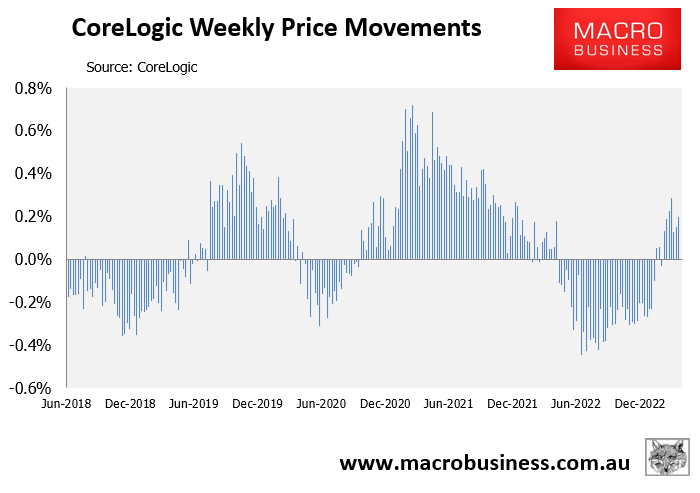

CoreLogic’s daily dwelling values index, which measures price changes across the five major capital city markets, rose another 0.20% in the week ended 20 April, which was the seventh consecutive weekly rise:

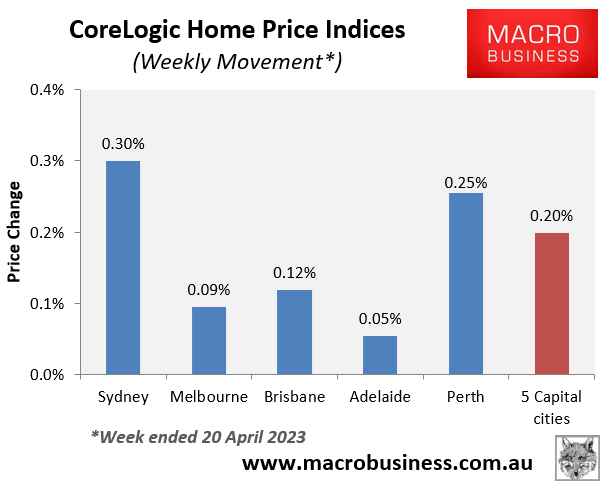

The weekly rise was once again driven by Sydney, although each of the major markets recorded value increases:

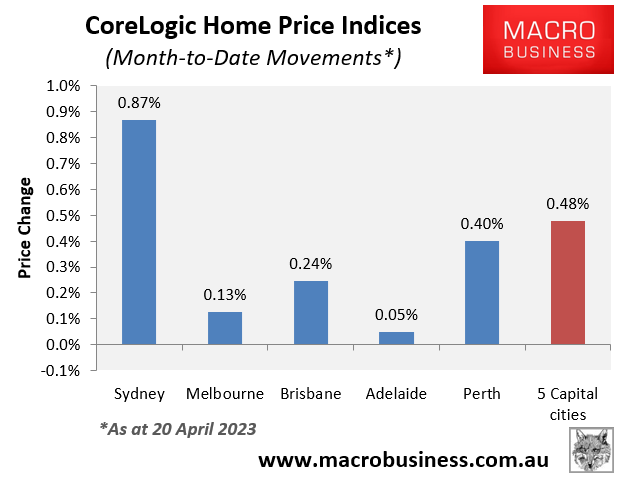

So far in April, values have risen 0.48% at the 5-city aggregate level, driven by Sydney (+0.87%). However, all major capital city markets have risen in value:

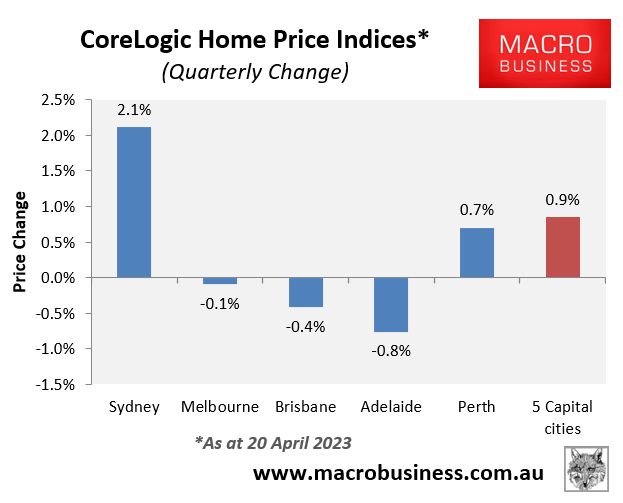

Values at the 5-city aggregate level have now increased by 0.9% over the quarter. Sydney (2.1%) and Perth (+0.7%) have driven the increase, offsetting small falls across the other major markets:

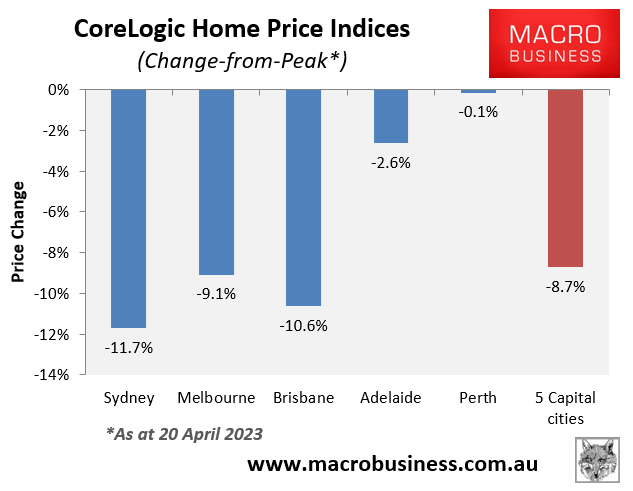

Home values are now down 8.7% from their peak at the 5-city aggregate level, driven by the three largest capitals where prices have fallen around 10%:

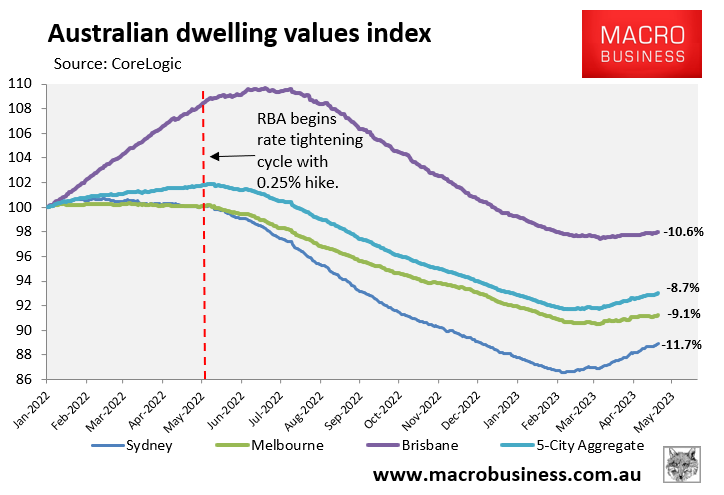

The next chart plots house prices since the RBA commenced its interest rate hiking cycle began in May 2022 and shows that prices bottomed on 8 February 2023:

Since then, Sydney home values have risen by 2.7%, which has driven home values at the 5-city aggregate level up 1.4%.

My view is that Australian home values will experience strong growth in 2023 for the following reasons:

- The Reserve Bank is likely to cut interest rates late this year, which will increase borrowing capacity and mortgage demand.

- APRA will likely then follow by reducing its mortgage serviceability buffer from 3%, which will further increase borrowing capacity and demand.

- Record high levels of immigration will increase housing demand, both to buy and rent.

- Housing construction will likely fall given builder collapses and ongoing materials price increases.

- The rental market will tighten further, incentivising more people to purchase.

- Foreign buyer demand is rising, driven by China.

Sydney typically leads housing booms and busts when interest rates rise and fall, which looks likely to repeat next year.