Jonathan Mott, a veteran banking analyst, has conducted a survey of around 1640 mortgage brokers who are responsible for 70% of home loans sold in Australia.

The survey backs up concerns about “mortgage prisoners” who are unable to refinance loans because the sharp rise in interest rates and fall in home prices over the last 13 months means they no longer meet the 3% serviceability buffer required by the Australian Prudential Regulatory Authority (APRA).

According to Mott’s survey, around 24% of borrowers trying to refinance are in this “mortgage prison” situation.

Mott also sees these borrowers’ financial hardship increasing.

“We expect mortgage arrears to rise sharply over the next 12 months to 18 months as these customers revert to higher interest rates and these loans season”, Mott is quoted as saying in The AFR.

Banks have several options for dealing with these clients, including switching them to interest-only loans, extending loan terms – which Mott refers to as a “extend-and-pretend” tactic – or encouraging some customers to sell.

“However, in our view, it is inevitable some customers will not be able to meet their higher repayments and a rise in credit impairment will likely be seen”, he said.

“We believe it will take until around the end of this calendar year until we have a good indication as to how severe this impairment cycle is likely to be”.

Mott expects these “mortgage prisoners” to push bad debts higher, albeit from historically low levels.

The survey also suggests that 25% to 30% of potential home buyers cannot borrow at all because they do not meet APRA’s mortgage serviceability requirements.

Accordingly, mortgage credit growth will remain constrained, which will pressure bank margins.

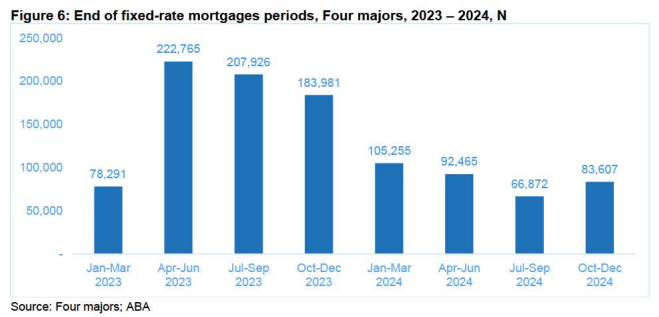

The number of “mortgage prisoners” will likely ratchet higher given more than 600,000 fixed rate mortgages were scheduled to expire between April and December 2023:

In turn, they will role off ultra cheap rates of around 2% to rates approaching 6%.

If they try to refinance, they will be assessed at an average variable rate approaching 9%, which will trap many with their existing lender.

Many may then be forced into selling their homes because APRA’s 3% serviceability buffer holds them prisoner to their current lender charging an uncompetitive rate they can no longer afford to repay.

The situation is most worrying for the tens-of-thousands of first home buyers that purchased near the peak of the house price boom in 2021 at ultra-cheap fixed rates of around 2%:

A significant share of these first-time buyers would have borrowed close to their maximum capacity and will see their mortgage rates reset to around triple current levels.

Many will inevitably become captive to their existing lender, unable to refinance, and facing default.