The AiG Industry Index released by the Australian Industry Group presents business conditions in the Australian economy.

This indicator integrates the different sub-indexes calculated by the AiG, including the manufacturing, construction, and services sectors – industries that together account for 36% of the Australian economy.

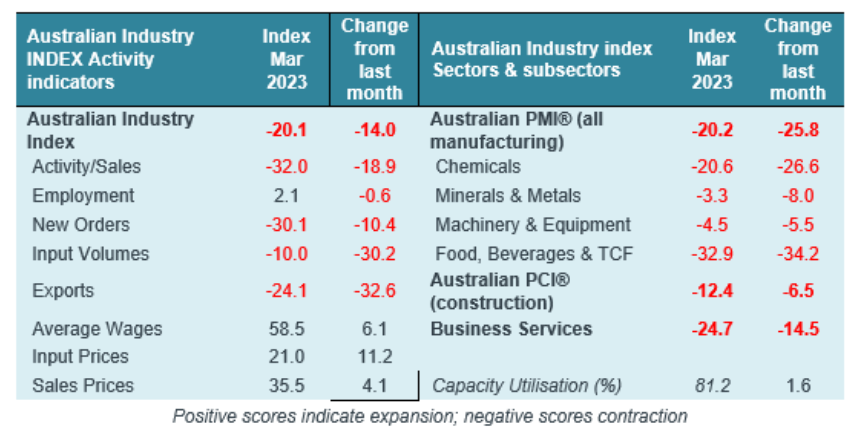

The AiG Industry Index plummeted 14.0 points to -20.1 points (seasonally adjusted) in April and has now been in contraction for the last 12 months “on the back of falling demand and activity”:

Industrial activity/sales sunk deeply into contraction while the fall in new orders, which began in March, continued.

All industrial subsectors are in contraction following declines in April. Manufacturing, chemicals, food & beverage and business services reported steep falls.

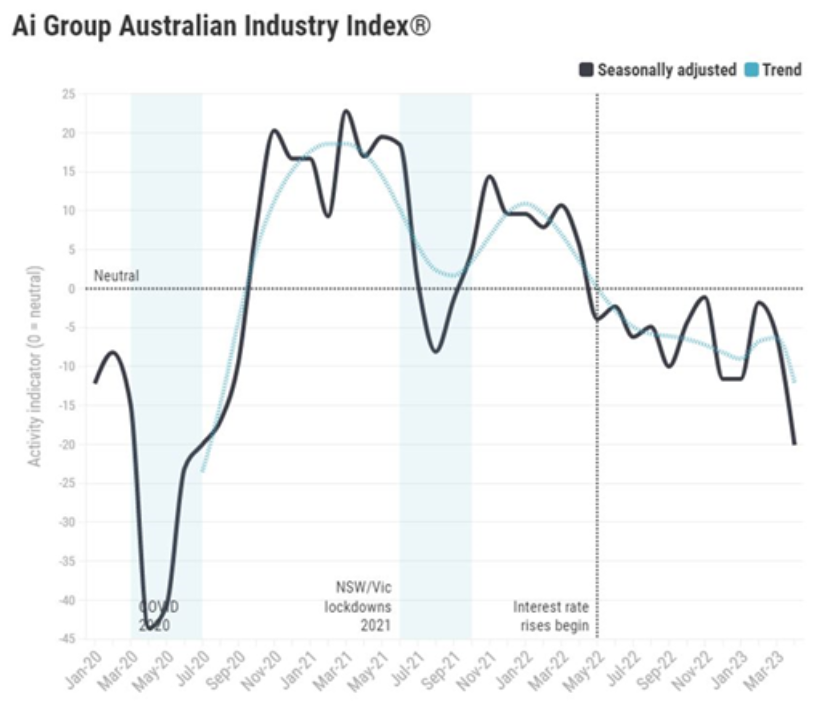

The index is now tracking at its lowest level since the pandemic lockdowns in mid-2020:

Commenting on the result, AiG CEO Innes Willox noted the result “marks a disappointing anniversary in April – 12 months of continuous contraction”.

“Activity and sales have fallen into contraction as demand is weakening, a pattern now affecting every subsector within industry”.

“Yesterday’s decision by the Reserve Bank to raise interest rates, while necessary to contain inflation, will add more pain to businesses facing a worsening economic outlook”. Willox said.

I’m not well versed on this indicator. But on the face of it, it is screaming ‘recession’.