The Reserve Bank of New Zealand has shocked economists by lifting the official cash rate (OCR) by 0.5% at today’s monetary policy meeting.

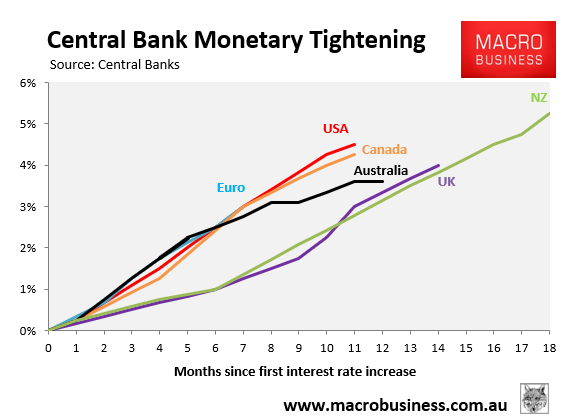

The rise has taken New Zealand’s OCR to 5.25%, which is the largest increase in the developed world:

Economists universally expected the Reserve Bank to hike rates by only 0.25%.

In coming to its decision, the Reserve Bank played down the fact that “the level of economic activity over the December quarter was lower than anticipated in our February Monetary Policy Statement and there are emerging signs of capacity pressures in the economy easing”.

Instead the Reserve Bank focused on inflation, noting it “is still too high and persistent, and employment is beyond its maximum sustainable level”.

“Demand continues to significantly outpace the economy’s supply capacity, thereby maintaining pressure on annual inflation”.

The Reserve Bank forecast that “economic growth is expected to slow through 2023, given the slowing global economy, reduced residential building activity, and the ongoing effects of the monetary policy tightening to date”.

“This slowdown in spending growth is necessary to return inflation to target over the medium-term”.

Despite this bearish view, “the Committee agreed that the OCR needs to be at a level that will reduce inflation and inflation expectations to within the target range over the medium term”.

I view the Reserve Bank’s decision to lift rates another 0.5% as highly reckless.

New Zealand’s economy is already falling into recession, with the economy contracting over the December quarter.

This year, around half of the nation’s mortgage book will also switch from ultra-cheap fixed mortgages to rates that are double or triple those levels.

This means that monetary conditions will tighten without further hikes from the Reserve Bank.

Put simply, the Reserve Bank of New Zealand is playing with fire on rates and looks set to push the economy into a severe recession.