A sharp divergence has arisen between mortgage growth and Australian dwelling values.

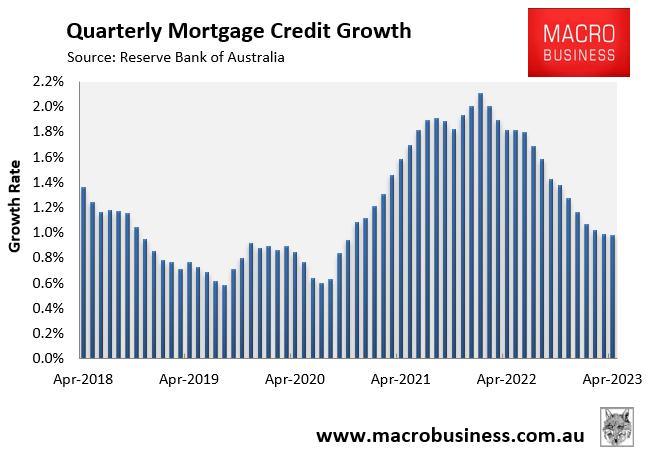

On Wednesday, the Reserve Bank of Australia (RBA) released its mortgage credit growth data for April, which revealed that the value of outstanding mortgages grew by only 1.0% over the quarter, which is the equal lowest rate since October 2020:

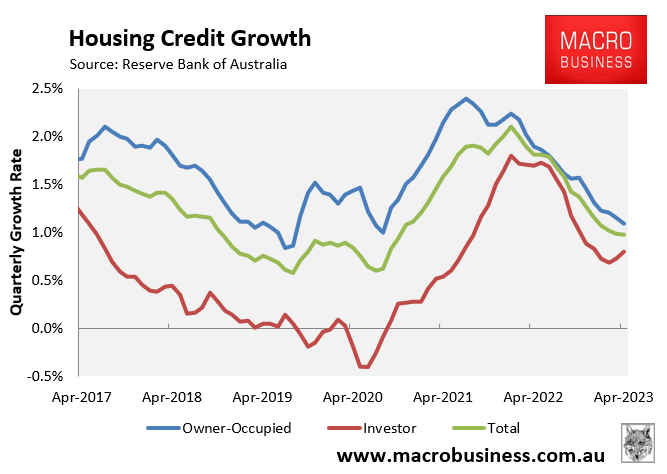

Owner-occupier mortgage credit growth continues to decline, whereas investor credit growth has begun to rebound:

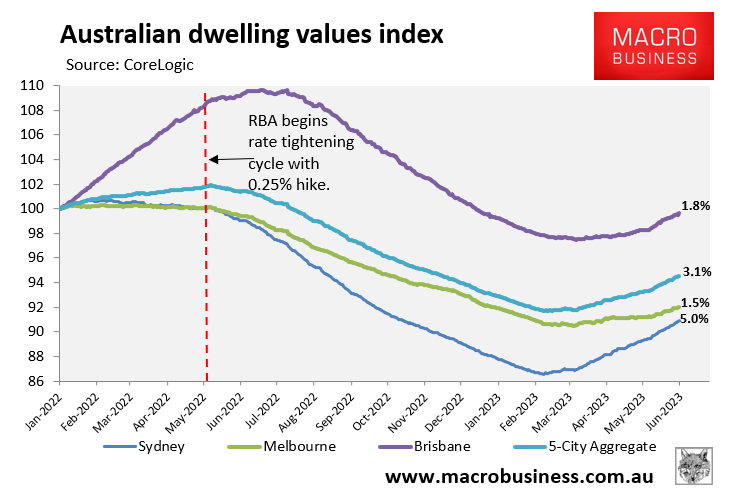

Meanwhile, CoreLogic’s daily dwelling values index has recorded a strong rebound in home prices:

At the 5-city aggregate level, dwelling values have rebounded 3.1% from their 7 February low, driven by a strong 5.0% price rebound across Sydney.

What this data suggests is that Australia’s house price rebound has occurred off a fairly narrow base.

Actual sales volumes are low, however the homes that are selling are fetching strong results.

The decline in mortgage credit growth could also reflect Australians making extra mortgage repayments above their scheduled amount, which is offsetting newly originated mortgages.

It will be interesting to watch whether the RBA’s latest 0.25% interest rate hike spoils the party.

I doubt it, given the strong rebound in both auction clearance rates and prices this month, alongside record immigration.