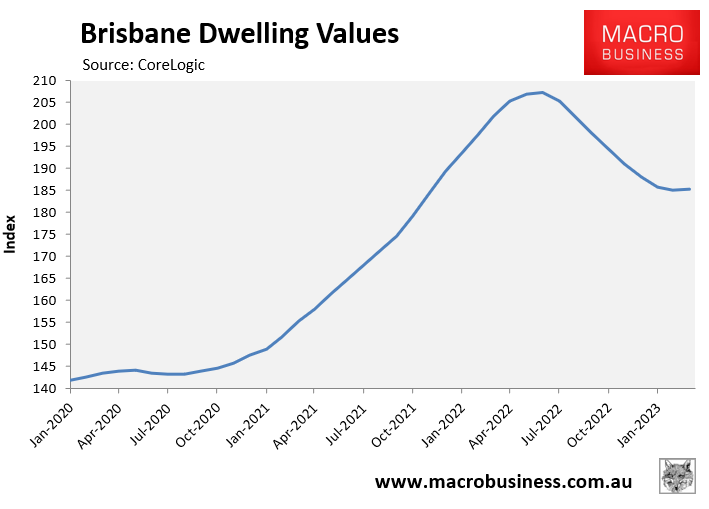

Brisbane experienced the nation’s biggest house price boom over the pandemic, with values soaring 45.3% between end-February 2020 and end-June 2022 according to CoreLogic:

Brisbane home values subsequently fell by 10.7% between July and February before staging a modest rebound in March, which has continued this month.

The end result is that Brisbane home values are now 29% higher than their pre-pandemic level.

My personal prediction is that Australian house prices will experience strong growth in 2024 due to:

- The Reserve Bank of Australia (RBA) cutting interest rates late this year, which will increase borrowing capacity and mortgage demand.

- The Australian Prudential Regulatory Authority (APRA) likely cutting its mortgage serviceability buffer from 3%, which will further increase borrowing capacity and demand.

- Record immigration will increase housing demand, both to buy and rent.

- Housing construction will fall, owing to builder collapses and ongoing materials price increases.

- The rental market will tighten further, prompting more people to purchase.

- Foreign buyer demand is rising, led by China.

So, will Brisbane lead the next house price upswing?

Smart Property Investment’s Melinda Jennison seems to think so, arguing that Brisbane is “gearing up with huge infrastructure advancements in the lead up to the 2032 Olympic and Paralympic Games”, which “will have a huge and lasting impact on the local economy”.

Jennison also notes “that Queensland’s population growth was higher than every other state and territory throughout Australia”.

Moreover, “the median house price in Brisbane is a lot more affordable than the cost of housing in areas such as Sydney and Melbourne”, which should keep people moving north.

Jennison makes some valid points.

Brisbane has indeed led population growth over the pandemic, driven by strong internal migration:

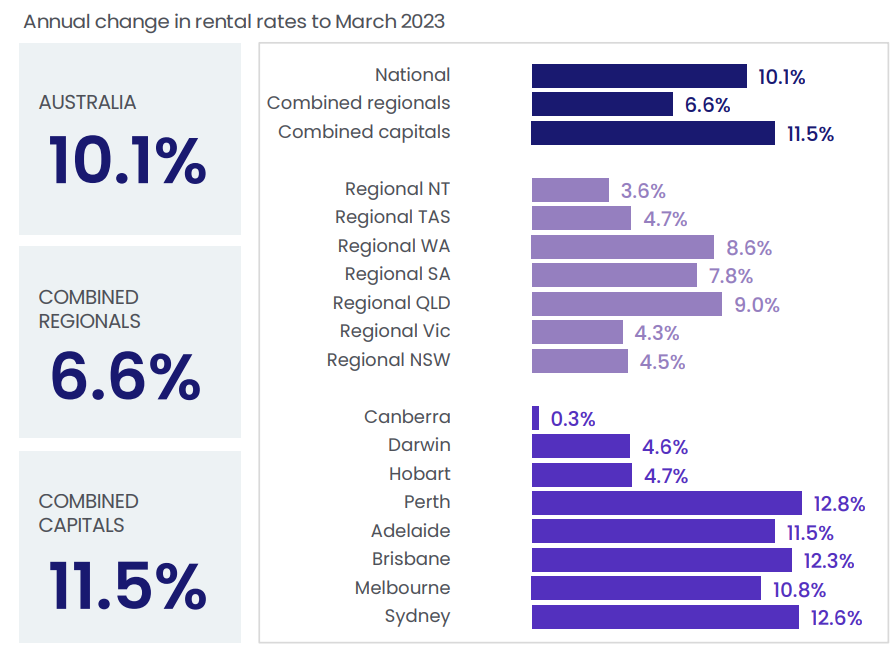

This strong population growth has led to Brisbane having one of the tightest rental markets in the nation with rents rising 12.3% in the year to March, according to CoreLogic:

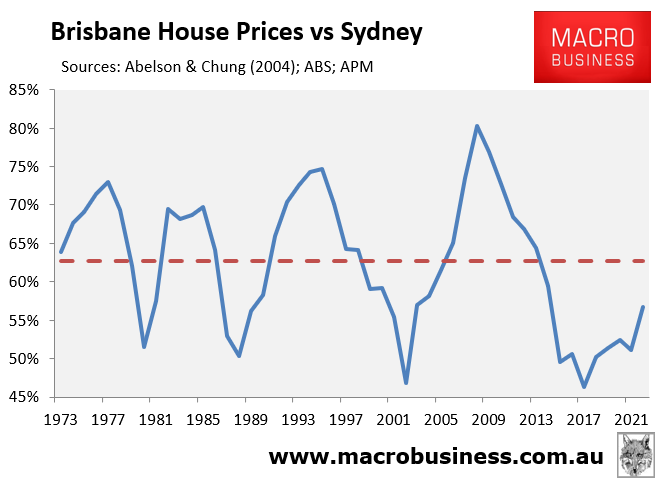

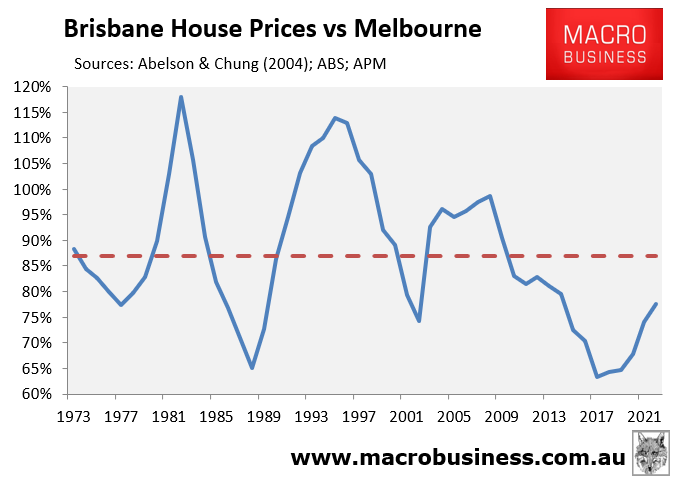

Brisbane’s house prices are indeed far cheaper than Sydney’s and Melbourne’s, which should ensure southerners continue to move north.

Brisbane’s median house price is only 57% of Sydney’s median house price according to Domain:

Whereas Brisbane’s median house price is only 78% as expensive as Melbourne’s:

Based on affordability, there seems to be far more upside for Brisbane property than its two larger southern counterparts.

Finally, in addition to promoting massive infrastructure investment, the 2032 Olympics should cement Brisbane as a global city, which could lead to more interest from foreign buyers.

My personal view is that Sydney will probably lead the next house price upswing given it tends to experience bigger booms and busts when interest rates rise and fall.

However, over the coming decade, Brisbane will likely lead capital growth among the East Coast capitals.