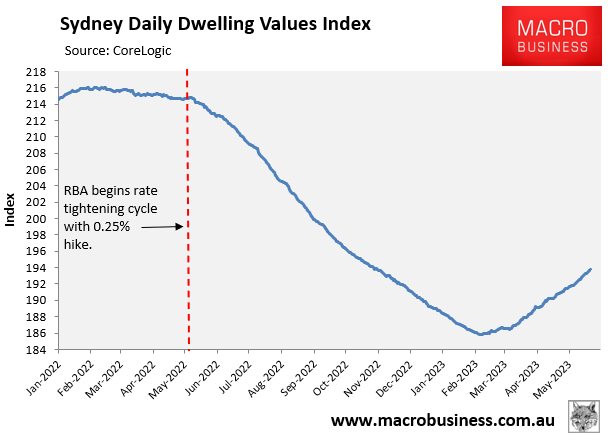

Sydney’s house price bounce continues in earnest, with values climbing by 4.3% from their low on 7 February, according to CoreLogic’s daily dwelling values index:

Despite three 0.25% rises in the official cash rate by the RBA in February, March, and May, Sydney’s housing market is running hot:

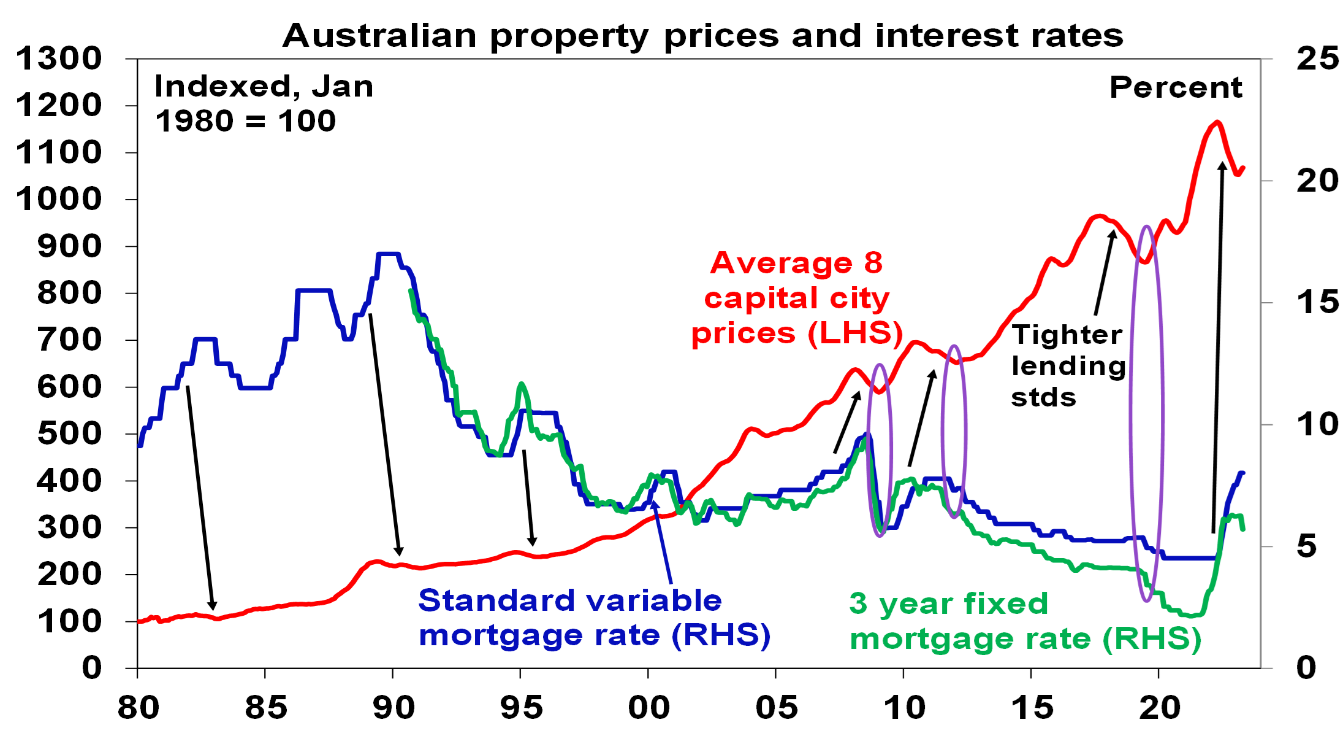

This is an extremely rare situation, considering house price increases have historically come after interest rates were cut (not increased), as indicated in the following chart from AMP Capital’s chief economist Shane Oliver (see purple ovals):

Source: Shane Oliver (AMP Capital)

One explanation for the unexpectedly strong rebound in Sydney home prices is the growing interest from Chinese buyers.

“Cashed-up Chinese buyers have re-entered Sydney’s property market with gusto”, reported The SMH a fortnight ago.

Daniel Ho, co-founder and group managing director of Juwai IQI, an Asian property listings company, said China’s border reopening and $US2.6 trillion of savings built-up over the pandemic had given Chinese buyers a war chest to splurge on Australian property (especially in Sydney).

Buyer inquiries from China for Australian properties increased 127% in the first three months of the year compared to the fourth quarter of 2022, according to Juwai.

“We expect Chinese investment in Australian real estate to climb at least 30% in 2023 from 2022″, Daniel Ho told The AFR.

“Chinese buyers are back, and more will come in the second half of the year than in the first”.

Australia is the top destination for Chinese buyers of offshore property, according to Juwai.

According to Peter Li, co-founder of Sydney-based Plus Agency, which offers new properties mostly to Chinese investors, three- and four-bedroom houses are in high demand.

“We have a lot of Chinese people who are finally coming back to Australia and reuniting with their families”, Li said.

Li told The SMH that recent housing developments across Chatswood in Sydney have sold to Chinese buyers.

“All the apartments that were still available after completion were sold to Chinese buyers”, Li said, adding that half paid with cash.

McGrath’s managing director and CEO, John McGrath, likewise said demand from Chinese buyers is rising across all price points.

“We have seen a strong bounce-back, especially in the last three to four months”, McGrath said.

“A lot of people are wanting to park their currency in Australian dollars and in a safe and stable political environment”.

“We’ve been helping a lot of buyers in the Eastwood, Epping and Marsfield areas because of schools and transportation”, McGrath Epping’s Steven Xie said.

“I had a buyer that didn’t need to use the bank. They were cashed up”.

“The market is fantastic for high-end properties”, said Monika Tu, founder and director of Black Diamondz Group, which markets high-end Sydney property to Chinese buyers.

“People still want to come to Australia, still want to invest here”.

“Rising interest rates are not a problem, not for international buyers from China”, Tu told The AFR.

The increased Chinese buyer activity helps to explain why Sydney values are growing so sharply in the face of continued rate hikes.

Given the low listing levels and scarcity of available homes, the increased demand from Chinese purchasers is having a larger-than-usual influence on prices.