DXY continues to skirt its great 101 suppert level. EUR sickened:

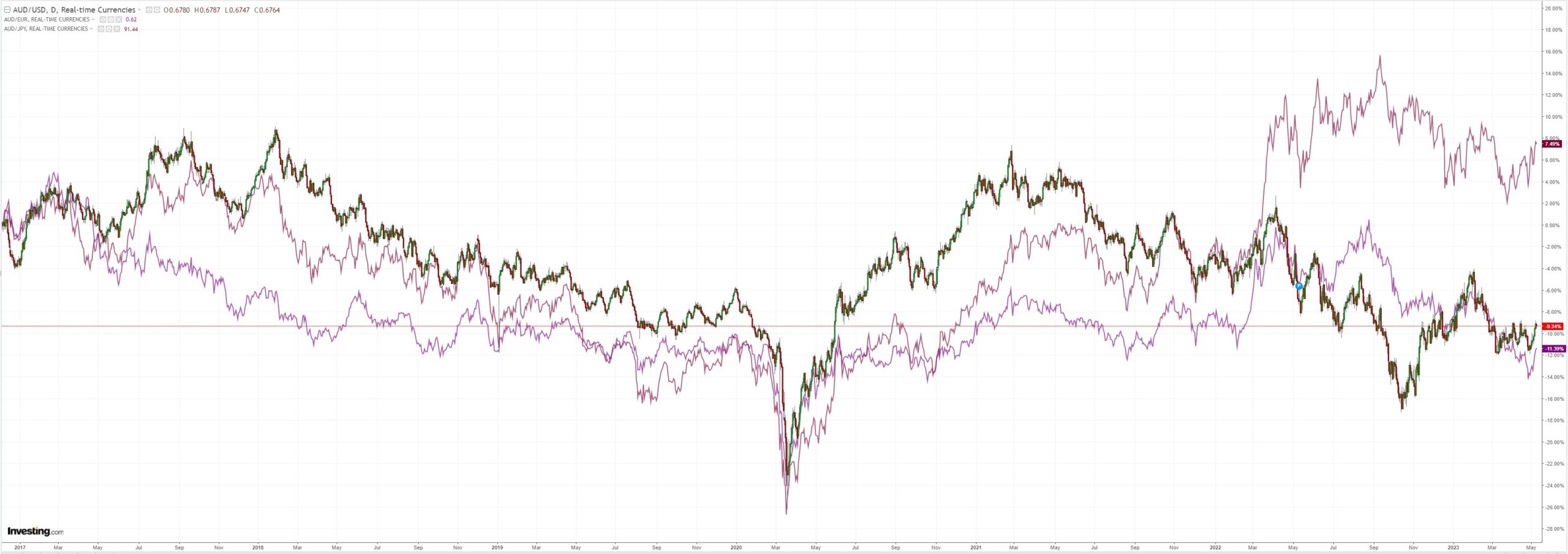

AUD flamed out:

Commodities are similar to DXY which is very unusual:

Advertisement

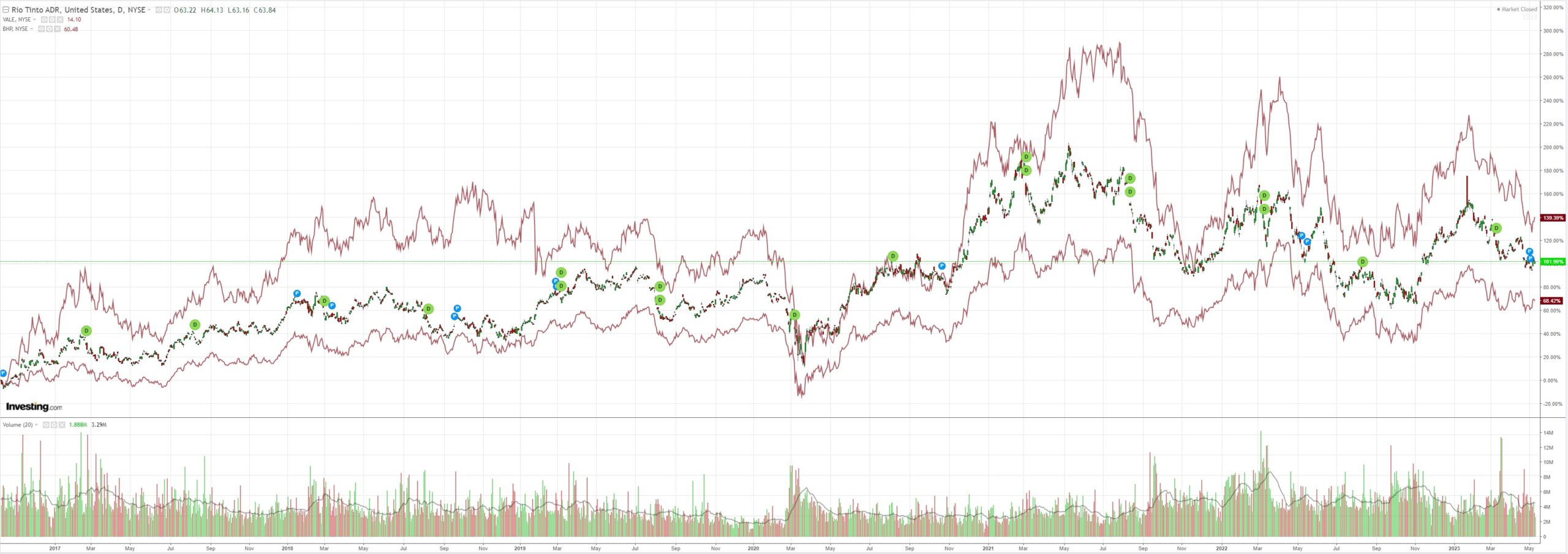

Miners eased:

EM stocks are fat and flat:

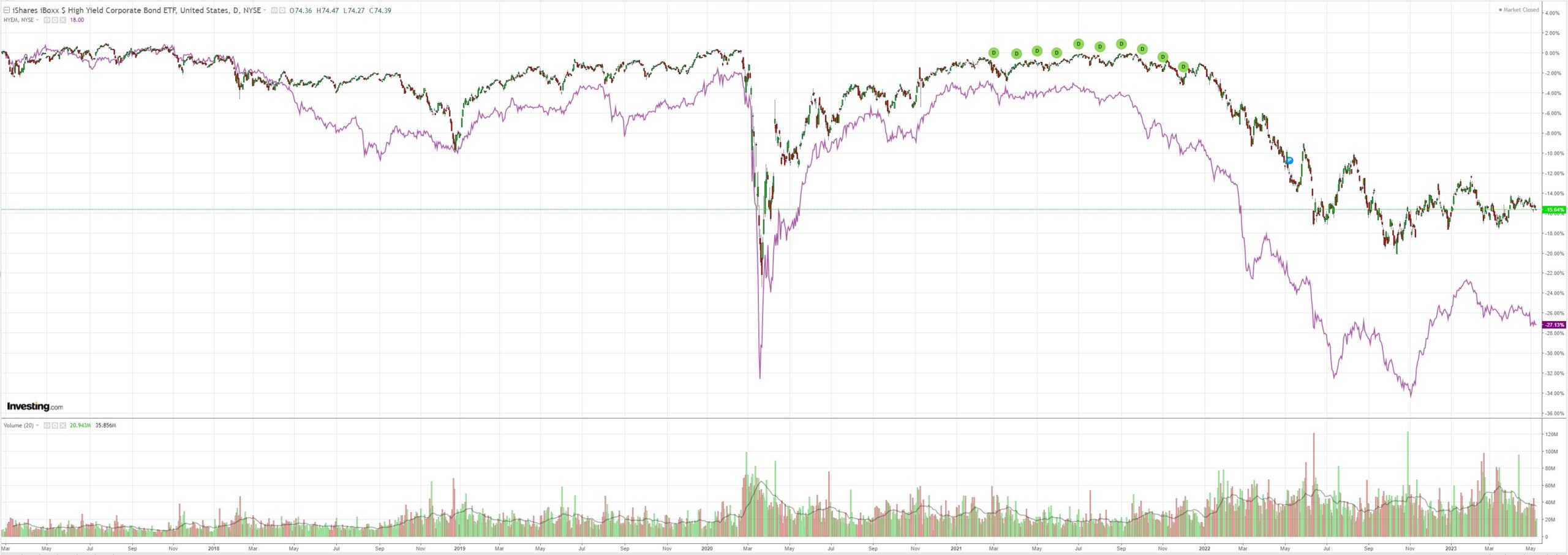

Junk is more nearish than anything:

Advertisement

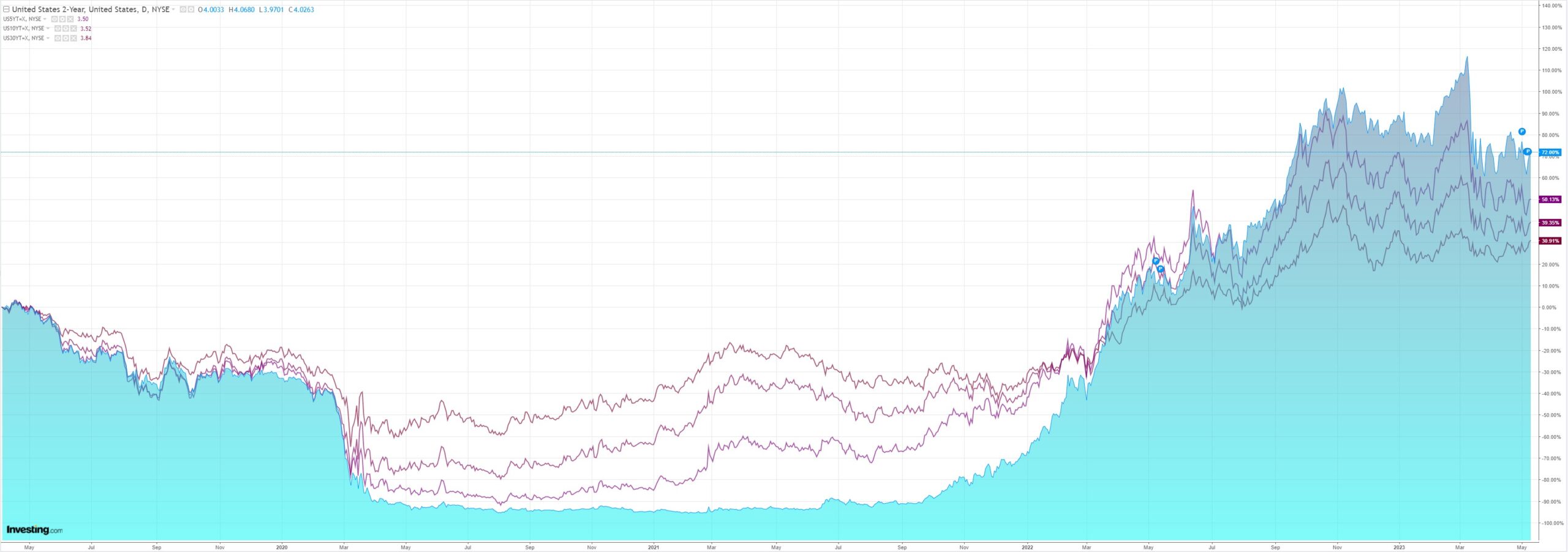

As the curve flattened ito US CPI:

And stocks fell back:

We are approaching US CPI tomorrow (which is rumoured to be hot) and Janet Yellen moved the X-date forwards to June 1 for debt-ceiling negotiations.

Advertisement

Both of these are DXY bullish, in my view. One on rates an other on safe-haven flows.

Add that the EUR bid looks exhausted:

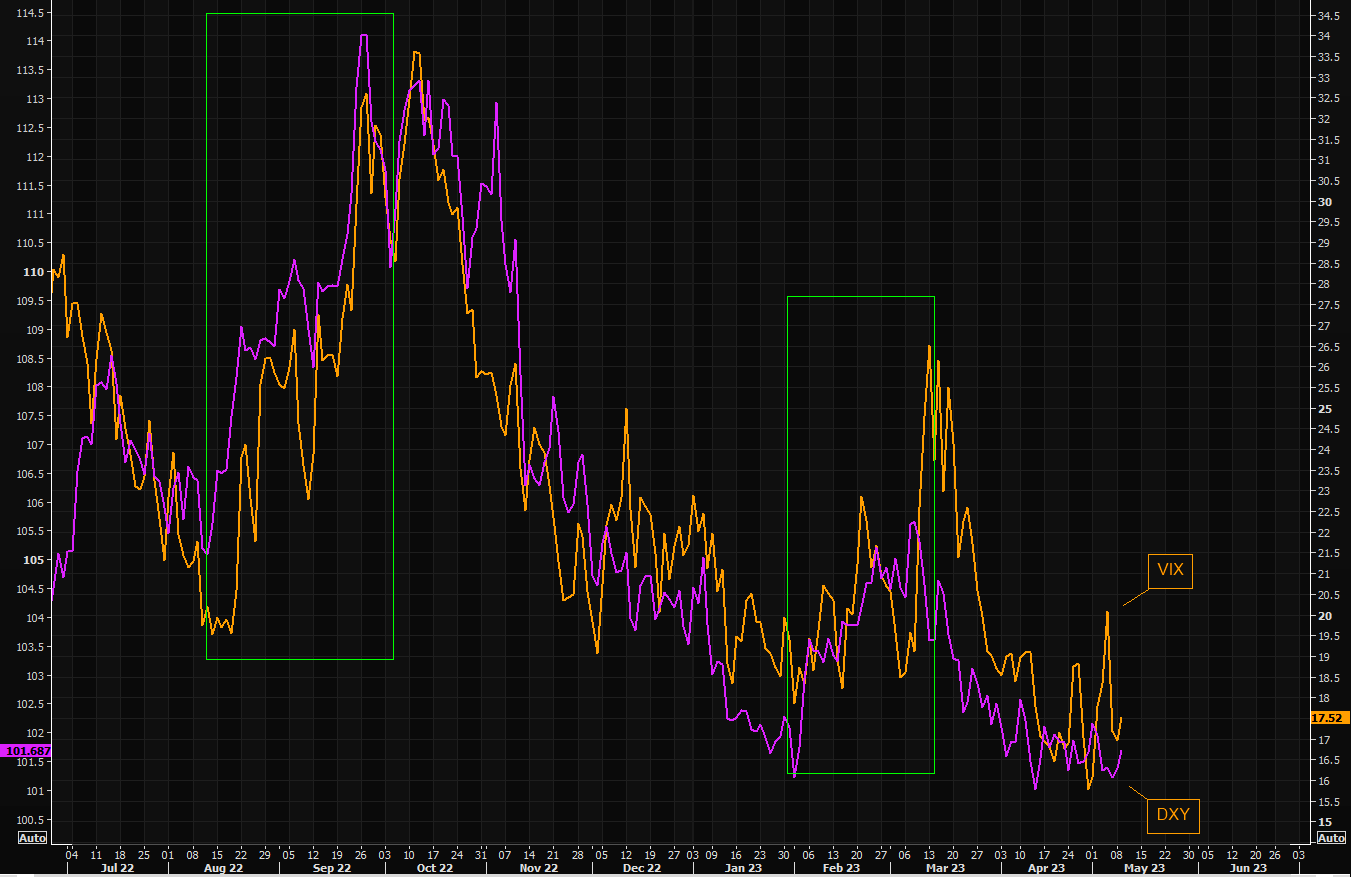

And that any kind of volatility bounce will lift DXY:

Advertisement

And we can conclude that the base case in the short term is for more AUD weakness.