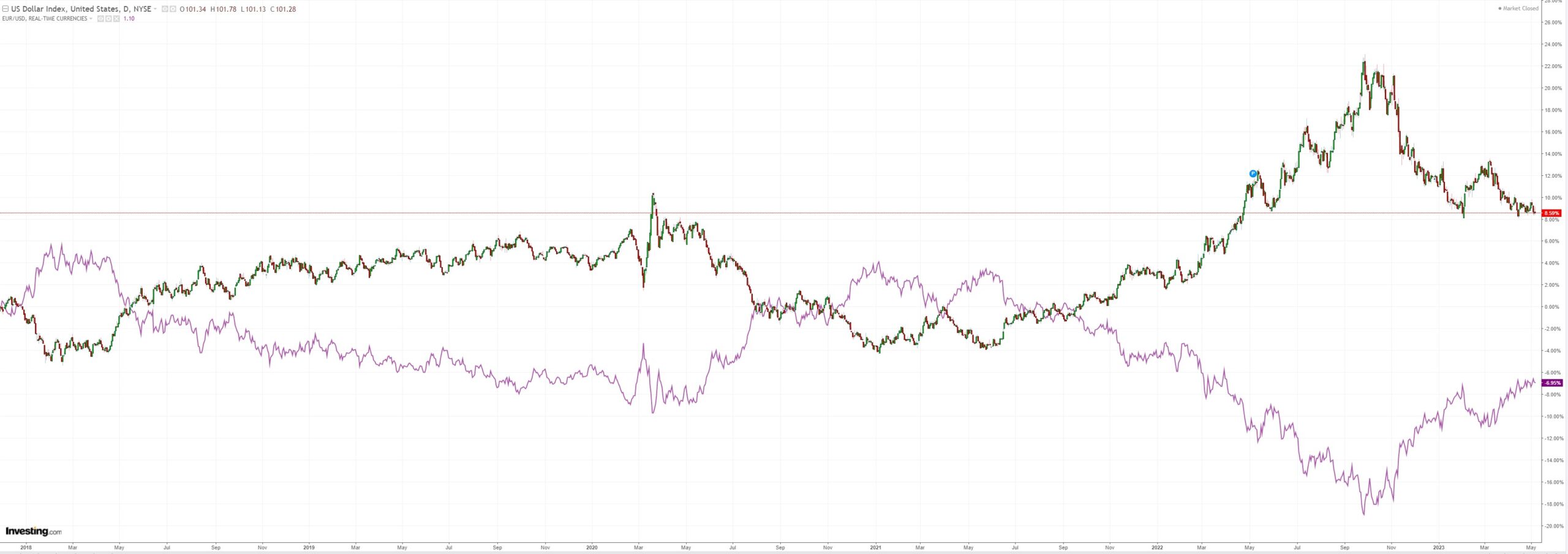

DXY still has a very bearish chart:

AUD blew the roof off on all DM crosses:

Gold sank but all commodities boomed:

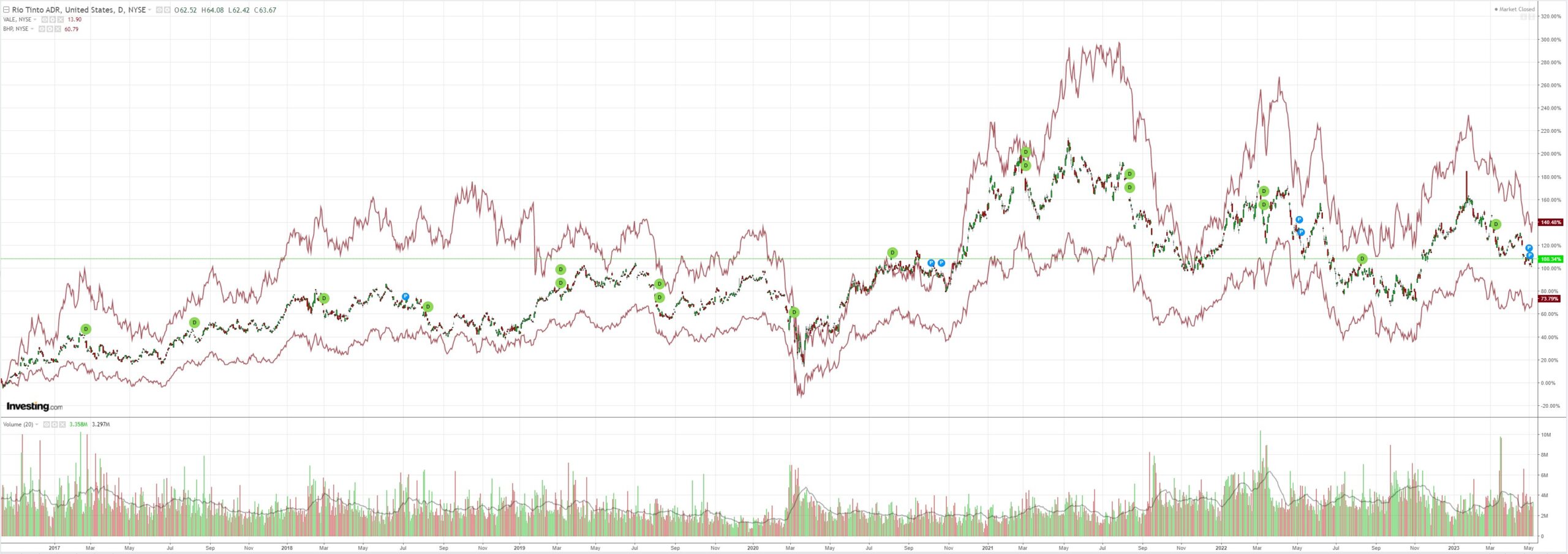

Miners ripped:

EM is lost:

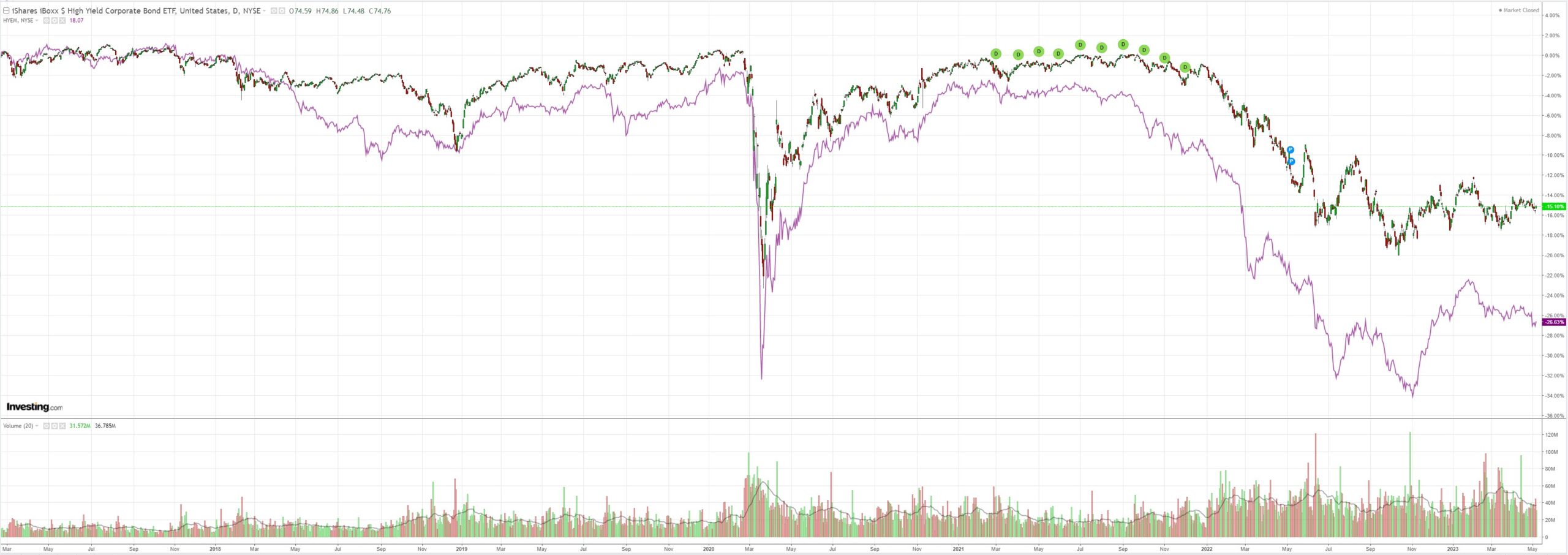

Junk not well:

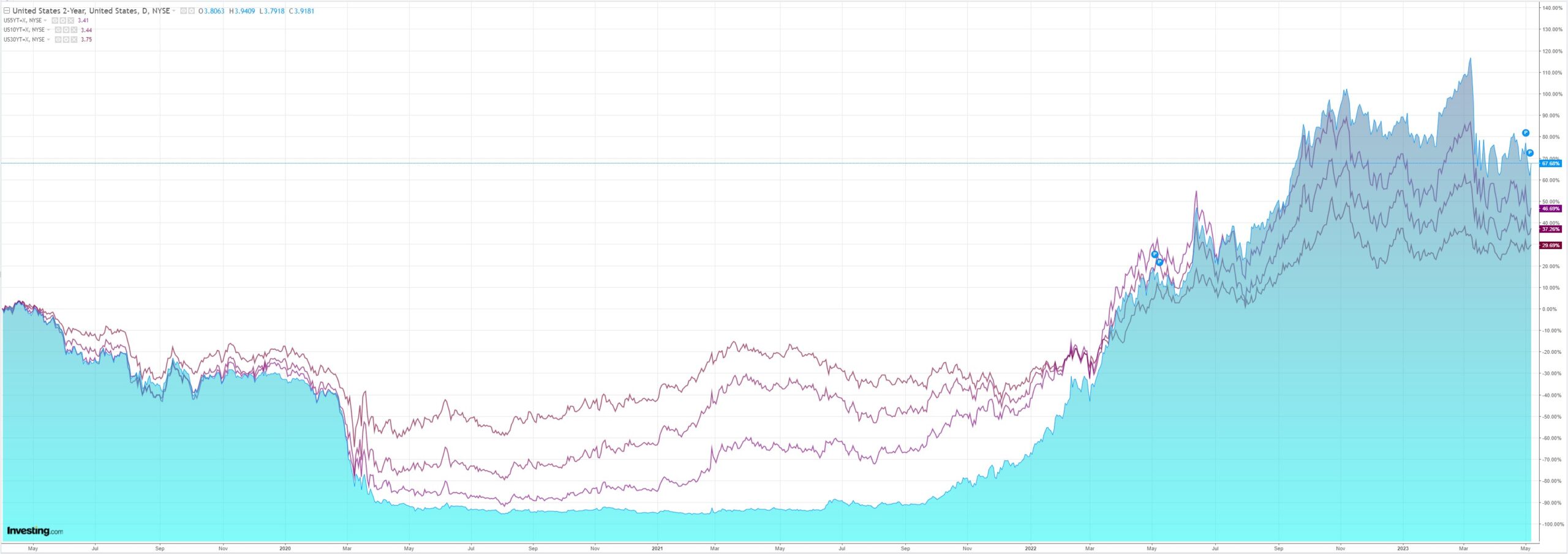

The Treasury curve was re-squashed:

As stocks launched a manic short squeeze:

The trigger was better than expected US jobs.

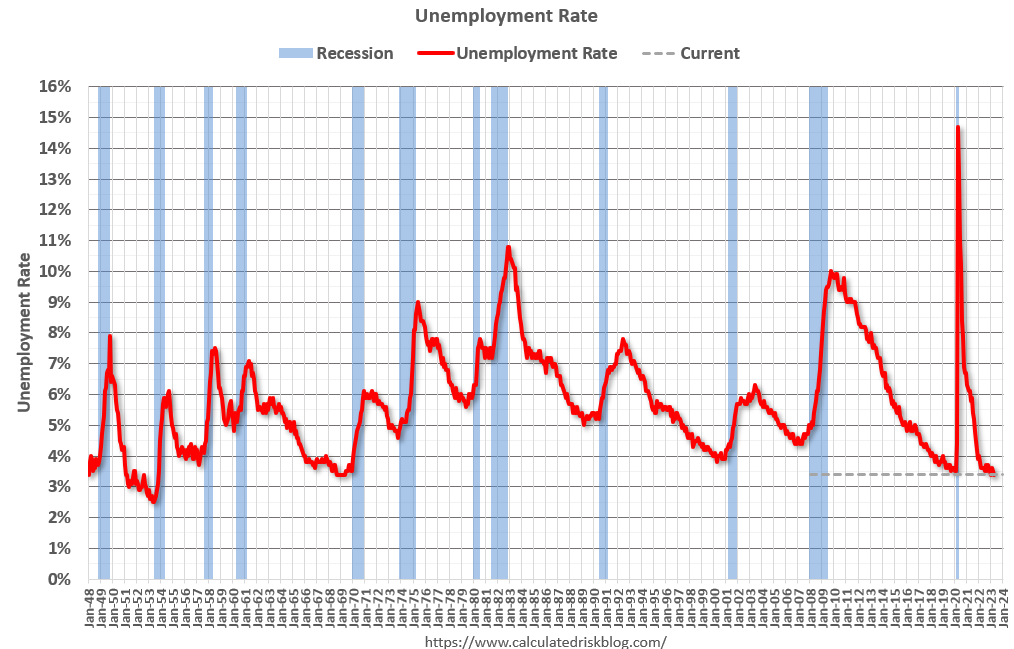

Total nonfarm payroll employment rose by 253,000 in April, and the unemployment rate changed little at 3.4 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in professional and business services, health care, leisure and hospitality, and social assistance.

…The change in total nonfarm payroll employment for February was revised down by 78,000, from +326,000 to +248,000, and the change for March was revised down by 71,000, from +236,000 to +165,000. With these revisions, employment in February and March combined is 149,000 lower than previously reported.

In April, average hourly earnings for all employees on private nonfarm payrolls rose by 16 cents, or 0.5 percent, to $33.36. Over the past 12 months, average hourly earnings have increased by 4.4 percent. In April, average hourly earnings of private-sector production and nonsupervisory employees rose by 11 cents, or 0.4 percent, to $28.62.

This is the lowest unemployment rate since 1969. They really do need some mass immigration to derail these worker gains.

Or not. This is obviously hawkish for the Fed which is now data-dependent. Another month like this and it will hike again in June.

The market chose instead to see it as Goldilocks with good jobs and falling inflation to deliver a soft landing.

Or, it was all just a big, fat short squeeze triggered by crushed small banks:

Anyway, I am still bearish AUD and very uncertain about DXY, with a small bank accident a great candidate to deliver a safe haven bid, meaning everything else is febrile as well.