The Real Estate Institute of New Zealand (REINZ) has released its House Price Index and sales data for March, which shows a continuation of New Zealand’s housing crash.

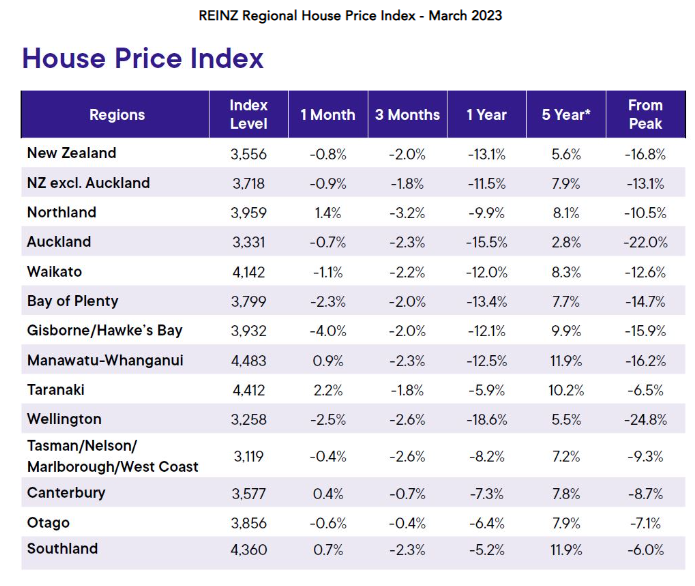

The House Price Index, which adjusts for differences in the mix of properties sold each month and is the main metric used by the Reserve Bank, fell 0.8% nationally in March to be down 13.1% year-on-year and by 16.8% from the November 2021 peak:

Values have fallen especially hard in Auckland (down 22.0% from peak) and Wellington (down 24.8% from peak).

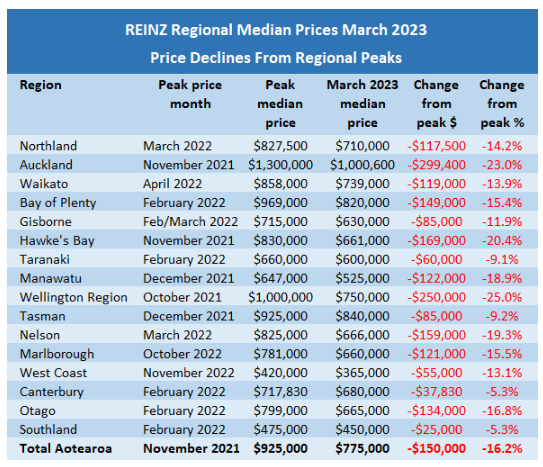

The next table shows median value changes in each region and shows that Auckland’s median house price has plummeted by just under $300,000, whereas Wellington’s has fallen by $250,000:

Across the whole of New Zealand, the median house price is down $150,000 from peak.

The amount of homes for sale across New Zealand continues to swell on the back of weakening demand.

The total number of properties sold across New Zealand in March 2023 was 5,877, down 15% year-on-year.

However, the total number of properties listed for sale across New Zealand was 29,284, up 14.1% year-on-year.

Commenting on the results, REINZ Chief Executive Jen Baird said the current recessionary conditions are clearly impacting the market.

“While we have seen activity pick up in March, this year’s summer season has been muted. Prices have eased as we can see, and properties are taking longer to sell. Buyers are taking their time, they are negotiating, and some are waiting to see if prices ease further”.

“Inventory levels are returning to the long-term average, which presents an opportunity for buyers looking to take advantage of the lower prices and less competition”.

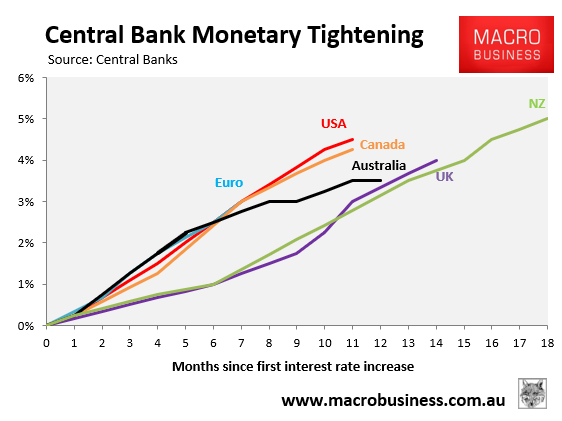

It is clear the Reserve Bank has crashed the housing market via its ultra aggressive monetary tightening:

Earlier this month, the Reserve Bank shocked economists and markets when it lifted the official cash rate another 0.5% to 5.25%.

This decision came despite the 0.6% contraction in New Zealand GDP over the December quarter, suggesting the economy is sliding into recession.

The latest survey of real estate agents by Tony Alexander showed that New Zealand home buyers are most concerned about rising interest rates, obtaining finance, and further price falls:

Therefore, the Reserve Bank’s aggressive rate hikes are behind New Zealand’s housing crash, which looks certain to continue.