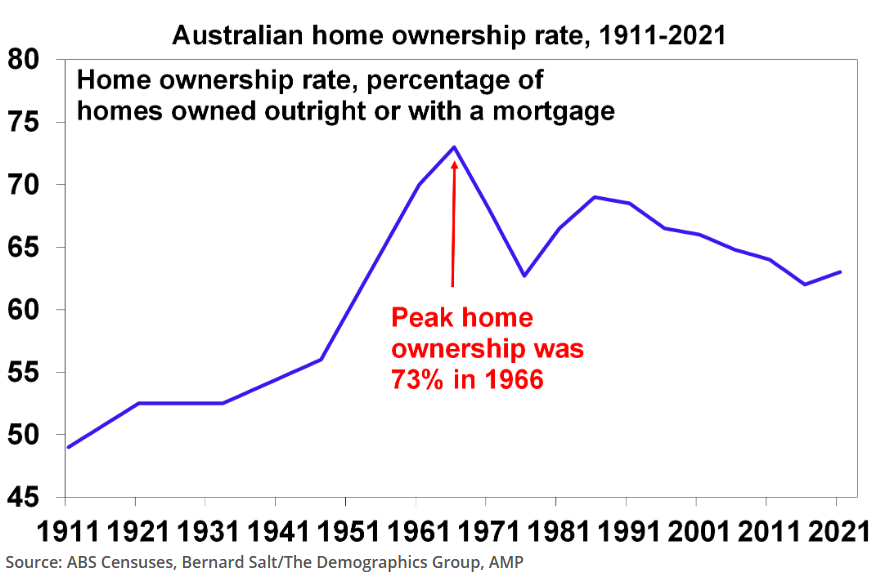

According to a joint analysis by AMP Capital chief economist Shane Oliver and demographer Bernard Salt, 73% of Australians owned a property outright or with a mortgage in 1966, but this has now dropped to 63%:

The report blames Australia’s falling home ownership on the following factors:

- More years spent in education, with people starting work further into their twenties.

- Preferences to rent over buying.

- The rise of superannuation, which has enhanced financial security.

- Declining housing affordability.

On the last and most important factor, the authors note that “it’s pretty clear that housing affordability has deteriorated massively since the 1990s”.

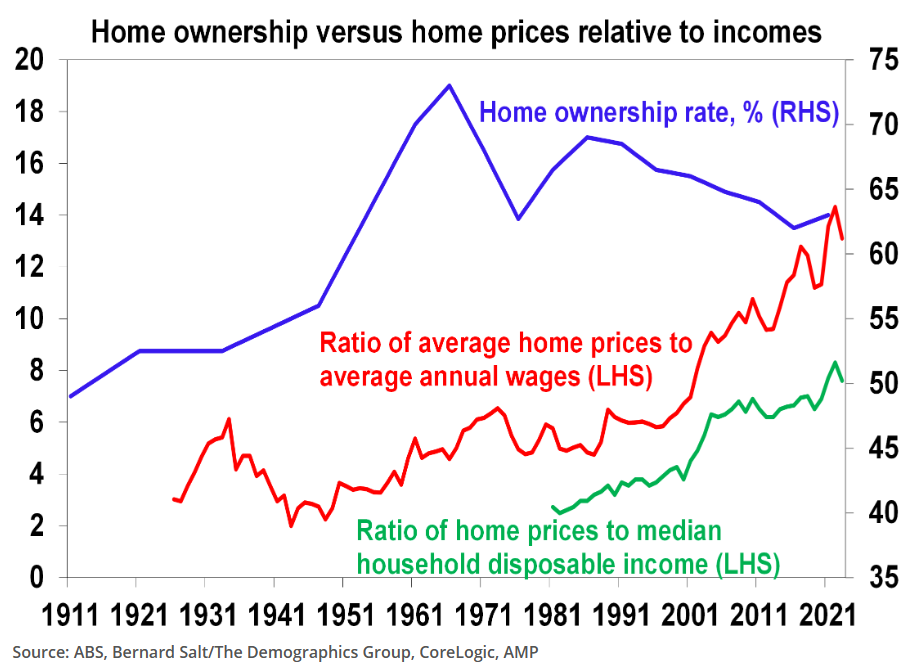

The next chart plots the ratio of average home prices to average annual wages (in red) and the ratio of home prices to median household disposable income (green):

“The message from both is that since the 1990s there has been significant rise in the ratio home prices relative to incomes”, they note.

“Prior to the mid 1990s average home prices ranged around two to six times annual wages but since then it’s steadily increased to around 14 times”.

“Similarly, the ratio of home prices to median household disposable income has blown out from around four times to eight times”.

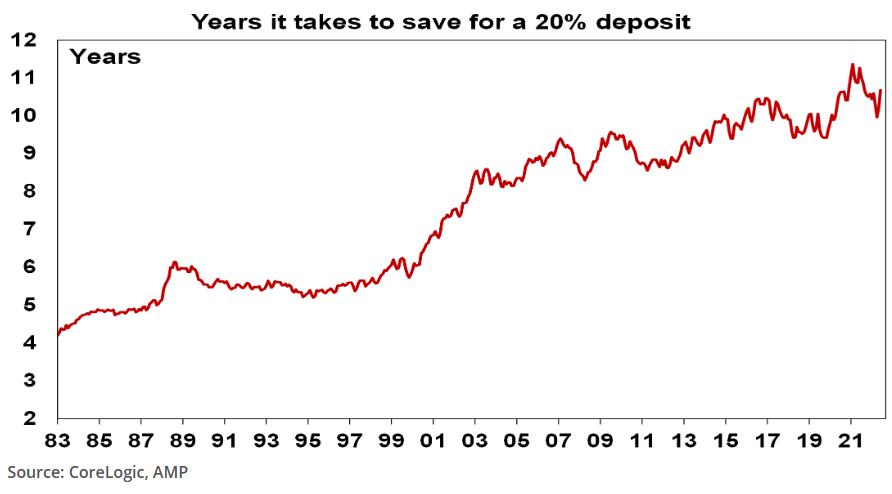

They also note that “for someone on average full-time earnings it now takes around 10 years to save a 20% deposit to buy an average property compared to around five years thirty years ago”:

The home ownership situation is actually far worse than the data presented above.

First, the latest Census data dissected separately by Bernard Salt shows that Australians are increasingly being shoehorned into high-rise apartments and granny flats, which were the fastest growing dwelling types (place of enumeration) at the 2021 Census:

Thus, the quality of housing (both location and form) has deteriorated.

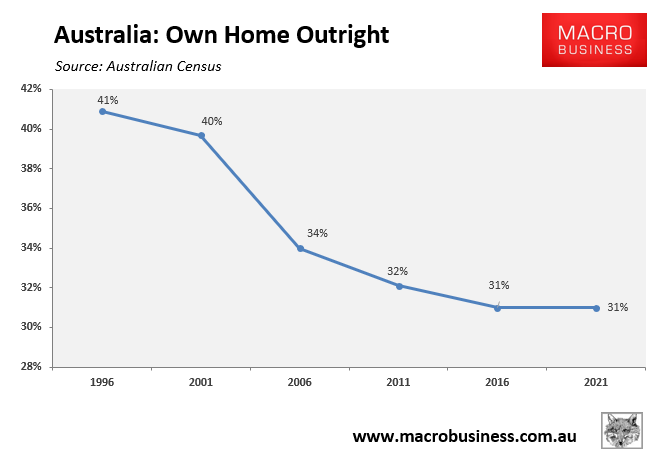

Second, the share of Australians that own their home outright without a mortgage has collapsed from 41% in 1996 to 31% in 2021:

Third, the OECD’s housing database shows that Australia has fallen well behind the OECD average for outright home ownership:

Fourth, OECD data shows that Australian home ownership rates have collapsed especially hard across younger and poorer Australians:

Finally, the median age of first homebuyers in Australia has ballooned by around 10 years this century, from 24 years in 2002 to 34 years in 2022:

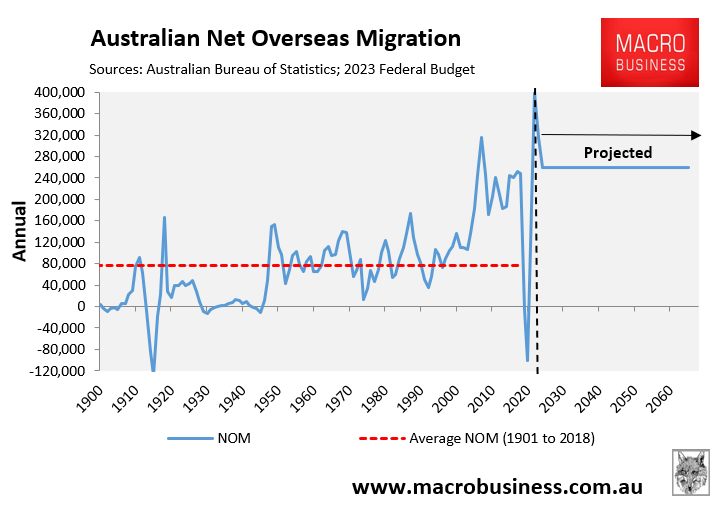

With the Albanese Government ramping immigration to unprecedented levels, the housing situation facing younger Australians will only worsen.

To the authors credit, they call on policy makers to match “the level of immigration to the ability of the property market to supply housing”, noting “we have clearly failed to do this following reopening from the pandemic, and this is now evident in severe supply shortfalls”.

I can think of few worse policies for young Australians looking for a place to live than forcing them to fight for housing with hundreds of thousands of new migrants every year.