By Gareth Aird, head of Australian economics at CBA:

Key Points:

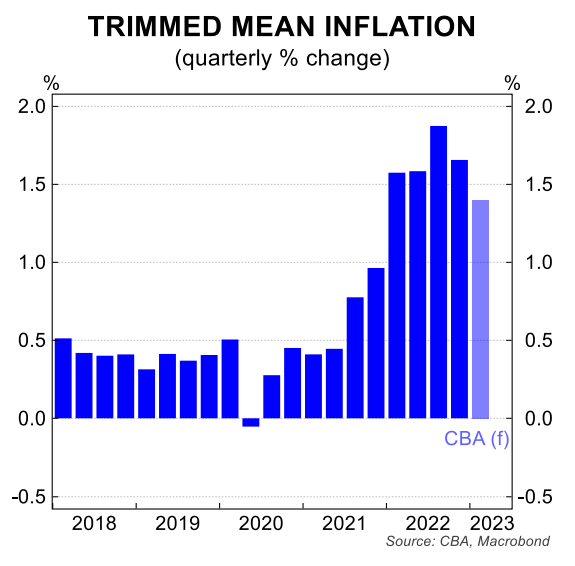

- We expect the headline CPI to increase by 1.3%/qtr in Q1 23 (7.0%/yr).

- The trimmed mean CPI on our forecast will rise by 1.4%/qtr (6.7%/yr).

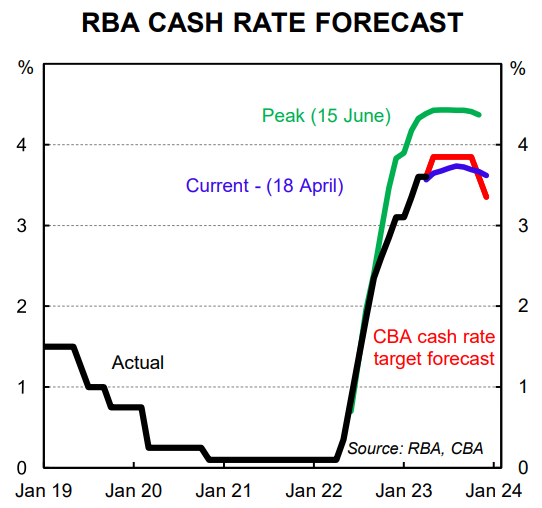

- An outcome in line or stronger than our forecast for underlying CPI will see us retain our call for the RBA to raise the cash rate by 25bp at the May Board meeting to 3.85%.

Setting the scene – why the upcoming CPI is so important:

High inflation is presently the main concern of the RBA (and many other central banks globally). Indeed the RBA is best described currently as an inflation fighting central bank.

The RBA has put through an incredible amount of tightening in a short space of time to put downward pressure on aggregate demand and in turn inflation. But monetary policy operates with a lag and inflation takes time to respond to changes in interest rates.

There is a growing body of evidence that policy tightening is working. Indeed we expect demand to weaken materially from here and for the quarterly pulse of inflation to abate relatively swiftly in H2 23. But the annual rate of inflation will still take some time to come down, largely due to base effects.

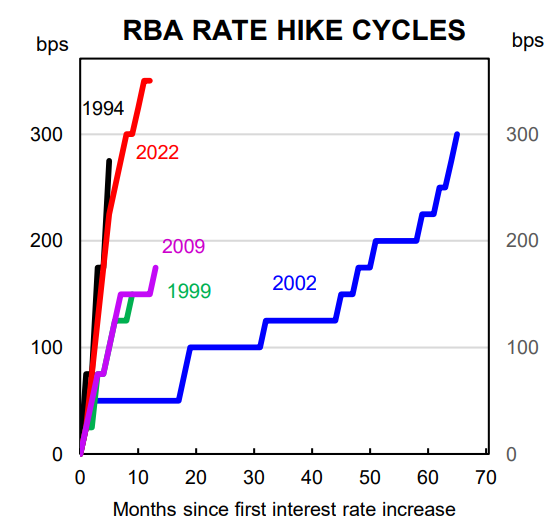

The RBA has increased the cash rate by a whopping 350bp since May 2022. The cash rate is currently 3.6%. According to the RBA this has taken monetary policy into “restrictive territory”. We would characterise the current level of the cash rate as “deeply restrictive territory” given mortgage payments will reach a record high of almost 10% of household disposable income by the end of 2024.

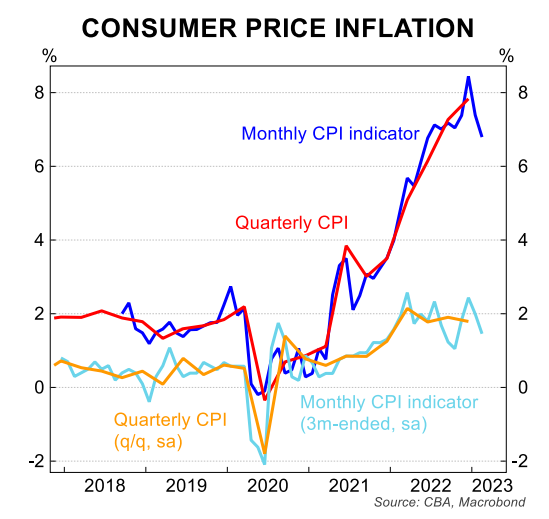

The good news is that the annual rate of inflation is all but certain to have peaked in Q4 22. Indeed the Q1 23 CPI, due for release on 26 April, will confirm this. But the rate of inflation will still be uncomfortably high for a central bank with an inflation target of 2-3%.

Plan A for the RBA from here is to bring the rate of inflation down over time while “keeping the economy on an even keel”. This essentially means trying to keep the unemployment rate low while the rate of inflation subsides.

Governor Lowe wants to keep as many job gains as possible as inflation is brought back to target over time. Essentially the RBA is trying to preserve both the gains in employment and the value of money simultaneously. This is not an easy task. But we believe it is the right objective.

The RBA Board has decided that there is a suitable trade-off between the speed at which they will seek to return inflation to target while still preserving jobs. More specifically, the Board will accept inflation returning to the target range by mid-2025 – this is best characterised as aiming for a ‘soft landing’.

We see inflation returning to the target range by early 2024. But that is neither here nor there in the short run when assessing what the upcoming CPI means for the May Board meeting.

A brief recap of the Q4 22 inflation data

Inflation once again surged in Australia over Q4 22. The headline CPI came in stronger than market expectations, but below the RBA’s forecast. On the other hand the trimmed mean, which is the RBA’s preferred measure of core inflation, was stronger than consensus and RBA expectations.

Recall the headline CPI increased by 1.9%/qtr and the annual rate lifted from 7.3% to 7.8%. For context the headline CPI rose by 1.8%/qtr in both the September and June quarters and by 2.1%/qtr in the March quarter.

The trimmed mean rose by 1.7%/qtr over Q4 22 to sit 6.9% higher through the year (consensus 1.5%/qtr and 6.0%/yr; CBA and the RBA on consensus). The trimmed mean for Q3 22 was upwardly revised to 1.9%/qtr (from 1.8%/qtr). This stronger than expected outcome for core inflation over Q4 22 coupled with the upward revision to Q3 22 meant the pulse of inflation over H2 22 was stronger than the RBA anticipated. As a result, the RBA made a hawkish shift at the February Board meeting when they increased the cash rate by 25bp to 3.35% and signalled that “‘further increases in interest rates will be needed”.

The change in tone and stance of the RBA following the Q4 22 CPI highlights the importance of the inflation data for market participants. If there is one piece of data that can cause the RBA to suddenly pivot in either direction, it is the CPI!

What to expect in the Q1 23 CPI

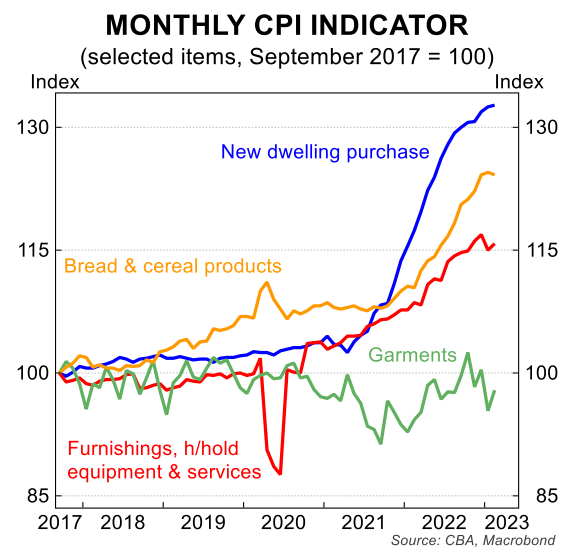

The ABS’ new monthly CPI indicator provides partial inflation data for the first two months of the year. Please see here and here for our write-ups on the January and February data.

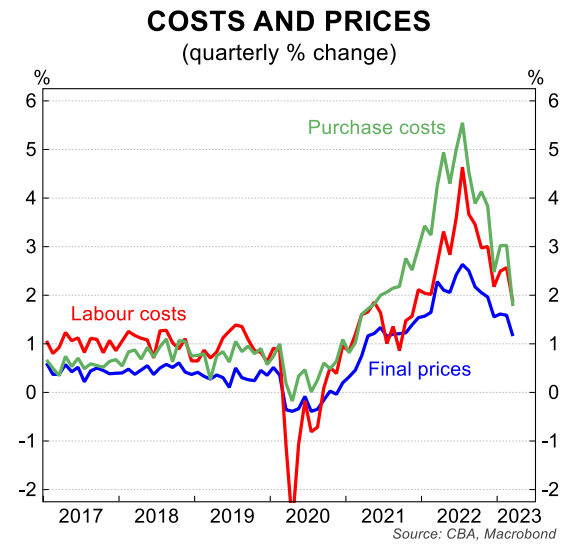

There were broadly two key messages from the monthly inflation data. The first is that goods inflation in Australia, like in most places, is abating. Some goods prices have in fact been falling. The second is that there look to be early signs that pockets of services inflation are moderating – though the partial nature of the monthly CPI indicator means this can’t be confirmed until the Q1 23 CPI prints.

We expect headline consumer prices rose by 1.3%/qtr in Q1 23. That would represent an easing in the quarterly pulse and would also see the annual rate fall to 7.0%/yr. We also expect underlying or core inflation, as measured by the trimmed mean CPI, to have eased to 1.4%/qtr, from 1.7%/qtr previously.

To be clear, there will still be some elements of strong price growth in the Q1 23 CPI basket. But the evidence from the monthly CPI indicator, as well as from surveyed measures of price pressures from the NAB business survey and the PMIs, support our view that the annual rate of inflation will step down in the March quarter.

Indeed output price growth in the Judo/S&P Composite PMI has fallen to its lowest level since March 2021. And the various price indicators from the NAB business survey have also declined to around their 2021 levels (see facing chart).

Services inflation outpaced goods inflation in Q4 22 after lagging over the pandemic. We expect that dynamic to play out further in Q1 23. The evidence overseas is that services inflation has been stickier on the way down.

In the US, UK and NZ, part of that stickier services inflation reflects a pace of wages growth that is generally sitting above what would be consistent with a return of inflation to central bank targets. However, in Australia wages growth at ~3½%/yr is not inconsistent with the inflation target. Here it is worth noting that the RBA’s inflation target of 2-3% is higher than most other central banks, where the inflation

target is 2%.

The downtrend in inflation in many advanced economies reflects goods disinflation. The signs from the monthly CPI indicator suggest that we will see a similar picture in Australia. We expect continued dissipating impacts from pandemic-era global supply chain shocks. And we expect softening consumer spending growth, a consequence of declining real disposable household incomes and negative wealth

effects, to have played a role too.

The detail of our Q1 23 CPI call

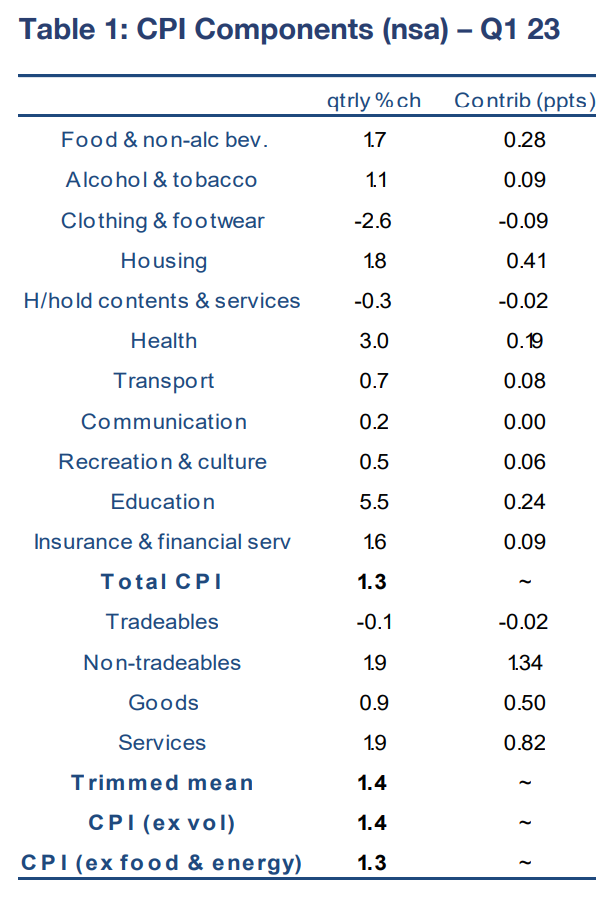

See table 1 below for our detailed forecasts for the Q1 23 CPI.

The main features of our call are as follows:

- Food inflation lifts by 1.7%/qtr – the sharp fall in fruit & vegetable prices in late 2022 is unwound, meat & seafood inflation remains elevated, and the usual seasonal lift in beverage prices occurs. Meals & take away food inflation should have moderated to 0.7%/qtr based on the monthly CPI indicator.

- Clothing & footwear prices decline by 2.6%/qtr, unwinding the gain in Q4 22. Over the first two months of 2023, clothing prices have fallen by 3.0% relative to Q4 22.

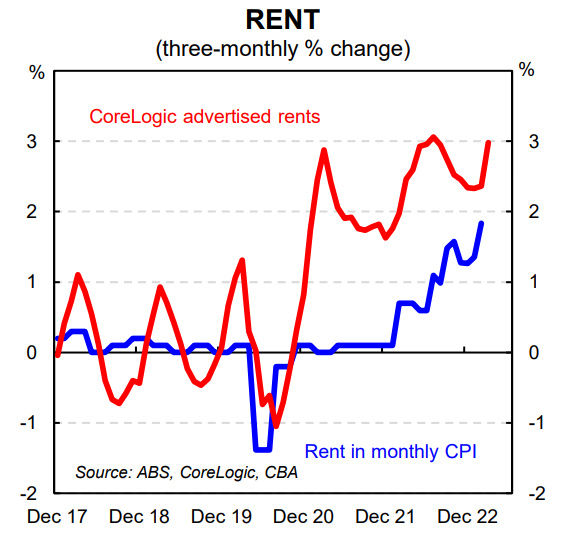

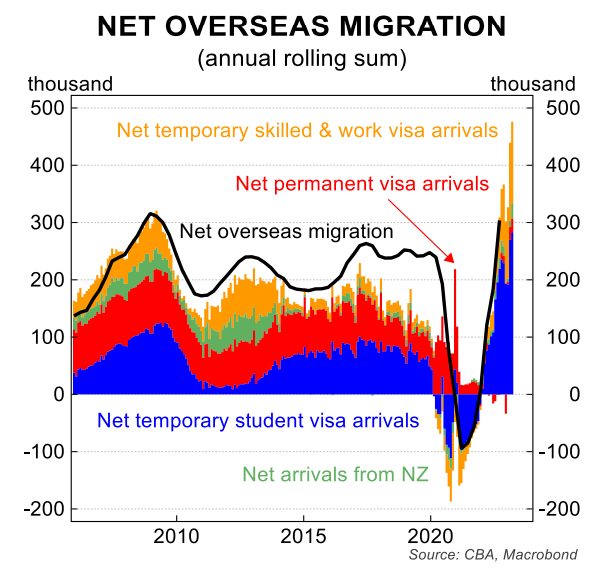

- Rent inflation continues to pick up steam, rising by 1.8%/qtr. Strong annual population growth of more than 2%, driven by net overseas migration, is stretching already-tight rental markets.

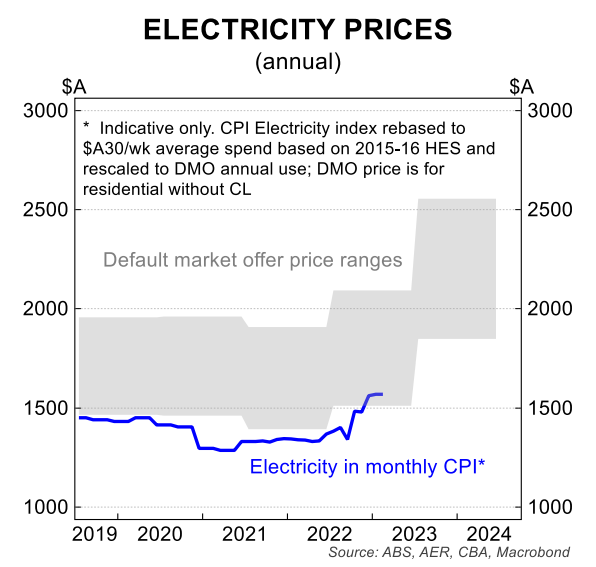

- Utilities rise by 4.0%/qtr, driven by further increases in electricity prices.

- Household contents & services prices decline by 0.3%/qtr. We expect to see large falls in the prices of furniture & furnishings, household textiles, appliances & tools. A shift away from spending on the home, and very low housing turnover should see weak demand for household goods. Household services on the other hand likely saw further price rises.

- Health inflation lifts by 3.0%/qtr. We have less conviction in this part of the CPI basket as these prices are measured in the last month of the quarter (i.e. there is no signal from the monthly CPI indicator). We anticipate reduced bulk billing to see higher out-of-pocket costs for medical services. There may be some partial offset from pharmaceuticals given the ~30% reduction in the Pharmaceutical Benefits Scheme (PBS) co-payment. The CPI indexation of the safety net threshold will have a greater impact across later quarters.

- Petrol prices decline by 0.8%/qtr, based on weekly fuel prices at the bowser.

- Holiday travel & accommodation prices fall by 0.5%/qtr after a massive 10.9%/qtr lift in Q4 22, as pent-up travel demand is satiated and households focus on budgets.

- Education prices rise by 5.5%/qtr, as indicated by the February monthly CPI indicator.

- Insurance & financial services prices lift by 1.6%/qtr, with higher costs for both insurance and financial services.

There are firm price pressures in parts of the CPI basket that will continue over the rest of this year.

Rent inflation is likely to stay elevated. Record high net overseas migration is further tightening already-stretched rental markets. With net overseas migration potentially exceeding 400k people over the year, there is significant additional demand for rental properties. In response, advertised rent growth (i.e. for new rentals) continues to lift, outpacing price growth on the overall stock of rents. Some upward adjustment to average household sizes (for instance, back to its long-term average of 2.5 people per household) will alleviate only part of this pressure.

Retail electricity prices are also expected to increase further this year, after already rising rapidly over 2022. Wholesale electricity prices in the National Electricity Market (NEM) have eased from their peaks in late 2022. But for retail electricity prices, the draft Default Market Offer – the highest price allowed for residents of NSW, south-east Qld and SA, and which is paid by ~ 10% of customers – suggests large increases could occur from H2 23.

But both rent and electricity price increases are not something the RBA can directly impact through higher interest rates. Indeed higher interest rates indirectly put upward pressure on rents through less residential construction than otherwise.

Implications for the RBA

We estimate the RBA’s implied quarterly profile for Q1 23 to be 1.6%/qtr for headline CPI and 1.4%/qtr from the trimmed mean.

As such, we forecast headline inflation to be lower than the RBA’s forecast, but core inflation to print in line with the RBA’s expectations. The core number is more important from a monetary policy perspective.

The RBA has a hiking bias. And the RBA April Board Minutes noted that, “the forecasts produced by the (RBA) staff in February had inflation returning to the target range only by mid-2025 and that it would be inconsistent with the Board’s mandate for it to tolerate a slower return to target. These forecasts were conditioned on monetary policy being tightened a little further”.

As such we think that if Q1 23 underlying inflation is in line with the RBA’s forecasts a 25bp rate hike at the May Board meeting is more likely than not, particularly given the labour market remains very tight.

A core print slightly stronger than the RBA’s implied profile will leave us with reasonably high conviction that the RBA will hike the cash rate in May. And a trimmed mean outcome of more than 1.6%/qtr would almost guarantee a rate increase at the May Board meeting.

We continue to look for rate cuts in late 2023 as we believe inflation will fall more quickly than the RBA currently anticipates. And that the unemployment rate will lift more sharply. We do not think the annual rate of inflation needs to return to target before the RBA cuts the cash rate. Rather we think a six month annualised pace of inflation that is within target would be sufficient for them to ease policy.