MySteel with the note.

Outlook

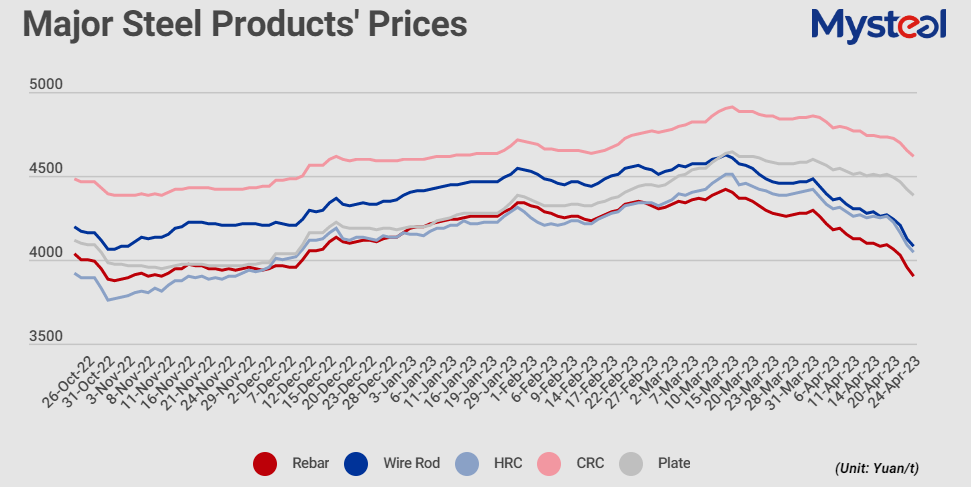

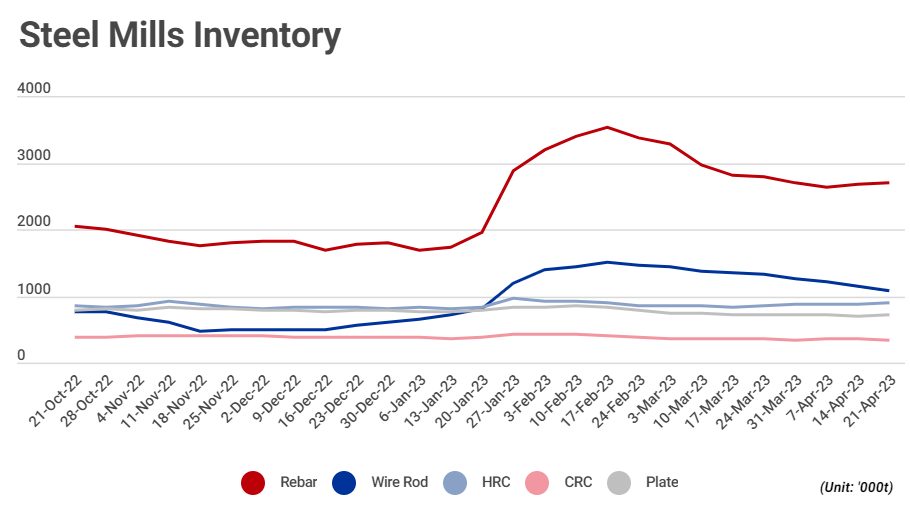

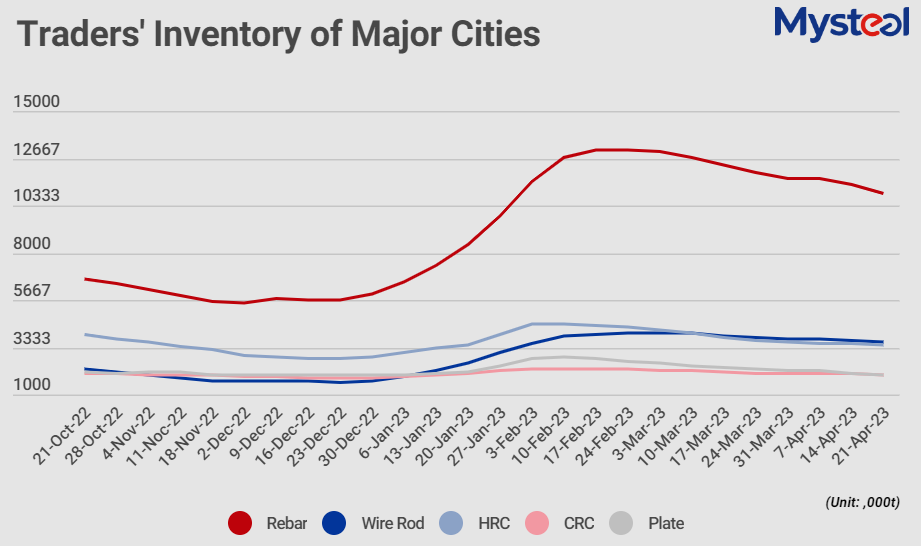

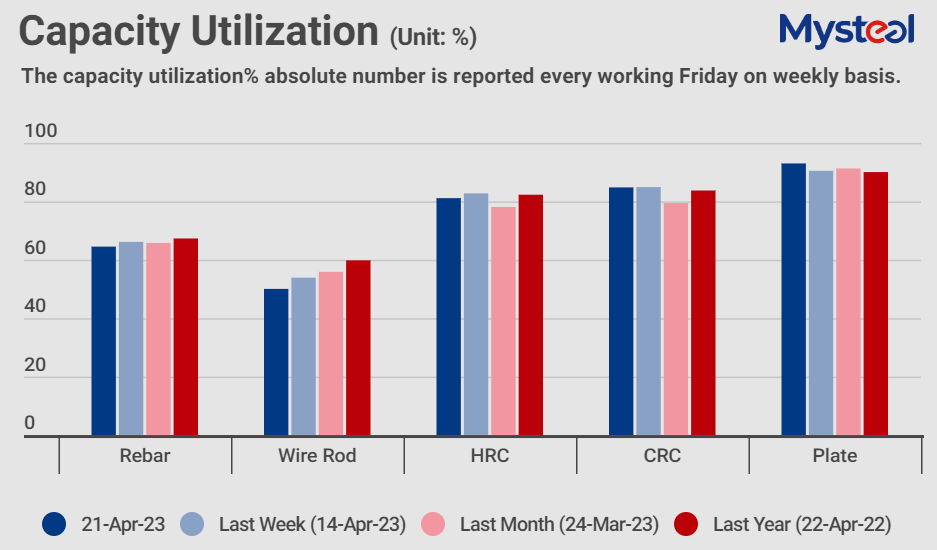

Mysteel Research & Consulting expects major steel product prices to continue trending down in the short term due to weakened demand and oversupply. It is estimated that the steel demand in the real estate sector decreased by 4.79% YoY from January to March this year, being the largest drag. Although the sales and funds secured for the real estate sector are improved, the funds are prioritized for completing ongoing projects on schedule and ensuring their delivery rather than investing in new construction projects. Meanwhile, demand for steel in infrastructure construction is expected to weaken marginally, indicated by a 0.2% YoY decline in infrastructure investment. In terms of supply, steel mills have begun to reduce production due to sluggish sales of steel products. The output of five major steel products last week dropped 1.89% to around 9.65 million tonnes, while steel mills need to reduce production by 15.96 million tonnes to stay at the same level as last year, which is estimated as a reasonable volume. However, due to the characteristics of the steel industry, production adjustments lag behind changes in demand, so it will take time to ease the oversupply. In addition, the decline in raw material prices has exacerbated the fall in steel prices.

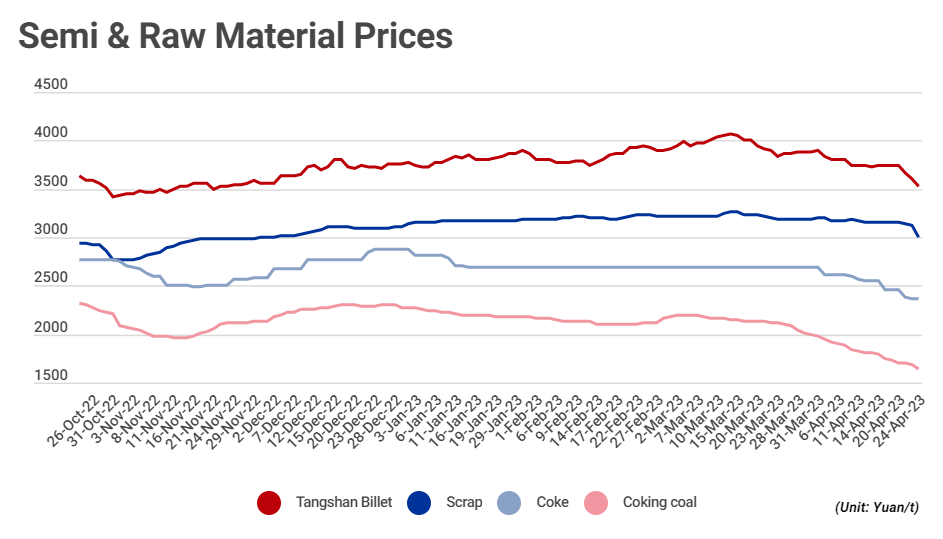

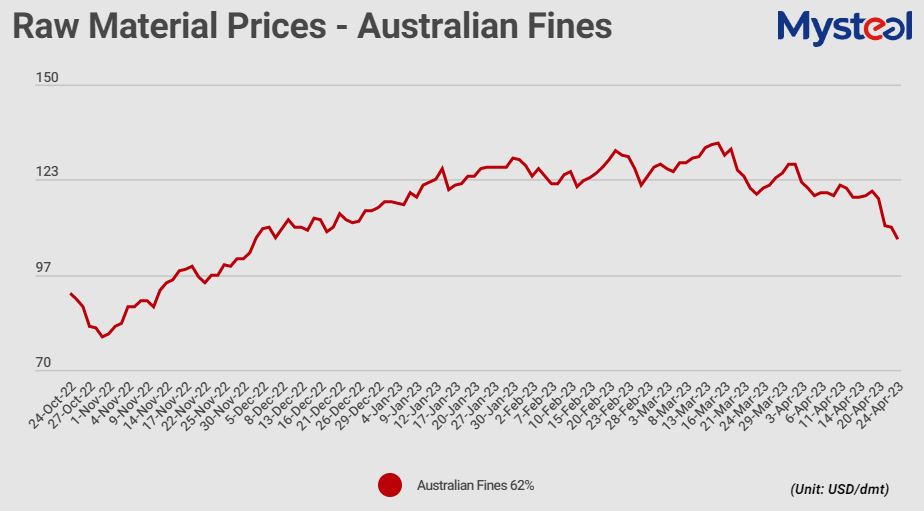

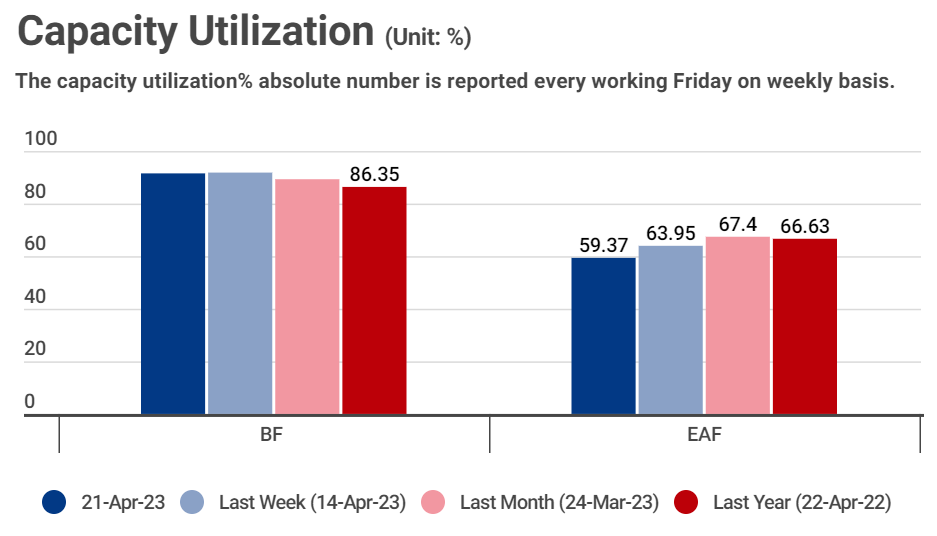

Iron ore prices are likely to decrease against lackluster steel demand and profits. There are indications that iron ore production may have peaked, and the consumption of iron ore is expected to decline. Met coal prices are expected to decline due to the increase in supply from newly operational domestic units and the rise in import volumes from Mongolia and Australia with their price advantage, while the demand from coke plants and steel mills is limited given the sluggish demand for steel products, and unsuccessful auctions are a common issue in the coal bidding market. Spot coke prices may decline in line with met coal priceswhen most coking plants are profitable and increase coke daily output by 40,000 tonnes, indicating the potential to reduce prices. On the demand side, steel mills are being cautious in their procurement of raw materials due to pressure to recover their funds, as well as decreased demand for coke resulting from signs of a turning point in hot metal production. Steel scrap prices may weaken due to reduced demand in BF and EAF steel mills, driven by lowered steel prices and poor sales performance. Mysteel data shows the capacity utilization rate in 87 EAF steel mills continued to decrease by 4.58% WoW.

To summarise: steel inventory is too high and end-user demand sucks.

Prices down.