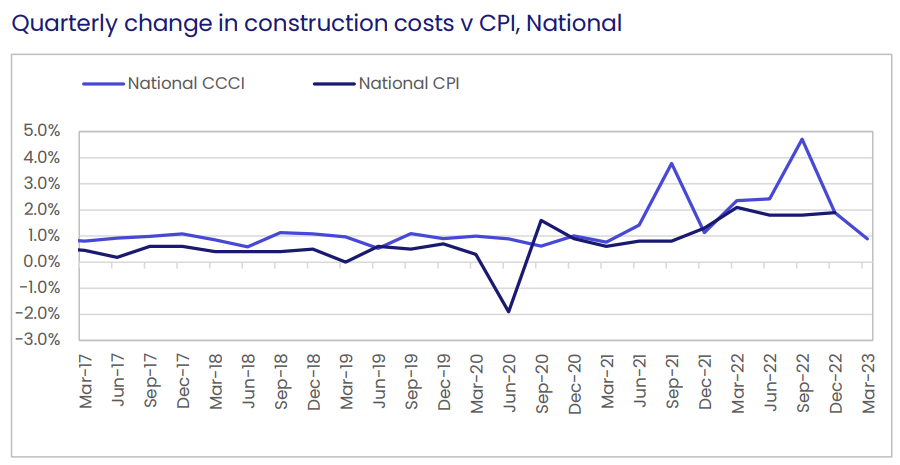

Cordell’s Q1 Construction Cost Index (CCCI) has been released, with costs rising 0.9% over the quarter to be up 10.2% year-on-year:

While the quarterly growth rate was well below the recent peak of 4.7% over the September quarter of 2022, the annual rate of change remains 2.8 times higher than the pre-COVID five-year average of 3.6%.

Commenting on the result, CoreLogic Construction Cost Estimation Manager John Bennett said while the national annual growth rate was still relatively high, the building and construction industry would take comfort in the quarterly figure returning toward long-term averages.

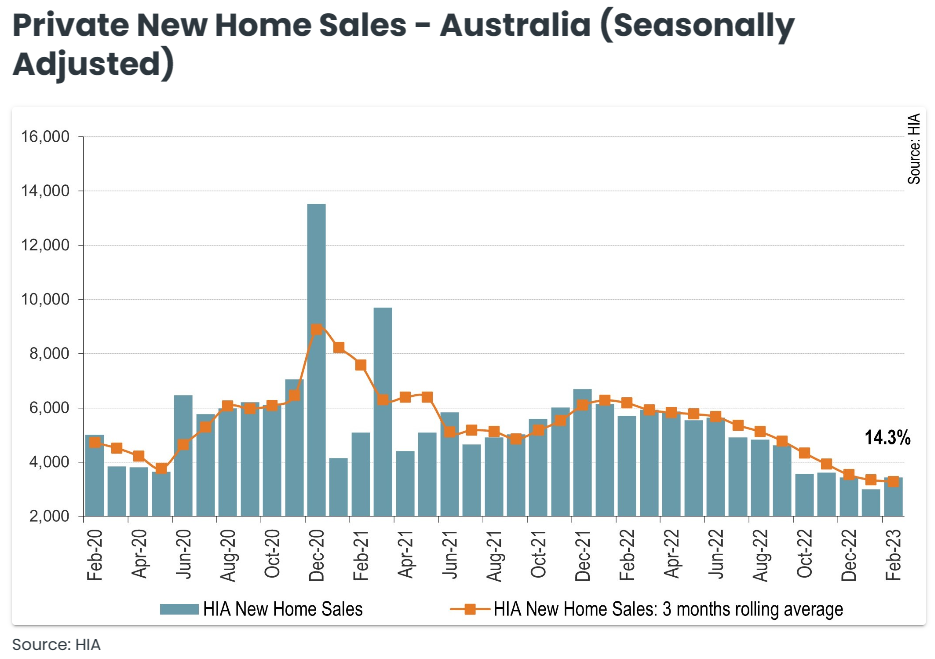

Although cost pressures are starting to ease, home builders are now facing a collapse in buyer demand, which should stifle activity in 2024 once the large pipeline of homes currently under construction are exhausted.

Since the RBA started its rate-tightening cycle last May, new home sales numbers from the Housing Industry Association have roughly halved:

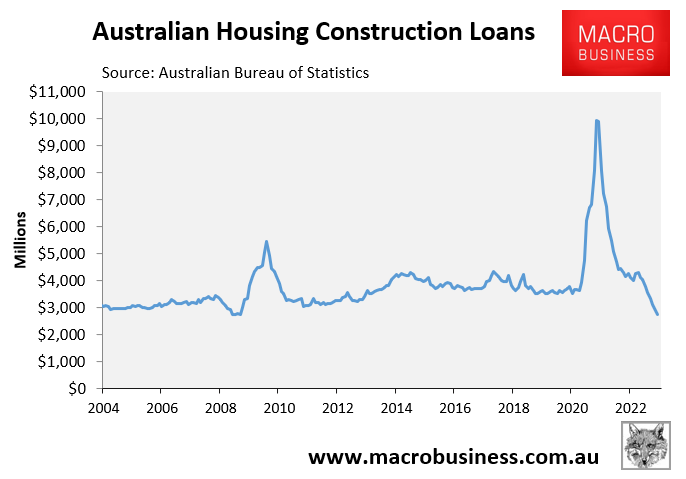

Finance commitments for the construction of new homes also collapsed to their lowest level on record in February:

The collapse in buyer demand means that when the pipeline of homes currently under construction finally runs dry late this year or early next, the home building industry will contract.

It also means that the rental market will continue to tighten given demand via immigration is now running at its highest level on record.

In turn, rents will continue to soar and more Australians will be thrown into homelessness.