By Belinda Allen, Senior Economist at CBA:

Key Points:

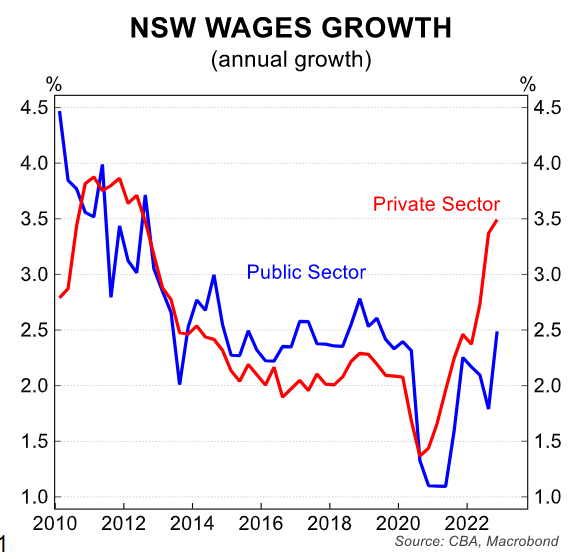

- There are signs that private sector wages growth could be flattening out, albeit at a much faster pace than pre pandemic.

- Public sector wages growth is set to lift from here as public sector wage caps are lifted and enterprise agreements renegotiated.

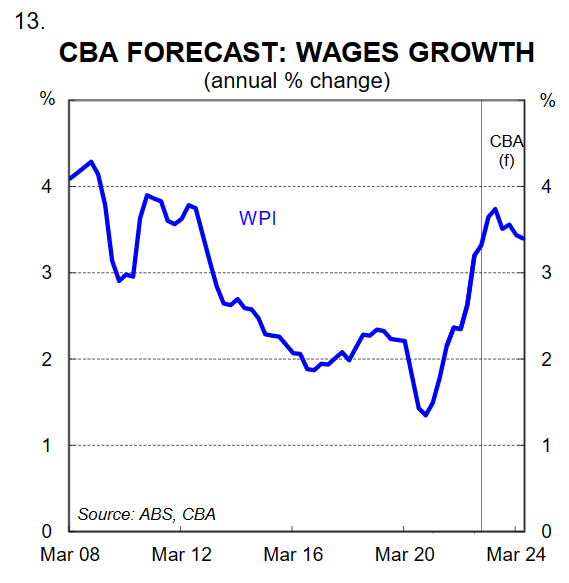

- We expect wages growth to reach 3¾% in mid-2023. This pace of wages growth is consistent with inflation returning to the RBA’s 2-3% target.

- There are currently no signs of a wage price spiral in Australia.

Overview:

The pace of wages growth is being watched heavily in Australia. The risk of a wage price spiral, similar to occurrences offshore, particularly the US, kept the Reserve Bank of Australia (RBA) hawkish at its first meeting of 2023 in February.

However a softer Q4 22Wage Price Index (WPI) released on 22 February led the RBA to shift its tune at the March Board Meeting, downplaying the risk of a wage price spiral.

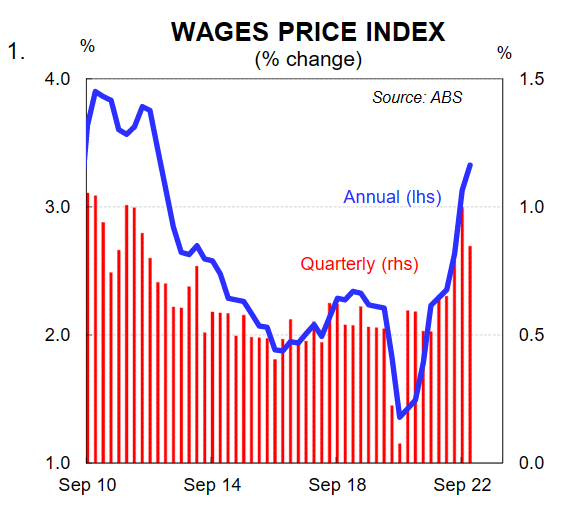

This ultimately contributed to the RBA pausing its interest rate hiking cycle in April. This shift was prompted by the December quarter WPI printing at 0.8%/qtr and 3.3%/yr (chart 1).

While this was the fastest annual pace of annual wages growth in 10 years, it was softer than the 3.5%/yr expected by consensus and the RBA. The context of this print is also important.

The survey reference period for the WPI is the last pay period ending on or before the third Friday of the middle month of the quarter, ie the Q4 22 WPI reflects the rate of wages growth around the 18th November 2022, arguably when the Australian labour market was at its tightest.

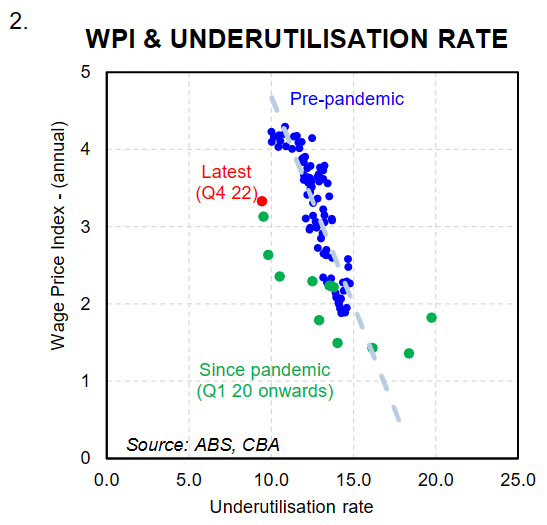

The underutilisation rate, the broadest measure of slack in the labour market reached its low in November at 9.3% and is the most correlated with wages growth (chart 2).

In this piece we look at how other measures of wages growth have performed in recent months and what are the key data points coming up.

We have not included broader measures of labour costs to limit this analysis purely to measures of pay rises.

CBA Wage Indicator:

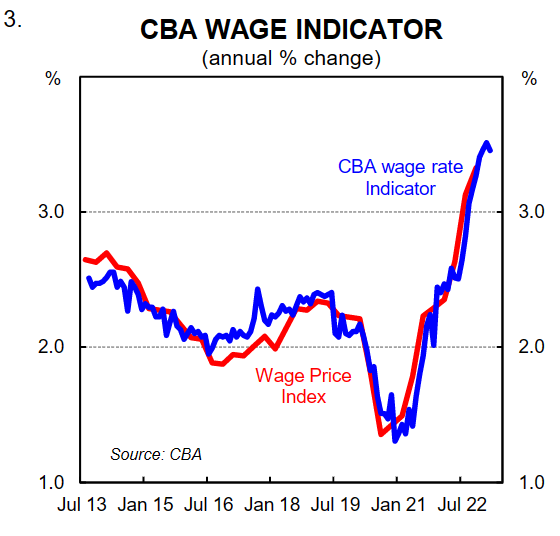

Our internal data on wages paid into CBA bank accounts indicates that wages growth was running at 3.4%/yr in December 2022 (note that our data measures actual dollars paid into a matched sample of ~275k CBA bank accounts).

This was just slightly above the WPI measure of 3.3%/yr and as chart 3 shows the two measures are closely correlated. The RBA is now using this indicator as one of the alternative source of wages growth they monitor.

The CBA wage indicator was tracking at 3.5% between January and March although as chart 3 shows there was a slight tick down in the annual pace of growth when taken to two decimal points.

Seek and Nero:

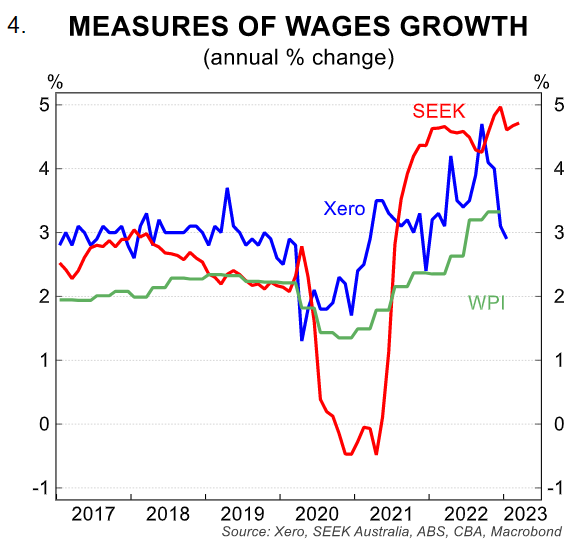

Seek and Xero both publish different measures of wages data (chart 4). The Seek Advertised Salary Index (ASI) measures the growth in advertised salaries for jobs posted on SEEK.

This measure is running at 4.7%/yr in February 2023, just below the record pace of 5% set in December 2022. The pace of growth is flattening out, rather than accelerating, a symptom the labour market is tight, but not tightening further.

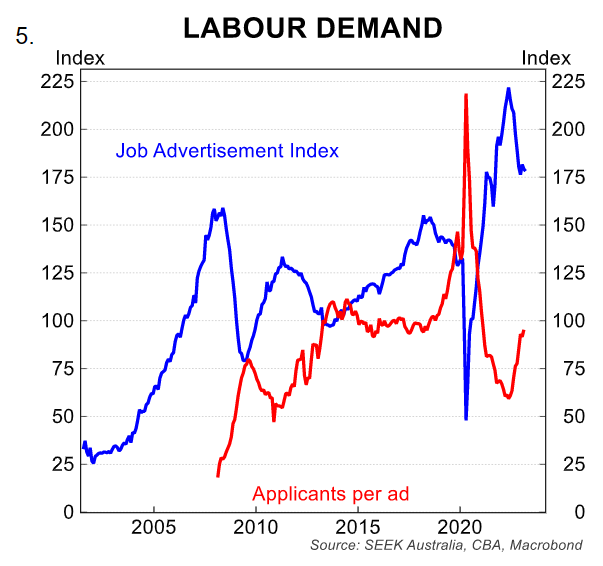

One reason could be is the number of job applicants per job ad is normalising upwards to pre pandemic levels. Applicants per job add rose 4% between January and February (chart 5).

Applications are picking up at a faster rate than job ads are falling. This could either be a symptom of higher labour market turnover, a move away from the extreme tightness in the labour market in late 2022, and/or a lift in supply of labour due to cost of living issues and the surge in net overseas migration.

Xero, the global small business platform, produces a wage index covering small businesses in Australia. This series is a job level measure of annual changes in year on year earnings per hour. This should reduce some impact from compositional changes.

The latest data from January shows wages growth was sitting at 2.9%/yr. This was the smallest rise since January 2021 and the fourth consecutive month of slowing. It peaked at 4.7%/yr in September 2022.

Enterprise Bargaining Agreements:

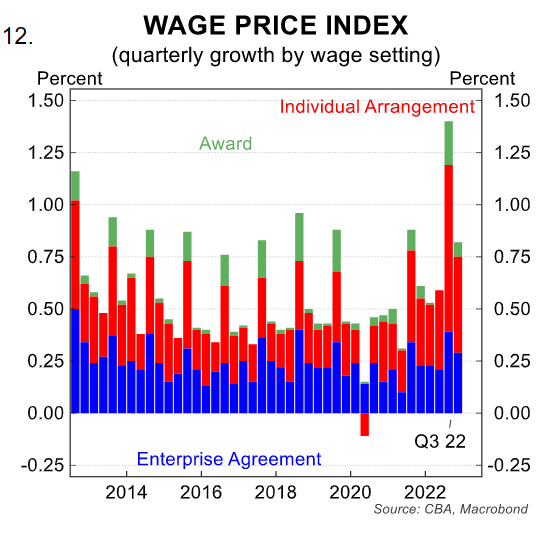

Enterprise Bargaining Agreements (EBAs) cover around 40% of the wage bill in Australia and just under 40% of employees. We detailed the different wage setting mechanisms in Australia in this piece from September 2022.

The majority of EBAs are in the public sector where wages have been held lower by public sector wage caps over the past decade.

There is a lag in the release of EBA data in Australia with the latest official quarterly data up until Q3 22. The Q4 22 data has been delayed from its expected release at the end of March 2023.

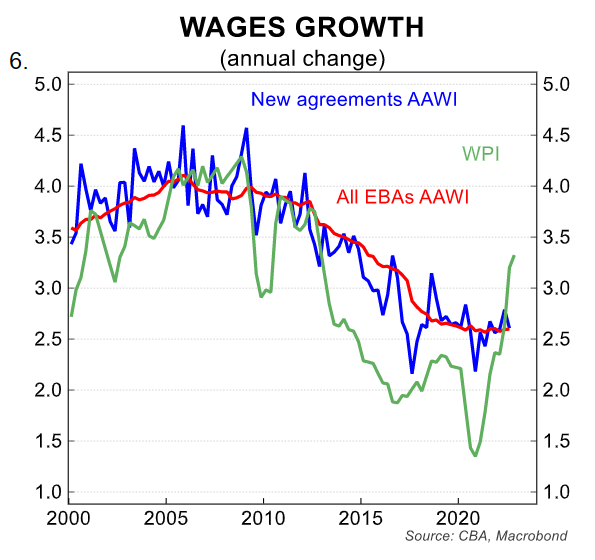

The data for Q3 22 showed new EBAs average annualised wages growth were set at 2.6%/yr, down from 2.8%/yr. This meant the average for all current agreements as at Q3 22 was 2.6%/yr (chart 6).

As we noted in the piece from September, the slow turnover in the stock of EBAs which are generally set for ~ 3 years was one reason holding down wages growth at the time.

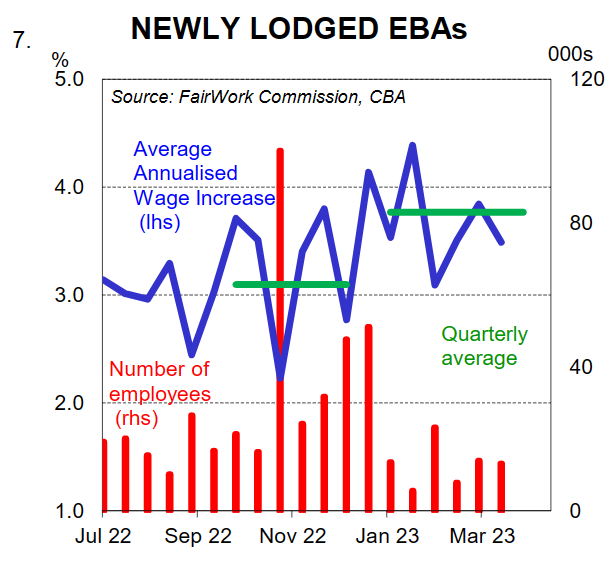

The Fair Work Commission now publishes a fortnightly report on new enterprise agreements applications lodged with the commission. Data is available from 15 July 2022.

This data differs from the quarterly data which only includes those approved. The Fair Work Commission notes just under 3% were either withdrawn, or not approved, or dismissed.

The fortnightly data does suggest a lift in wages growth being set by EBAs. In Q4 22 if we weight the average annualised wage growth by number of employees the data shows new EBAs lodged were set at ~3.1%. This accelerated to 3.7% in Q1 23 (data up until 24 March, chart 7).

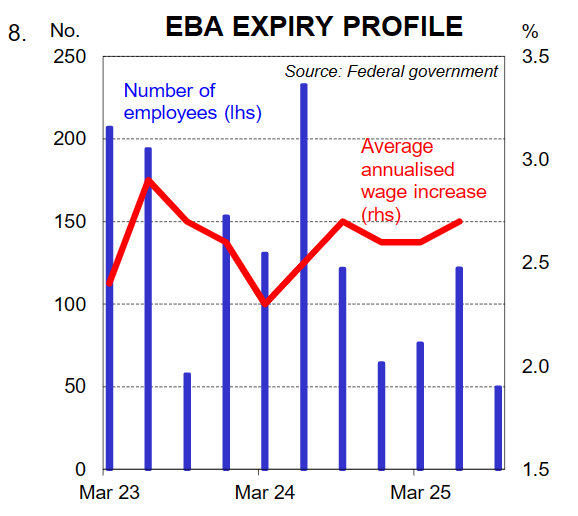

This acceleration in EBAs will put upward pressure on the WPI all other things equal. However it is important to remember that only a small number of EBAs expire each quarter so any move to lift wages growth in EBAs takes time.

In Q1 23 the data suggests 592 EBAs expire covering ~ 207k employees. This lifts to 2,137 agreements in Q2 23 and 194k employees. Chart 8 shows the EBA expiry profile from Q1 23. Over just shy of 3 years (the average duration of EBAs) there are 8,745 EBAs expiring covering 1.4mn employees.

Given signs in other measures of wages noted above, we could see a situation where EBA wages growth continues to rise, but private sector wages flattens out.

We are not alone in this view. The RBA Board Meeting Minutes for April notes “firms in the Bank’s liaison program expected annual wages growth in the private sector to level out at a little below 4 percent. Wages growth in the public sector was likely to increase in coming quarters as recently announced state government wages policies take effect”.

Public sector wage caps:

Public sector wage caps have been a part of public finance policy for over a decade. NSW has had one of the longest standing wage caps introducing a 2.5% wage cap in 2011. This was held till 2019 before being cut to 0.3% in 2021 during the pandemic.

In the 2022 NSW Budget released under the previous Liberal government, the cap was lifted to 3% and 3.5% the year after if productivity enhancements are secured.

As chart 9 shows there has been a considerable difference in the performance of NSW public wages growth versus private sector wages.

The lifting of public sector wage caps has raised questions about whether public sector wages growth could pull up private sector wages. As we noted above we expect private sector wages growth to flatten out given recent evidence in wages measures and the expectation that the unemployment rate trends higher over 2023.

Public sector employees accounted for 13.5% of the workforce as at February 2023. And 80% of public sector workers have wages set by EBAs. However in some industries with a high proportion of public sector wages, particularly health and education, public sector wage caps have contributed to more anaemic wages growth.

In NSW the new Labor government campaigned on removing the wage cap. The NSW Budget has been postponed three months and will now be delivered in September, a normal development post a change in government.

Any change / removal in the wage cap will take time to flow through to aggregate wages growth given the expiry of EBAs noted above and the length of the renegotiation process.

According to the AFR, the new NSW government has noted it will maintain “targets” of 3 to 3.5% wage growth in 2023-24 and reopen public school teachers’ award negotiations before its expiry at the end of the year.

Nurses and public servants are due a wage rise by July 1with negotiations reportedly underway.

The Victorian government currently has a wages cap of 1.5% in place. However no wage negotiations have had to take place at this level.

Almost all agreements were put in place by the end of 2021 before the step down in the wage cap from 2% to 1.5%.

However there are ways for higher pay outside the cap with retention payments and bonuses. The relatively new SA government has also yet to outline its new fiscal strategy.

With state budgets under pressure, the size of the public sector workforce and wage caps will need to be monitored closely.

Chart 10 details the current pace of public sector wages growth in each major state.

Minimum Wage Decision:

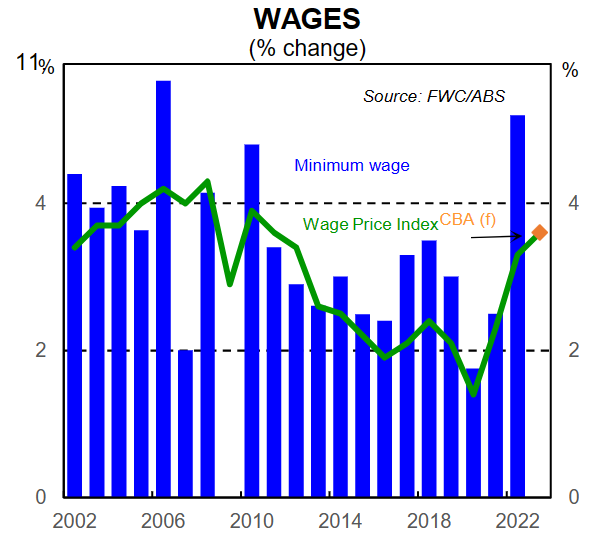

The Fair Work Commission should hand down its decision on the minimum wage by the end of June.

Last year the decision was to lift award wages by $A40.00 per week (an increase equivalent to between 4.6% and 5.2% wage increase). This was the largest lift in over a decade (chart 11).

The Federal government has indicated it would support a lift in the minimum wage in line with inflation. The annual headline inflation rate was 7.0% in Q123.

This is the last quarterly print the Fair Work Commission will have when deciding the lift.

There will be a monthly CPI Indicator released on 31 May 2023 that maybe used although the quarterly CPI remains the official benchmark.

We expect a further deceleration in the annual rate of inflation.

An increase in the minimum wage in 2023 of the same rate as 2022 (5.2%) would have no impact on the annual pace of wages growth in Q3 23. Anything above 5.2%, ie 7% would push the annual pace higher.

However this is dependent on what pace of wages growth occurs in EBAs and individual agreements over this period.

Chart 12 details the proportion of wages growth by each wage setting. In Q3 22 award wages contributed 0.2% pts to the 1.4% lift in wages growth (in original terms).

In Q3 22 the ABS noted a higher proportion of private sector jobs recorded a wage movement greater than normal. This reflected financial year pay reviews and outside of cycle pay rises as a retention strategy due to a tight labour market.

This is less likely to occur in the September quarter this year both in terms of the number receiving a wage movement and the size. We expect the labour market will be loosening over the remainder of this year due to a combination of weaker demand and rising supply of labour.

Summary:

There are a number of measures of wages growth that suggest the pace of private sector wages growth has flattened out at a higher pace than pre pandemic, but it no longer rising.

We expect this to continue over 2023 given demand for labour should slow as the economy weakens and the slack in the labour market lifts. It will also be helped by lift in the supply of labour due to the rapid pace of population growth currently underway.

Partially offsetting this though will be further growth in public sector wages, award wages and the renegotiation of enterprise bargaining agreements that have until recently been set at lower levels. This should provide some support to wages growth but given the smaller proportion of this group it should not overwhelm the move in private sector wages.

Overall we expect wages growth to reach 3¾% in mid-2023 (chart 13).

Wages growth in line with this forecast is consistent with the inflation target returning to the RBAs 2-3% target band.