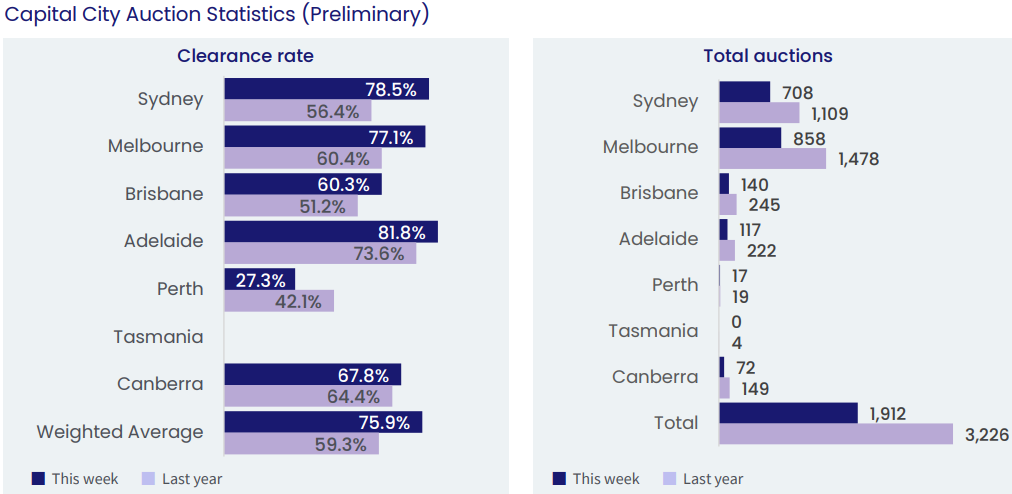

Preliminary data from CoreLogic shows that Sydney’s residential auction clearance rate rose to 78.5% in the week to Saturday, which was its equal best result since February 2022.

Melbourne’s preliminary clearance rate rose to 77.1% – the seventh consecutive result above 70%.

Whereas the national preliminary clearance rate rose to 75.9%, which is its highest level since November 2021:

Source: CoreLogic

Domain’s preliminary clearance rates were equally strong, with 77% of auctions selling in Sydney and 74% in Melbourne:

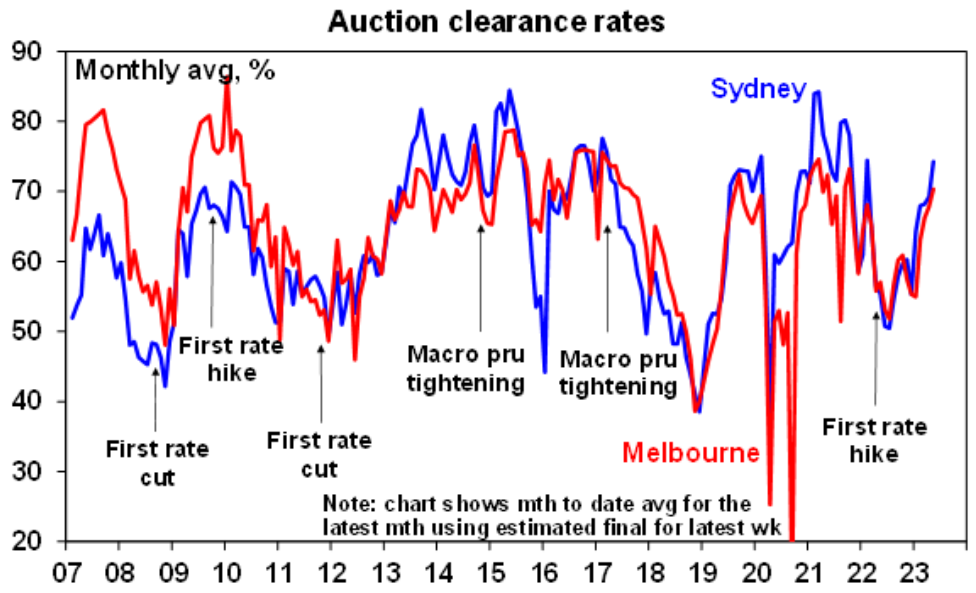

Source: Shane Oliver (AMP Capital)

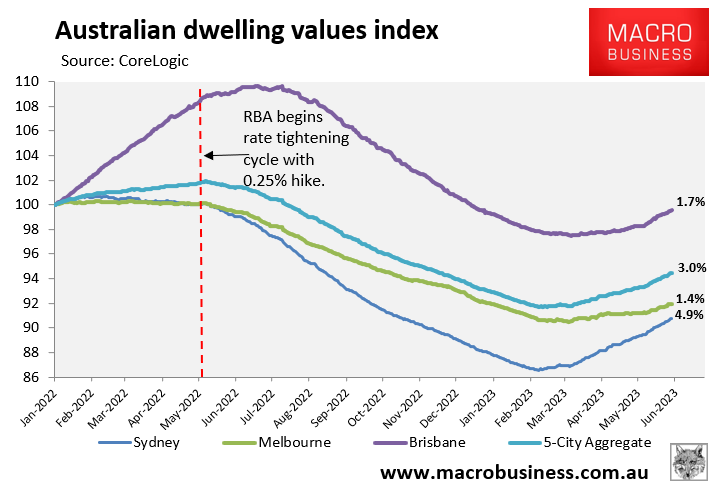

Meanwhile, CoreLogic’s daily dwelling values index continues to surge, with values lifting 3.0% at the 5-city aggregate level from their trough on 7 February:

Sydney has led the nation’s rebound, with values surging 4.9% from 7 February, while smaller bounces have occurred across Brisbane (+1.7%) and Melbourne (+1.4%).

Ray White Surry Hills lead agent, Astrid Joarder, said a lack of stock is driving FOMO (‘fear of missing out’) in the market.

“There’s such a high cost and lead time on renovations at the moment, so first home buyers are looking for something ready to move into, whereas, historically, it’s been homes that needed a bit of work which would attract first home buyers”.

Melbourne-based buyers agent David Morrell agrees.

“The plug-in-and-play mentality has come to fore. In other words, they just want to move in and will really pay for it”.

“The ‘renovator’s delight’ is not appealing to people now”, he said.

SQM Research managing director, Louis Christopher, notes that both investors and first-home buyers are active at present, although he cautions that another increase in the cash rate in June could see a pause in housing market activity.

“First home buyers are active in the market. They are being squeezed by the rental market. Investors are also active, they’re capitalising on the increase in rents”, Christopher said.

“All buyers are keeping one eye on the Reserve Bank of Australia”.

“If the RBA were to lift rates again next week that could pause the market, it could create the false dawn in the market that we’ve been a little cautious about for the year”.

With record immigration into Australia and a tight rental market, FOMO is now playing a crucial role in the housing recovery.

This FOMO is worsened by a severe dearth of inventory, with auctions, listings, and sales volumes all significantly below average.

One can only speculate on how swiftly prices will rise if and when the Reserve Bank begins its next easing cycle.

With buyer demand strong and supply limited, the only thing holding back rapid price growth is the lower borrowing capacity caused by rising interest rates.

Once interest rates begin to fall and borrowing capacity increases, housing prices will inevitably launch.