By Gareth Aird, head of Australian economics at CBA.

Key Points:

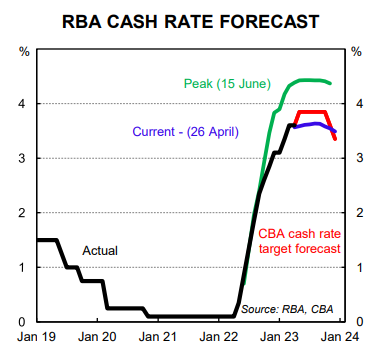

- We retain our call for the RBA to increase the cash rate by 25bp to 3.85% at the May Board meeting (our forecast for the peak in the cash rate).

- We ascribe a 55% chance to a 25bp rate increase and a 45% probability to no change (we consider the risk of any other move immaterial).

- Governor Lowe will deliver a speech at the RBA Board dinner on Tuesday 2 May. And an updated set of economic forecasts will be published on Friday in the May Statement on Monetary Policy (SMP).

- We expect the RBA to retain their forecast for headline and underlying inflation to only return to the top of the target band by mid-2025 despite the Q1 23 CPI printing a little softer than the RBA’s implied profile from the February SMP.

- The RBA considers the stronger-than-anticipated lift in population growth to be inflationary and we expect this factor to offset the slightly lower starting point for the RBA’s inflation profile.

- We expect the RBA to leave their forecast profile for the unemployment rate unchanged.

Overview:

The coming week is another big one for Australian financial market participants.

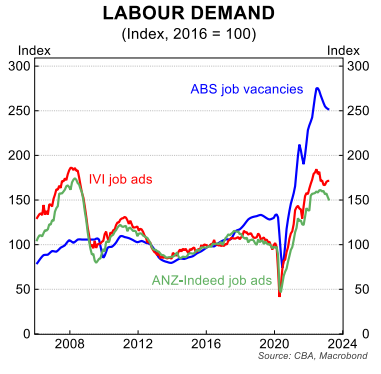

The RBA May Board meeting on Tuesday comes in the wake of the still elevated Q1 23 CPI. It also follows the March labour force survey, which was a robust set of numbers.

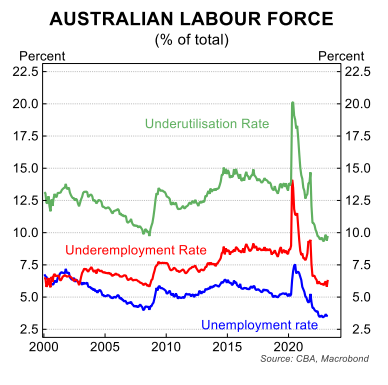

Employment increased solidly over the month and the unemployment rate remained near its 50 year low at 3.5%.

The RBA Board will debate the case to extend the pause in the tightening cycle or raise the cash rate by 25bp to 3.85%. We expect a 25bp rate hike, but acknowledge it’s a very close call.

Money markets disagree with our view. As we go to press just 3bp is priced for the May Board meeting (i.e. a 12% chance of a 25bp rate increase). It is not the first time we have gone into a Board meeting with a call not supported by the markets. And undoubtedly it won’t be the last!

The week contains plenty of other events for RBA enthusiasts.

RBA Governor Lowe will deliver a speech in the evening following the RBA Board meeting on Tuesday 2 May. And an updated set of economic forecasts will be tabled in the May SMP, which will be published on Friday.

These forecasts will be previewed in the Governor’s Statement accompanying the May Board decision. Assistant Governor Luci Ellis will also deliver a speech at a CEDA event on Wednesday 3 May.

Setting the scene – a recap of the April decision:

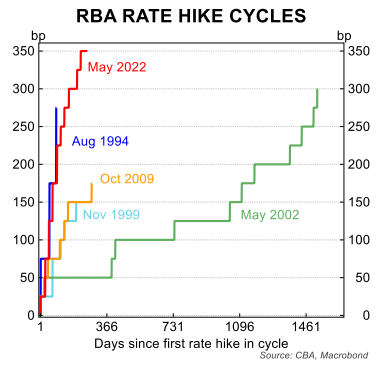

The RBA Board left the cash rate on hold in April at 3.6%, as we anticipated. It was the first ‘pause’ in the tightening cycle since the RBA began lifting the cash rate in May 2022.

The RBA April Board Minutes fleshed out the thinking behind the April decision.

Indeed the Minutes made it quite clear that the policy choice in April to ‘pause’ should not to be interpreted as an end to the tightening cycle.

Specifically, it was noted that, “members observed that it was important to be clear that monetary policy may need to be tightened at subsequent meetings and that the purpose of pausing at this meeting was to allow time to gather more information”.

This statement aligned with our base case heading into the April Board meeting. Namely that the Board would pause in the tightening cycle in April. But that a subsequent 25bp rate increase remained more likely than not.

Indeed the April Minutes stated that members would, “reassess the need for further tightening at future meetings.” And that, “members agreed that it would be helpful to have additional data and an updated set of forecasts before again considering when and how much more monetary policy would need to be tightened to bring inflation back to target within a reasonable timeframe.” (our emphasis in bold).

An updated set of economic forecasts will be presented by RBA staff to the Board at the upcoming May meeting. This confirms that the May Board meeting next week is ‘live’.

The case to keep the cash rate on hold in May:

The arguments the Board will debate in favour of leaving the policy rate on hold next week are quite straight forward:

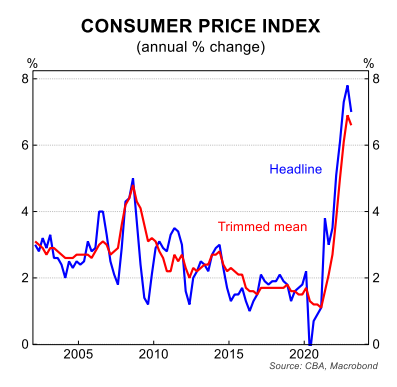

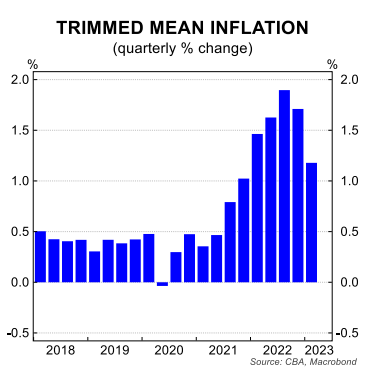

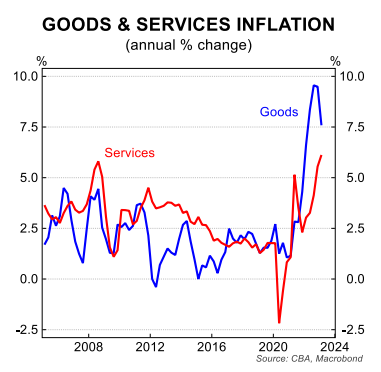

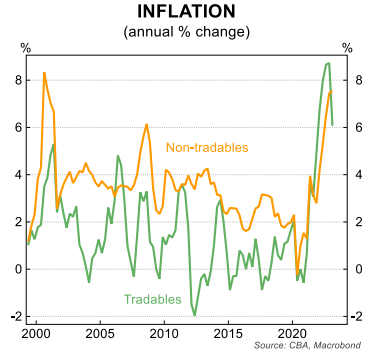

The Q1 23 CPI confirmed that the annual rate of headline and core inflation peaked in Q4 22. And more importantly from a policy perspective, the trimmed mean came in a little below market and RBA expectations in Q1 23. Monetary policy works with the well documented ‘long and variable lags’. And inflation itself is a lagging indicator.

There is a growing body of evidence that indicates aggregate demand is slowing in the economy. And given there has been an incredible amount of tightening in a short space of time there is merit in extending the pause in the tightening cycle to further assess trends in spending and the outlook for inflation and the labour market.

We think the aforementioned arguments in favour of leaving the cash rate on hold in May are sound. But the Board will weigh up these factors against the case to lift the cash rate again.

The case to raise the cash rate in May:

The case to increase the cash rate by 25bp in May is more nuanced. This is why it is important to consider how the Board will frame the arguments in favour of increasing the cash rate.

Indeed the RBA’s updated economic forecasts will be a critical input to the Board’s decision, so we start with our expectations for the RBA’s new inflation forecasts.

The RBA’s implied profile from the February SMP put Q1 23 trimmed mean, the Bank’s preferred measure of core inflation, at ~6.7%/yr.

The Q1 23 trimmed mean printed at 6.6%/yr. As such, the annual rate of core inflation in Q1 23 was only 0.1ppt lower than the RBA’s forecast.

The Q1 23 headline CPI came in a little below the RBA’s forecast from the February SMP. But the monthly CPI indicator had already suggested headline inflation in Q1 23 would print below the RBA’s February forecast. The RBA Board took this into consideration when they left the cash rate on hold in April but reiterated their hiking bias.

We do not expect the RBA to downwardly revise their forecast profile for core inflation in the upcoming SMP despite the slightly lower–than-anticipated Q1 23 outcome. We arrive at this view because population growth has been stronger than the RBA expected. In the February SMP the RBA assumed population growth to be in line with its pre-pandemic average of ~1½%.

In contrast, Governor Lowe noted in his speech on 5 April that, “it now seems likely that the annual rate of population growth will soon be around 2%”.

The RBA views higher population growth as inflationary. In the April Board Minutes it was noted that, “members noted that the net effect of a sudden surge in population growth could be somewhat inflationary for a period.”

No change to the RBA’s inflation profile would bolster the case to raise the cash rate in the Board’s eyes next week given their objectives. Plan A for the Board from here is to bring the rate of inflation down over time while “keeping the economy on an even keel”. This essentially means trying to keep the unemployment rate low while the rate of inflation subsides.

Governor Lowe wants to keep as many job gains as possible as inflation is brought back to target over time. Essentially the RBA is trying to preserve both the gains in employment and the value of money simultaneously. This is not an easy task. But we believe it is the right objective.

The RBA Board has decided that there is a suitable trade-off between the speed at which they will seek to return inflation to target while still preserving jobs.

More specifically, the Board will accept inflation returning to the target range by mid2025 – this is best characterised as aiming for a ‘soft landing’.

The RBA April Board Minutes noted that, “the forecasts produced by the (RBA) staff in February had inflation returning to the target range only by mid-2025 and that it would be inconsistent with the Board’s mandate for it to tolerate a slower return to target. These forecasts were conditioned on monetary policy being tightened a little further.” (our emphasis in bold).

If the RBA does not lower their inflation forecasts and considers monetary policy will need to be tightened a little further to see inflation to return to the target range only by mid-2025 then they are likely to hike the cash rate in May.

For the record, we disagree and think that inflation will return to target in early 2024. But that is neither here nor there when thinking about the Board meeting next week. The Board will set monetary policy based on their assessment of the economic outlook.

The labour market data will also feed into the May interest rate decision. The March labour force survey, which printed on 13 April, was a strong set of numbers. The key metric in that report was the unemployment rate, which held steady at 3.5%. The RBA considers that significantly below the nonaccelerating inflation rate of unemployment (NAIRU), which Governor Lowe recently said the RBA estimates to be an “unemployment rate in the low 4s”.

This means that the RBA will remain somewhat concerned about a potential wage price spiral while the unemployment rate has a 3 handle and inflation is sitting well above target. We do not share those concerns. But once again, it is about how the Board assesses the risks around this potential outcome and not us.

The resilient labour market should mean the RBA leaves their unemployment rate forecasts unchanged from three months ago.

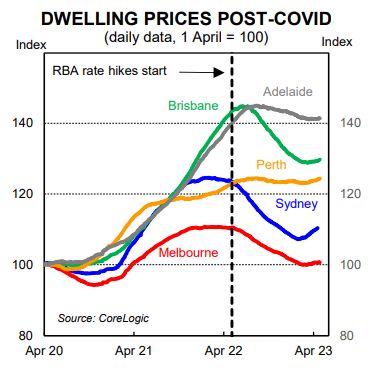

Finally the recent lift in home prices will also feed into the RBA’s thinking given the impact of a negative wealth effect looks to have run its course (note that we will publish updated home price forecasts next week).

If the negative wealth effect from falling home prices on consumption dissipates it will mean stronger household spending than would otherwise be the case.