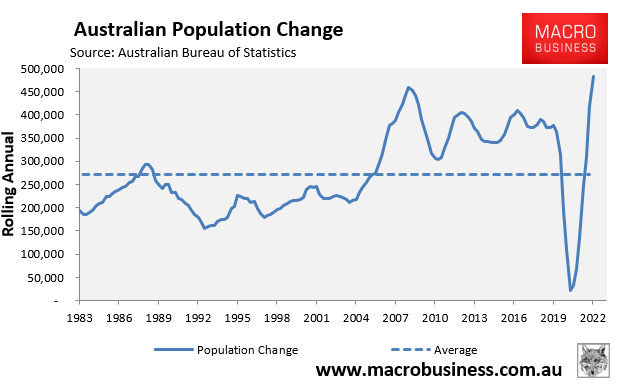

That’s what happens when Australia’s population grows at a record pace amid unprecedented immigration:

Where will the hundreds of thousands of migrants arriving live when there is already a critical shortage of rental homes for the current population?

Australia’s rental market will soon descend into the Hunger Games.