Will nobody think of the poor gas cartel?

An unexpected glut in the global LNG market has added to the woes of Australia’s gas producers just as they are being hammered on all sides by price intervention, toughened requirements on emissions reductions and looming petroleum tax changes.

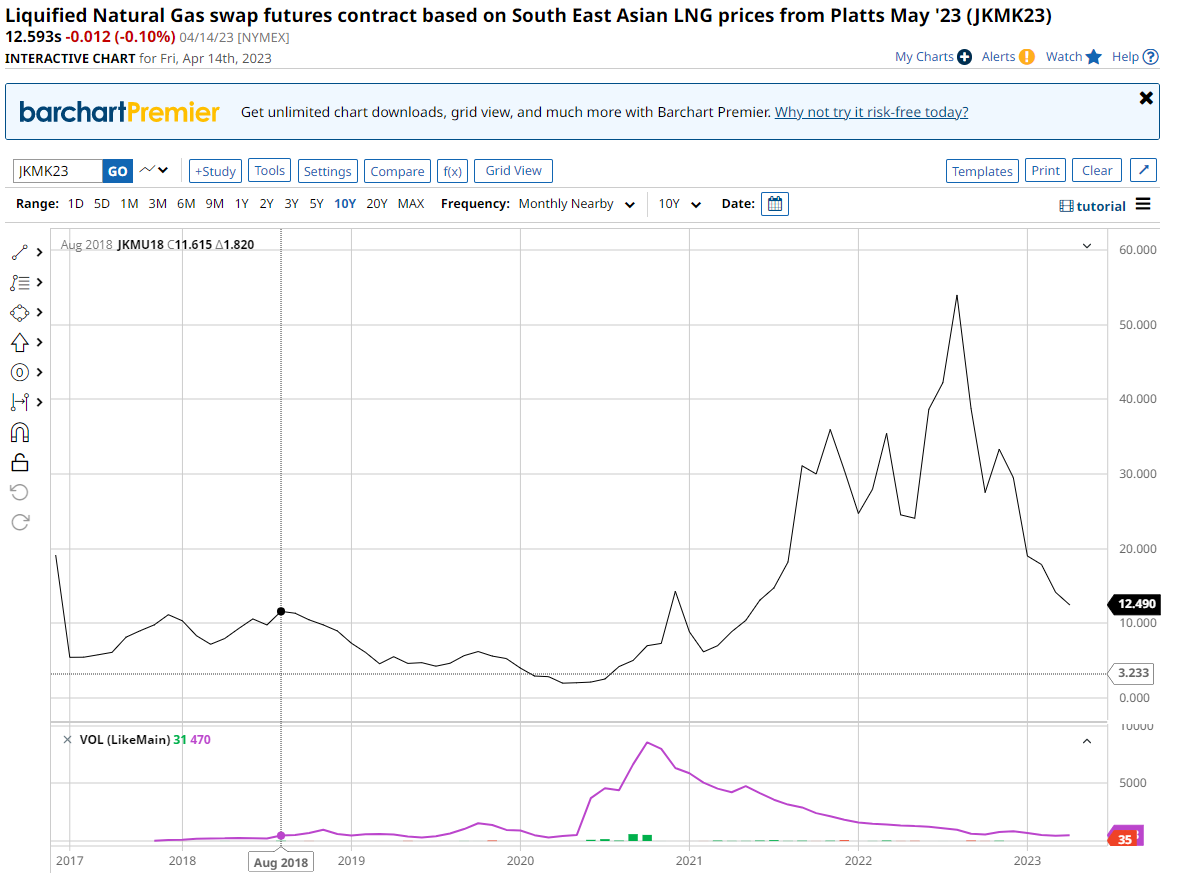

…At $US12.50 per million British thermal units, the price still remains above long-term historical averages, and many analysts anticipate the oversupply hitting the market will be temporary as Europe continues to struggle to replace Russian gas supplies.

Poor things. $12.50Gj is only double the pre-Ukraine War average price:

The truth of it is that this is just more dreadful reporting by the cartel-friendly AFR, which wouldn’t know the Australian national interest if it was jammed into it via a large-diameter gas pipe.

More to the point, gas cartel shareholders in Santos and Woodside, who led the rhetorical assault upon Australians during the Ukraine War price spike, should now be livid.

This management dramatically overplayed its hand. This resulted in price caps, a savage crackdown on the ADGSM, and now a looming tax hike via the reformed PRRT.

These responses by the Albanese Government have so far been moderate. They could and should yet be far worse.

But they have only arrived at all thanks to the extraordinary arrogance of cartel management.

Shareholders ought to be pissed. Profits will be hit, shareholder returns will fall, and those domiciled in Australia will see their utility bills go through the roof as well.

These are structural that will lower ROE over the long run versus a short-term pop in profit gouging that will pass like rain on the mountainside.

That is, greedflation is a form of control fraud that works until it doesn’t and leaves the business worse off in the long run as the public takes its revenge via policy.

The cartel was so greedy that it had no idea what poking the bear would do.