Below is an interesting note on the economic impacts of Australia’s immigration surge by Belinda Allen, Senior Economist at CBA.

Allen projects that the labour supply shock from record levels of immigration will help to lift Australia’s unemployment rate by 0.75% by the end of 2023, as well as tighten the rental market further.

Key Points:

- Australia’s population forecasts are being upgraded due to a surge in net overseas migration.

- A lift of 400k net overseas migrants are expected in 2022/23, compared to the previous forecast of 235k.

- around half the lift has been driven by international students, with more arrivals and less departures (due to visa changes).

- The lift in population will have implications for labour supplyand wages growth, but also inflation in the Australian economy.

The rapid lift in net overseas migration has been stronger than policy makers, and we expected over the past year.

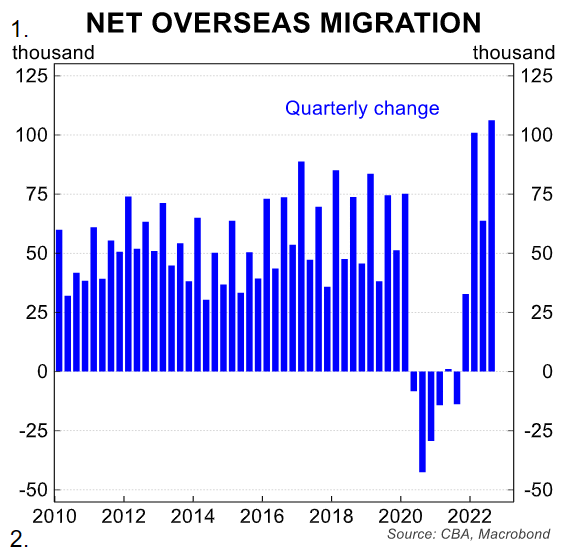

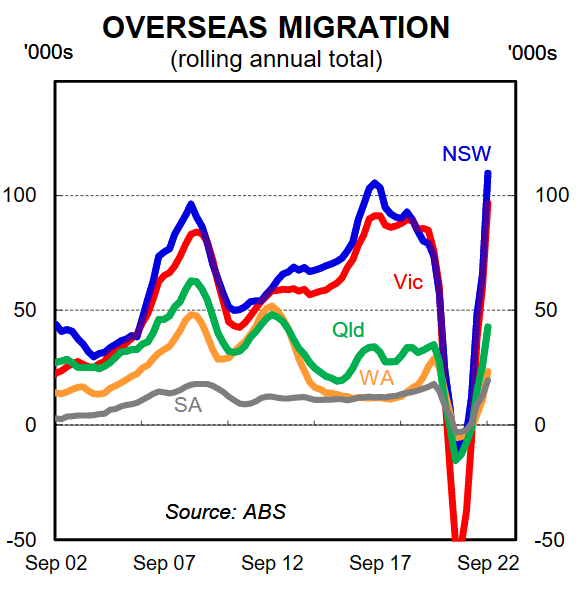

The latest official data (Q3 22 released on 16 March 2023) confirmed there was a record lift of net overseas migration of 106k in Q3 22 (chart 1).

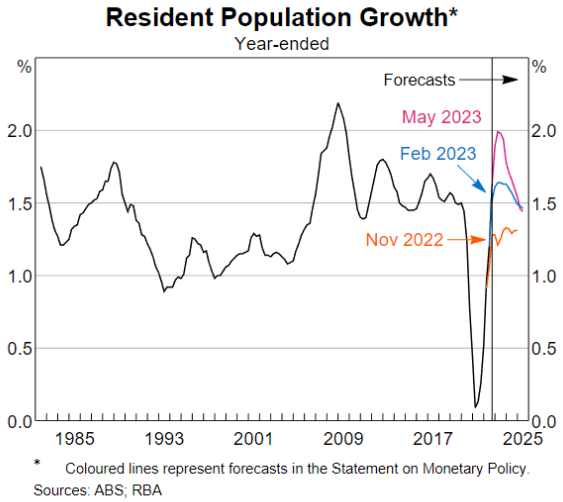

Annual net overseas migration sits at 303.7k, just shy of the annual record set in December 2008. This took the rate of annual population growth to 1.6%, back above where it was pre pandemic. The expectation is population growth to reach over 2%/yr.

Chart 2 shows the revisions the RBA has made to population projections. Next week’s Federal Budget will update these population projections.

Net overseas migration is expected to reach400k in 2022/23, well up on the 235k forecast in the October budget. 2023/24 should also be updated to ~315k.

Despite these upgrades Australia’s population will still be smaller than expected pre pandemic given temporary border closures in 2020 and 2021.

In this note we update and extend on previous work we have done on population growth and dig deeper into how this rapid lift in net overseas migration has occurred.

We also cover the source of migration and the impact on the Australian economy.

International students leading population growth higher

Australia recorded negative NOM from Q2 20 to Q3 21 (there was a small lift in Q2 21 as chart 1 shows).

The rapid return of NOM began in earnest in Q4 21 as borders began to reopen. However the large lifts occurred in Q1 22 and Q3 22, in conjunction with the start of the university semester in Australia.

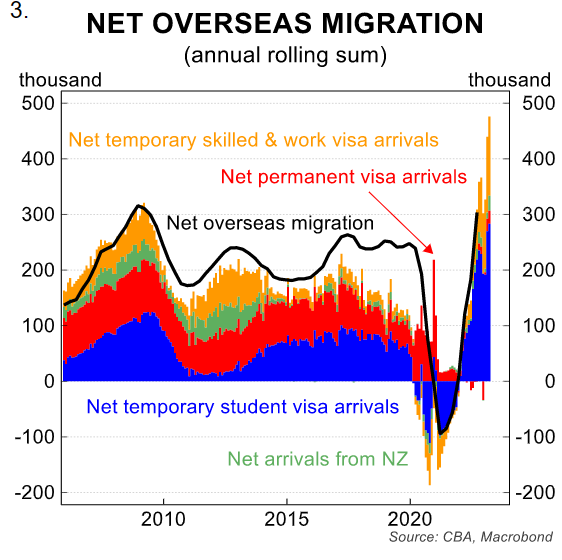

Chart 3 uses the monthly arrival and departure data to continue the analysis. This data uses the monthly arrivals and departures data which counts trips into and out of Australia.

This will generally overstate NOM numbers, but is a good proxy given the quarterly population data is dated and has a limited breakdown of what is driving NOM.

International students arriving in higher numbers

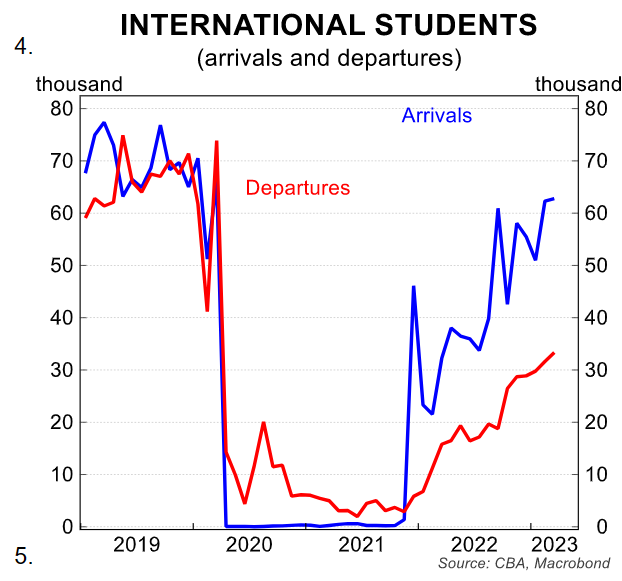

Chart 4 shows one driver of the rapid lift in NOM was net arrivals for foreign students. The lift began in February 2022 as the start of the 2022 university semester and continued through 2022 and into 2023.

For context there is no cap on the number of student visas granted. But not all student visas are approved. The grant rate in Q4 22 was 87.6%.

The return of net overseas students was not surprising. Many had remain enrolled in Australian universities but studied in their home country through the pandemic. These students largely returned in late 2022 and early 2023 with only 8% currently enrolled but studying from their home country as at late March compared to closer to 15% in November 2022.

Also contributing to the lift in arrivals was a focus on removing the student visa back log by the Department of Home Affairs through mid-2022.

A change in China’s covid policy in December 2022 and edict to return to in person learning provided further momentum in 2023. Australian universities are also returning to in person learning.

Changes to hours able to work

The removal of limits on hours worked each fortnight are also thought to have led to a lift in international students.

In January 2022 those on student visas (subclass 500) could work unlimited hours (previously 40 hours per fortnight).

This led to some concerns over the exploitation of student visas from non-genuine students who were in the country to work, rather than study.

The Federal government recently announced that a 48 hour fortnight work limit will be reinstated on 1 July 2023.

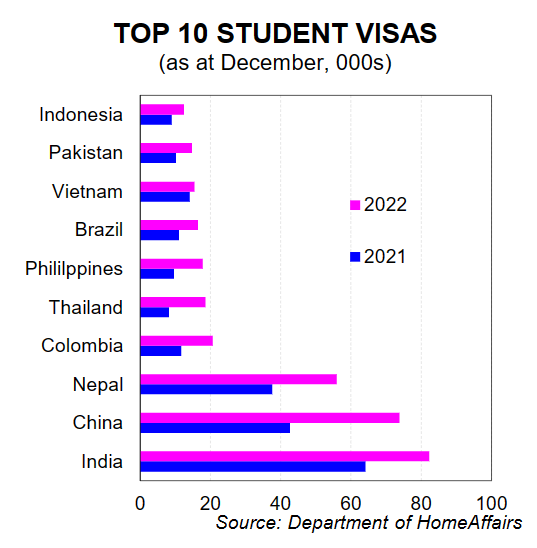

What countries are students coming from?

The top 5 largest lifts in international student visas over the past year were citizens from China (+31k), Nepal (+21k), India (+18k), Thailand (+10k) and Colombia (+9k).

In total there were 141k more student visa holders in Australia at the end of 2022 when compared to 2021 (chart 5).

In terms of total student numbers, there are ~550k international students studying on a student visa according to the Department of Education.

China (126k), India (90k), Nepal (48k), Colombia (23k) and Vietnam (21k) make up the top 5.

Students staying in Australia longer after study

The other driver of the large lift in NOM has been less international students departing Australia.

As chart 4 shows pre pandemic departures largely kept pace with arrivals (although in adjacent months in the year once students had finished studying).

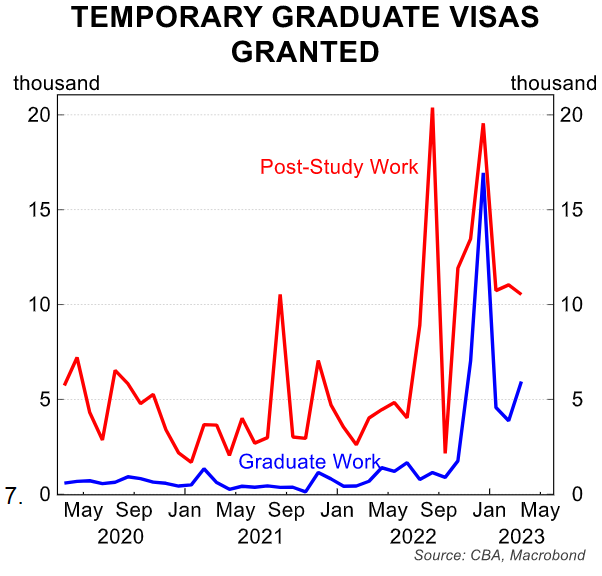

In 2022 and now into 2023, international students are staying. This has been driven by visa changes, particularly the 485 Temporary Graduate visa (chart 6).

This allows graduates to stay and work in Australia for longer and was temporarily increased to 24 months for visas granted from 1 December 2021.

In the FY23 year to December there were 104k subclass 485 visas granted, compared to 34.5k in FY22 to Dec.

The lift was driven by citizens from India (40k), Nepal (+15k), China (10k), Pakistan (4k) and Sri Lanka (+4) amongst many others.

We should continue to see more students stay after1 July 2023 rather than leave.

Some holders of subclass 485 Temporary Graduate visas will be allowed to stay for a longer period. For example four years for a bachelor degree, up from two.

To be eligible for an extension the degree must meet the eligible qualifications list. This is part of the focus on providing a pathway to permanent residency.

Temporary skilled and work visas

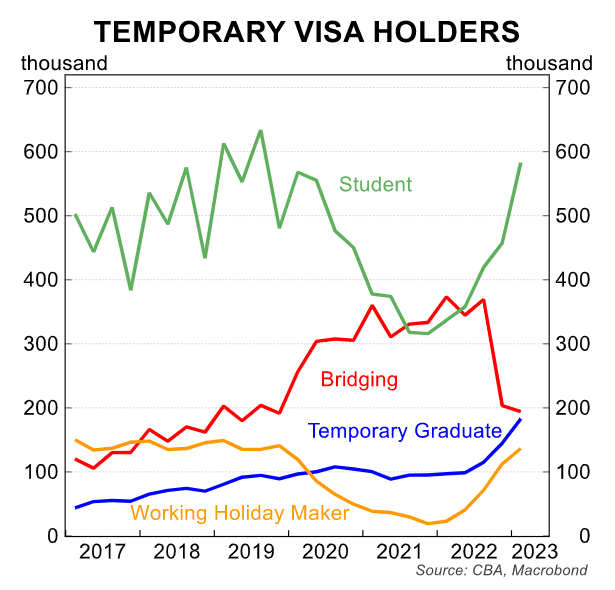

There has also been a lift in temporary resident (skilled) migration, although not to the same degree as student visas.

For the FY23 till March there were 39k visas granted, compared to 23k for the same period a year earlier.

The increase has come from citizens in India and the Philippines. There has also been a lift in working holiday makers as well (chart 7).

Overall the lift in net overseas migration has occurred through a rise in international students and working holiday maker arrivals.

There has also been a return to pre pandemic levels of permanent net overseas migrants.

The reduced departures though is a critical part of the story and recent visa changes to allow students to stay after graduating, and for a longer period of time could see this dynamic to continue.

Economic impact

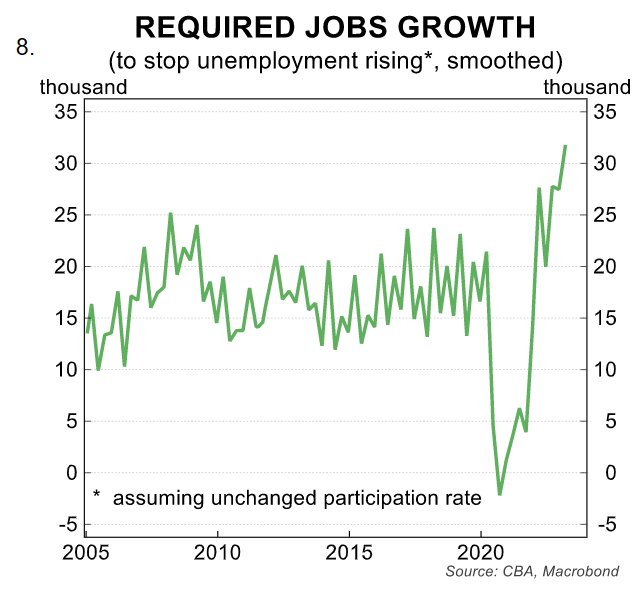

A much stronger rate of population growth is impacting the economy in a number of ways.

The working age population is growing at a record pace and the number of jobs required each month to keep the unemployment rate steady is rising.

As chart 8 shows this is currently sitting at just over 30k each month. When combined with a slowdown in the pace of demand for labour we forecast a lift in the unemployment rate to ~4¼% by end 2023.

The return of international students has also seen a fall in job ads in industries where students generally work, particularly the hospitality and retail sectors.

There has also been reports that some other sectors like aged care and health could suffer as work hour limits are reintroduced on 1 July 2023. Students will be capped at working 48 hours a fortnight.

There has also been an announcement that the minimum wage for skilled migrants will be lifting from $A53.9k to $A70k.

There are other impacts though, particularly through the demand for housing.

Harry Ottley detailed the outlook for rents in this piece. The surge in net overseas migration together with smaller household formation had led to a lift in demand for housing.

Vacancy rates are at low levels, rents are rising and there is limited increase in supply.

In the medium term we would expect a lift in the supply of dwellings to meet higher demand. We expect this lift in demand for rental properties has helped contributed to the turnaround in property prices. We now expect home prices in the eight capital cities to lift 3% in 2023 and 5% in 2024.

New migrants are most likely to settle in the major capital cities of Sydney and Melbourne. Chart 10 shows that NSW and Vic have recorded record net overseas migration for the 12 months to September 2022.

Generally international students are more likely to study in Sydney and Melbourne within a group of 8 universities. Although there has been an increase in other universities and states in recent times.

Overall stronger population growth will boost aggregate demand for goods and services beyond just housing.

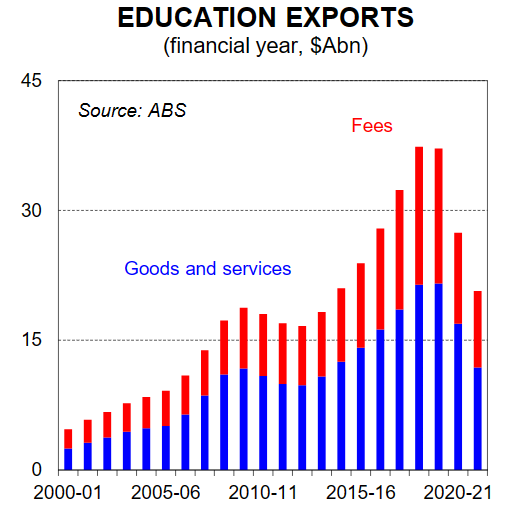

International student spending on fees and tuition, as well as on other goods and services consumed while in Australia are counted as part of education exports (chart 10) and not household consumption.

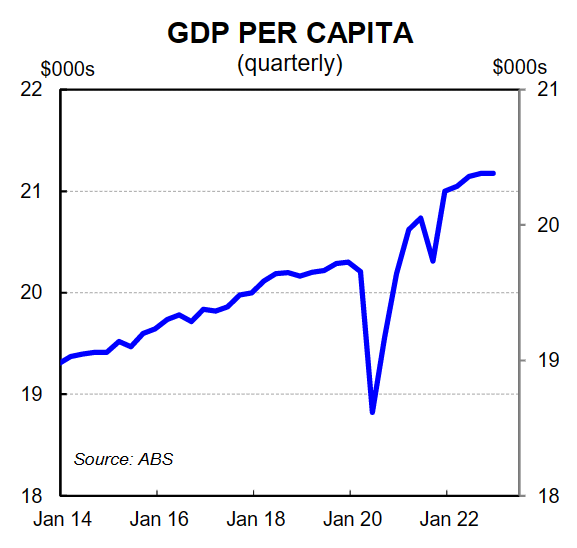

Other migrants spending on goods and services will boost measures of aggregate demand. Both should lift GDP, but not GDP per capita (chart 11).

The RBA has noted in the April Board Meeting Minutes the impact of faster population growth on inflation “members noted that the net effect of a sudden surge in population growth could be somewhat inflationary for a period”, particularly driven by the demand for housing when supply is already tight.