It would be more accurate to say that EUR was smashed as the Chinese recovery stalls:

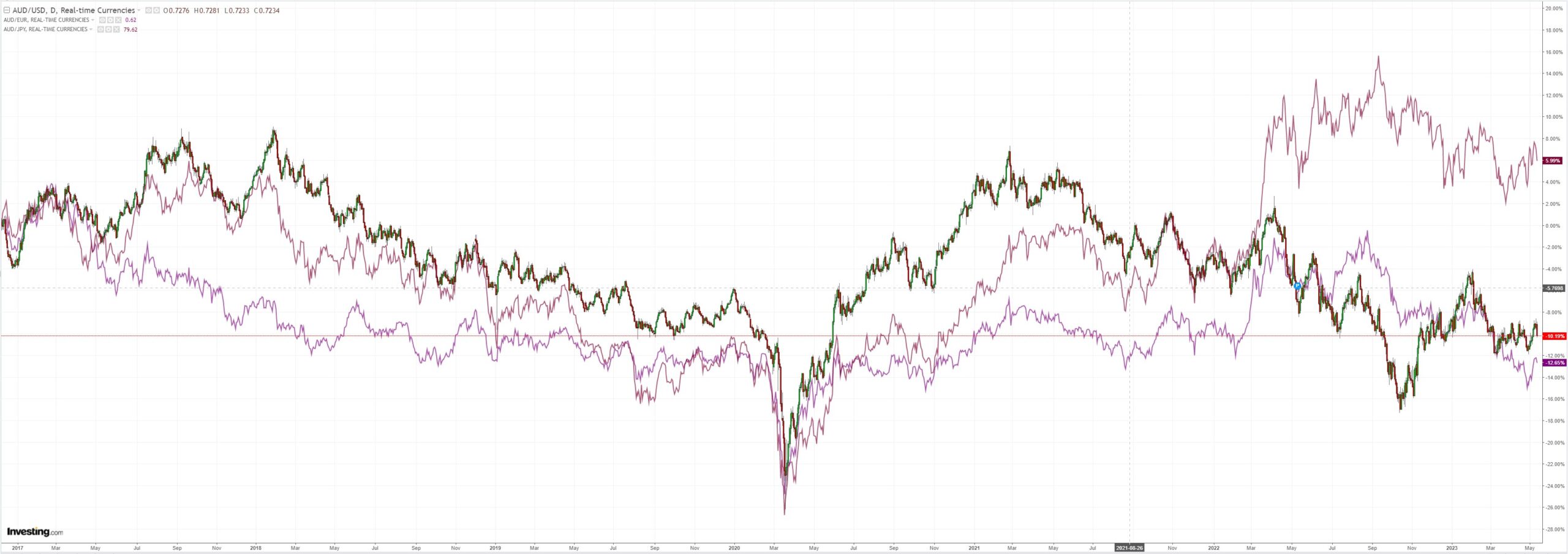

As we know, AUD follows EUR:

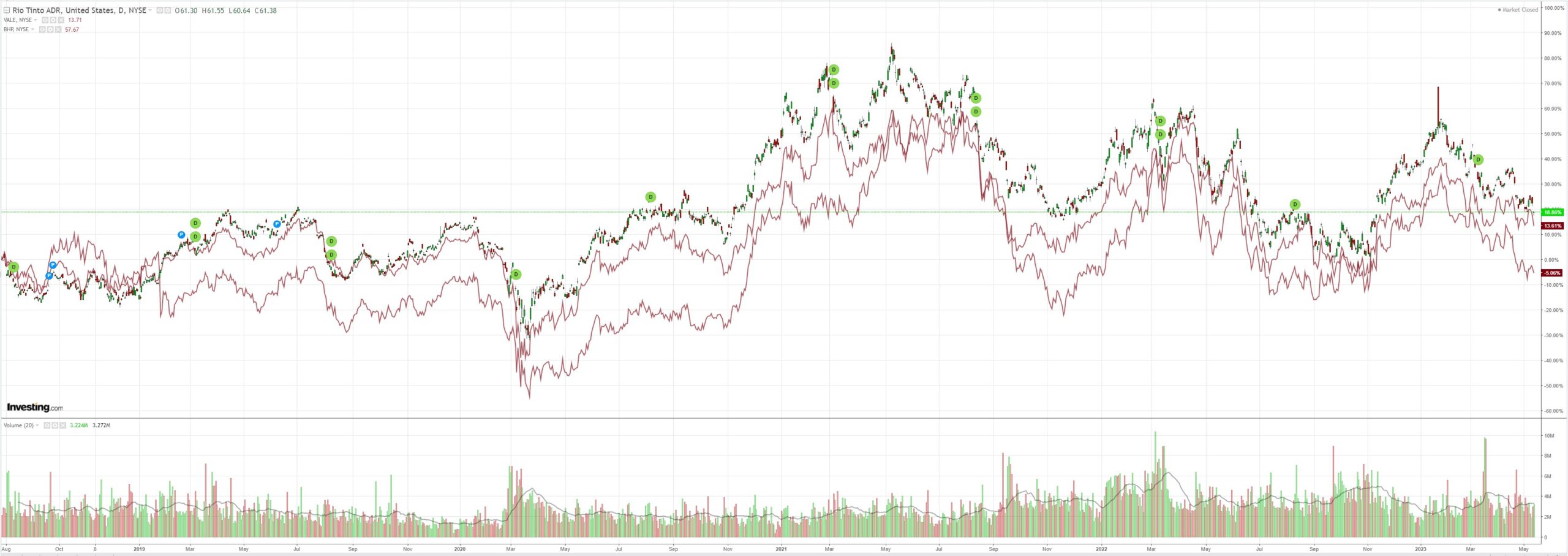

All commods were pulverised as the Chinese property recovery turns L-shaped. I am still giggling at Goldman’s ex-China commodity super cycle thesis:

Miners were crushed:

EM stocks are stuck in a bog:

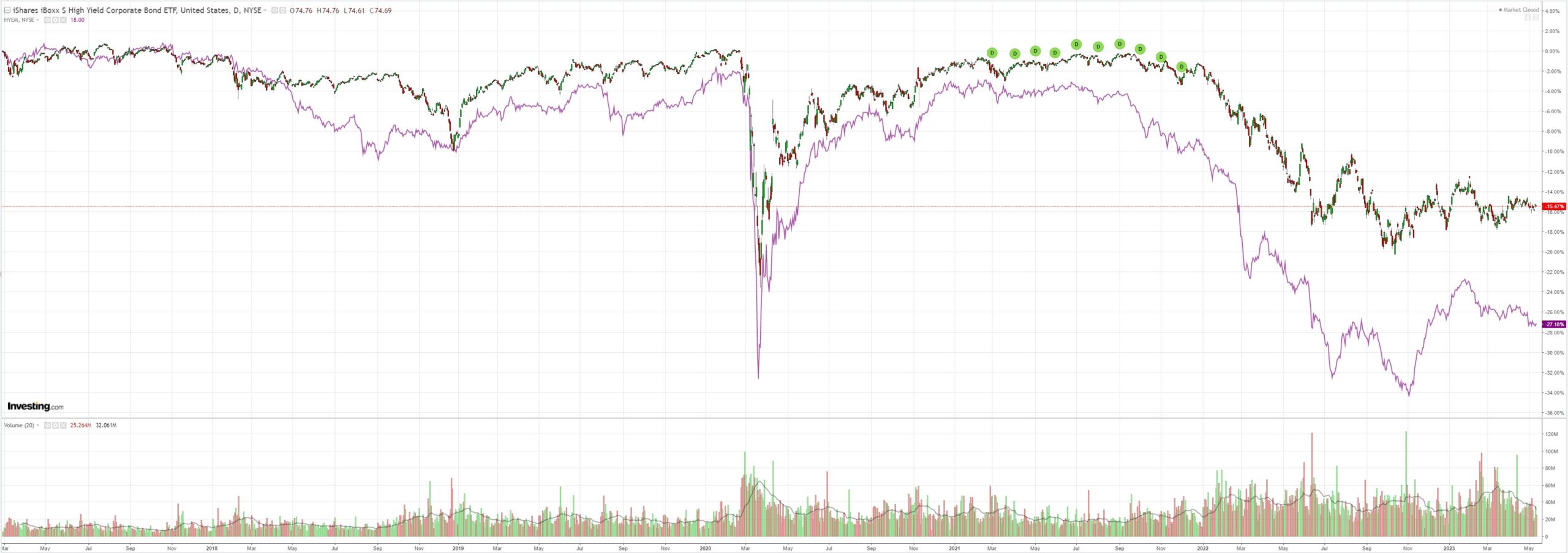

Junk is sinking into the same:

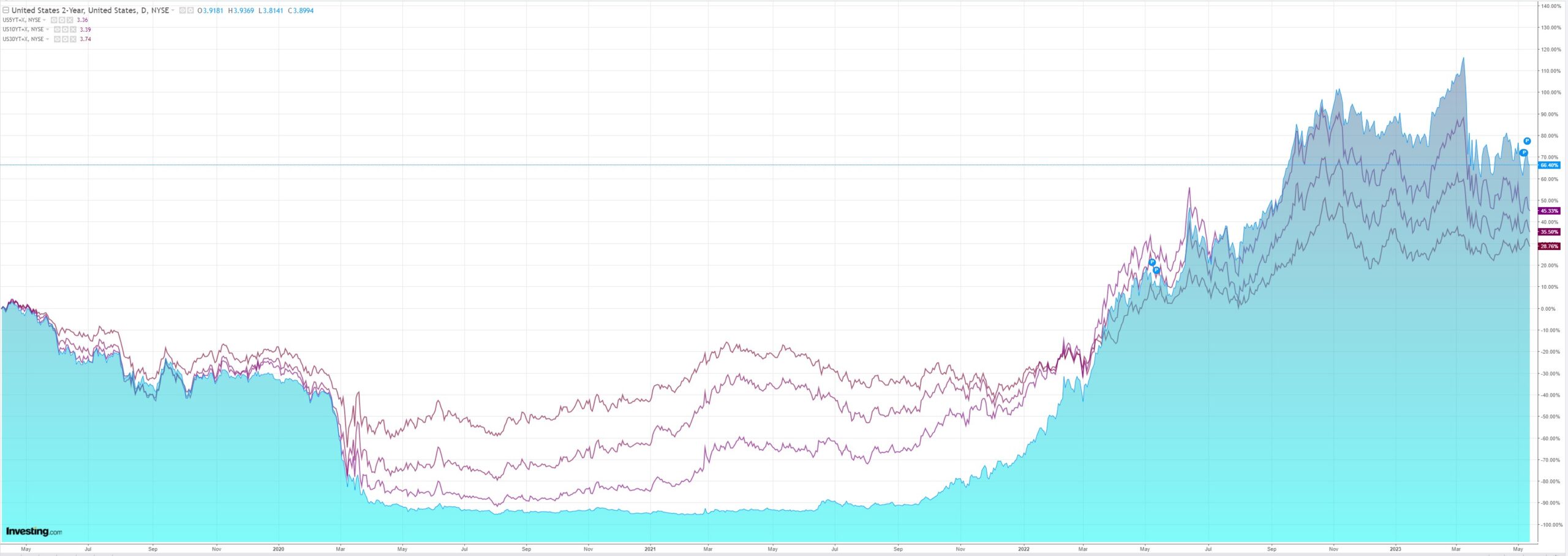

The US curve flattened:

Tech only goes up:

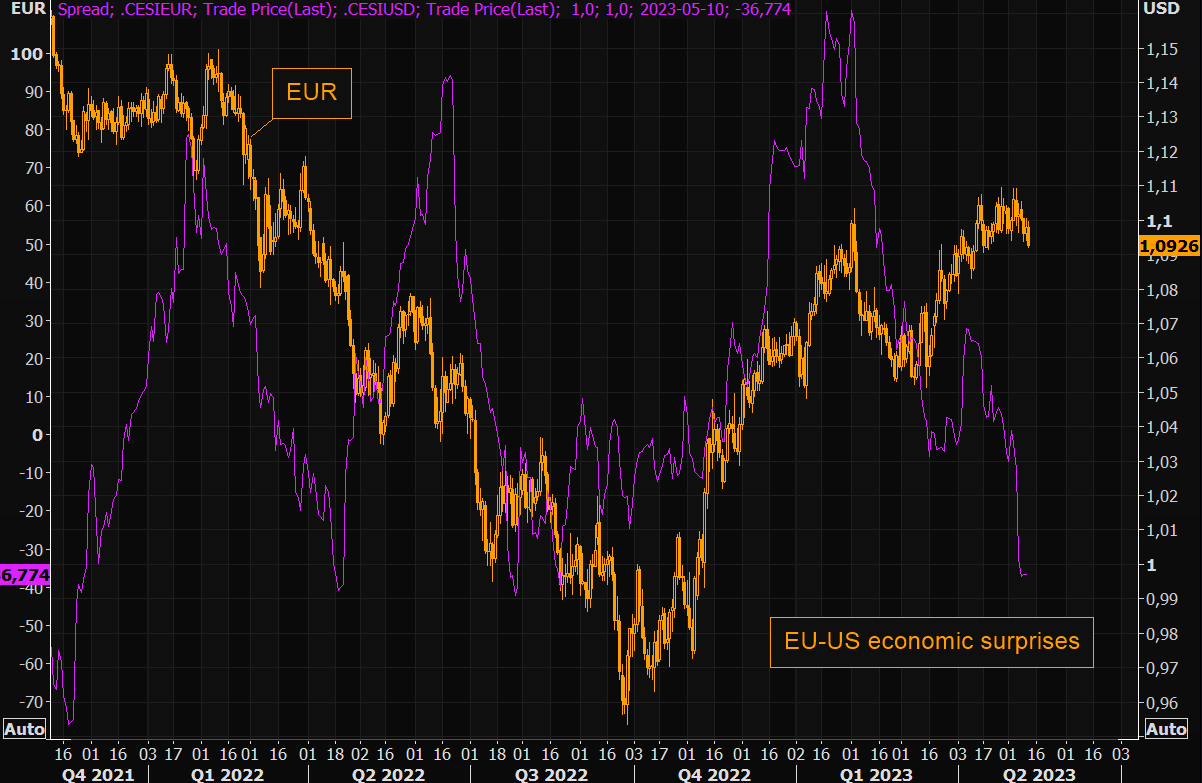

Weak Chinese inflation and credit (though not weak growth given the services boom and base effects) upset the massive EUR long. It is now in trouble as we approach X-date.

Market Ear has some more on a very tired EUR rally.

Euro – not that great

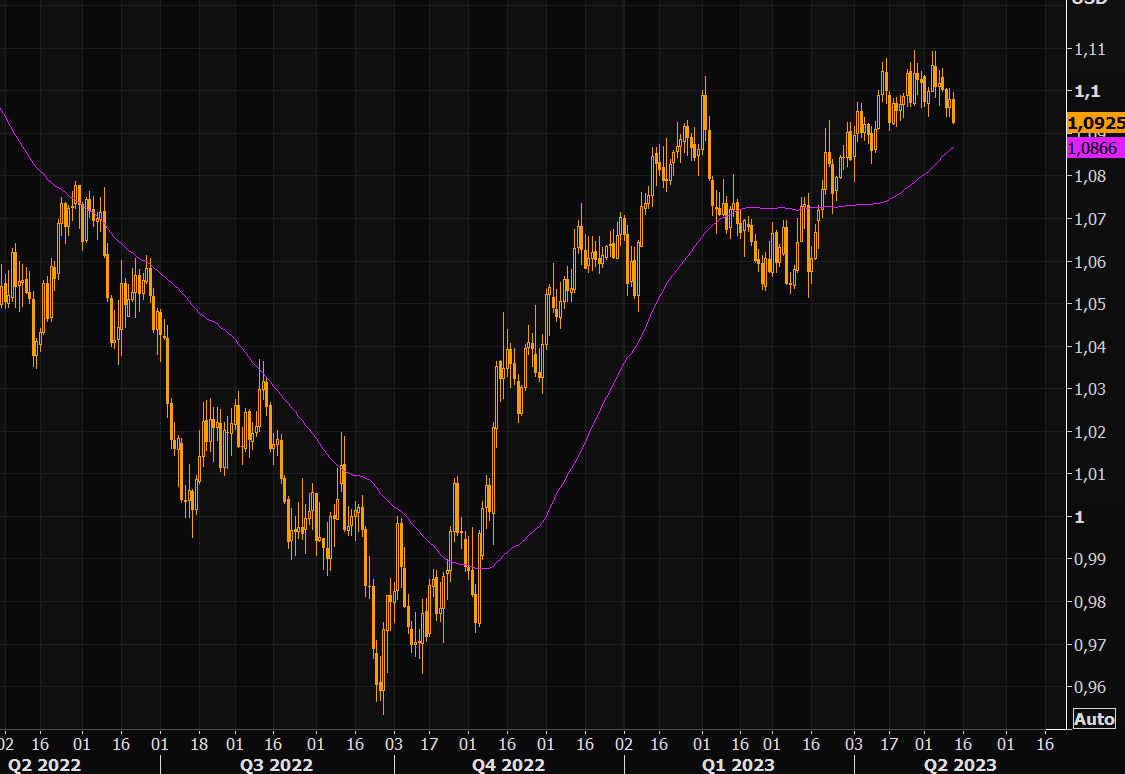

Investors are still talking about the horribly weak dollar and pushing their euro long narratives, but price action isn’t supporting that view. Yes, the dollar is down since mid March, but it is basically unchanged since late January. First support for the latest weakness in the euro is the 50 day, around 1.087.

Euro’s headache gap

Economic surprises in Europe have collapsed recently, both absolutely as well as relatively speaking. Let’s see if the euro move lower gets some more serious traction…

EUR/USD forward vol breaches floor

EUR/USD 1y1y forward volatility is below 8 for first time since Ukraine was invaded…

Fed rate cuts are priced into DXY

Short rates suggest the dollar has fallen enough for now.

The ECB is still hiking and the European economy is sliding alarmingly. It has no China support and domestic demand is in the throws of a credit crunch.

Europe is going into recession in H2 and AUD is going with it.