The Australian Bureau of Statistics (ABS) has released housing finance data for March, which shows that the value of mortgage commitments originated over the month rebounded by 4.9%.

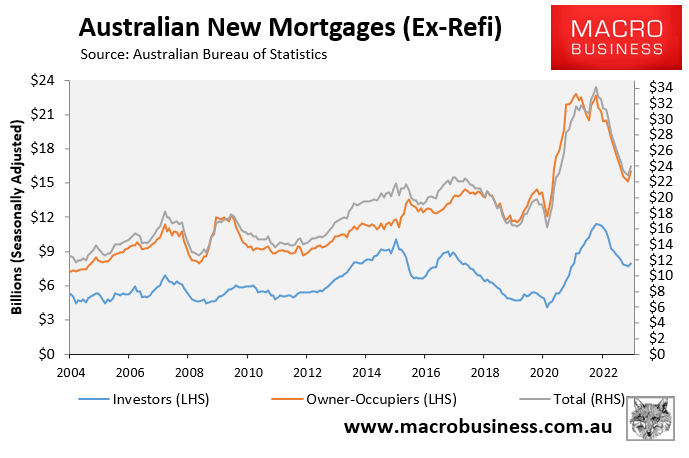

The lift was broad-based, with owner-occupier commitments rising by 5.5% in March and investor mortgage commitments rising 3.7%:

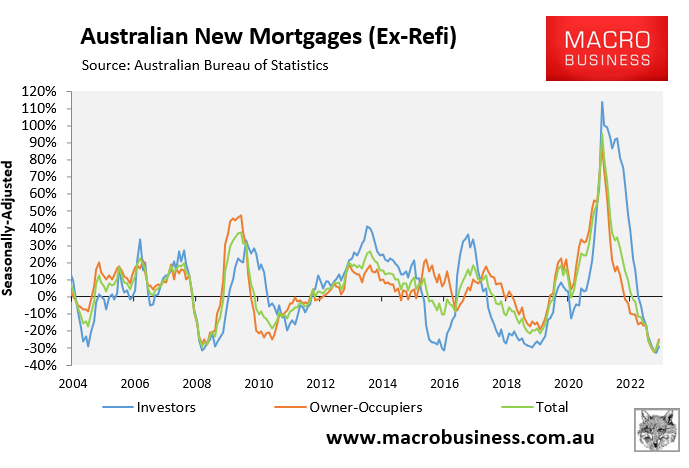

The annual growth rate has also improved to -26.3% from a trough of -32.4% in January:

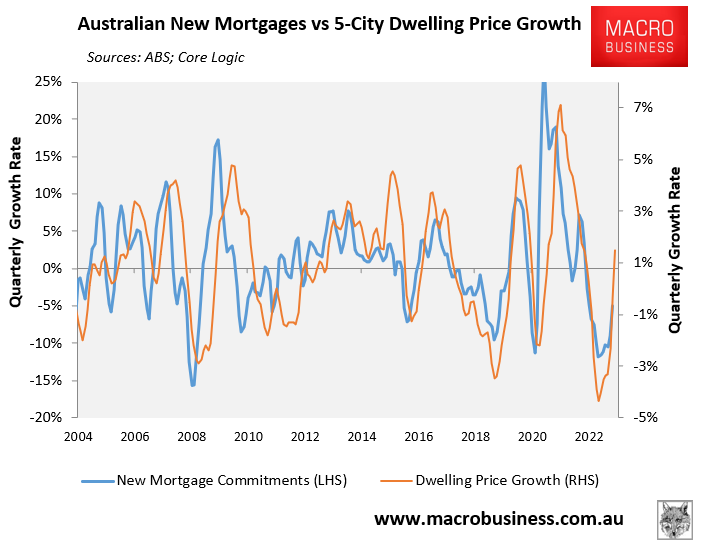

The growth in new mortgage commitments has historically been strongly correlated with house prices, given most homes are purchased with finance.

As illustrated below, the quarterly growth in new mortgage commitments has rebounded from a low of -10.4% in January to -5.0% in March.

In a similar vein, dwelling value growth across the five major capital city markets has rebounded from a trough of -3.3% in January to +1.5% in April:

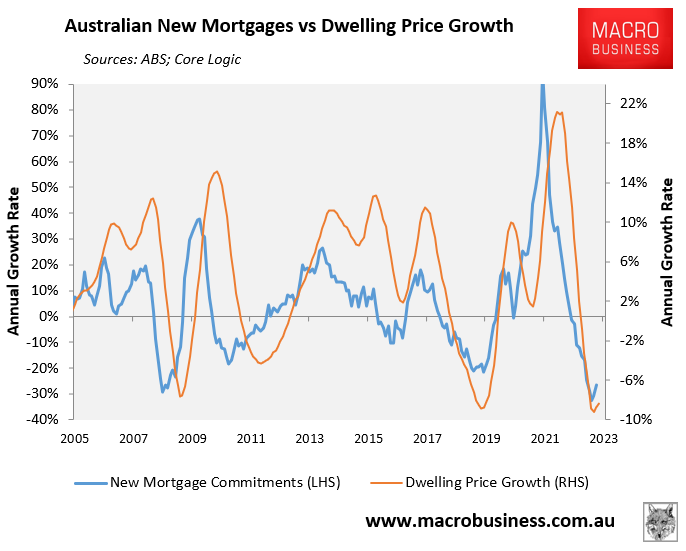

The annual time series below shows the relationship more between mortgages and house prices more clearly.

Annual mortgage growth turned the corner in March, as did dwelling values:

It will be interesting to watch whether the Reserve Bank of Australia’s (RBA) latest 0.25% interest rate hike spoils the party.

I don’t think so given prices rose in the face of 0.25% hikes in February and March amid record high population growth and soaring rents.

Most pundits (including me) believe interest rates are close to their peak, even though the RBA could hike one more time.

But if this view is wrong and the RBA delivers a series of rate hikes, then its could easily deliver a double-dip house price correction.

If you are looking to save thousands of dollars in mortgage repayments, try the Compare n Save mortgage comparison tool. It takes less than a minute. And if you wish to refinance, the process is easy.