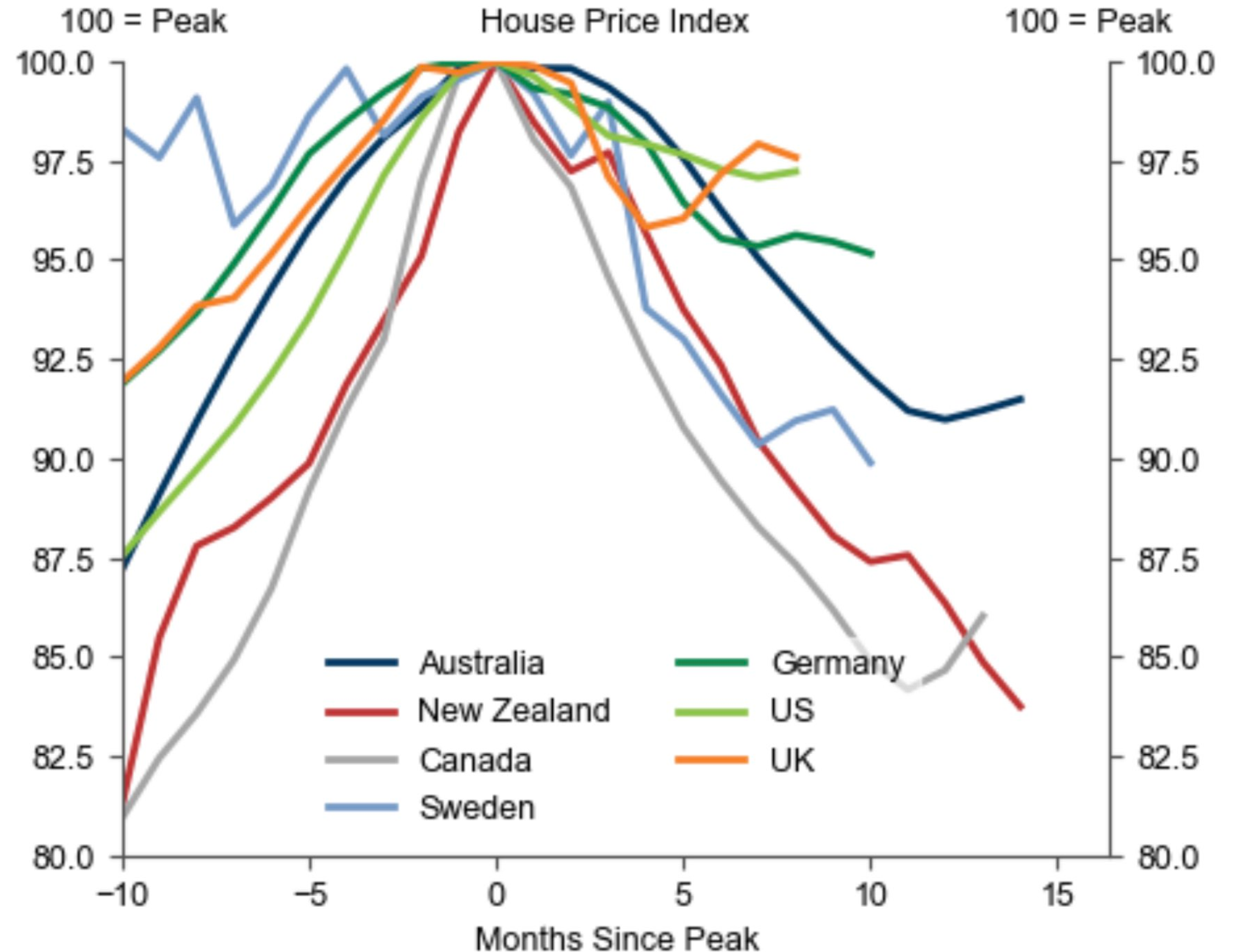

Goldman Sachs (via Shane Oliver on Twitter) has published the below chart tracking the house price busts across various developed nations:

Source: Goldman Sachs

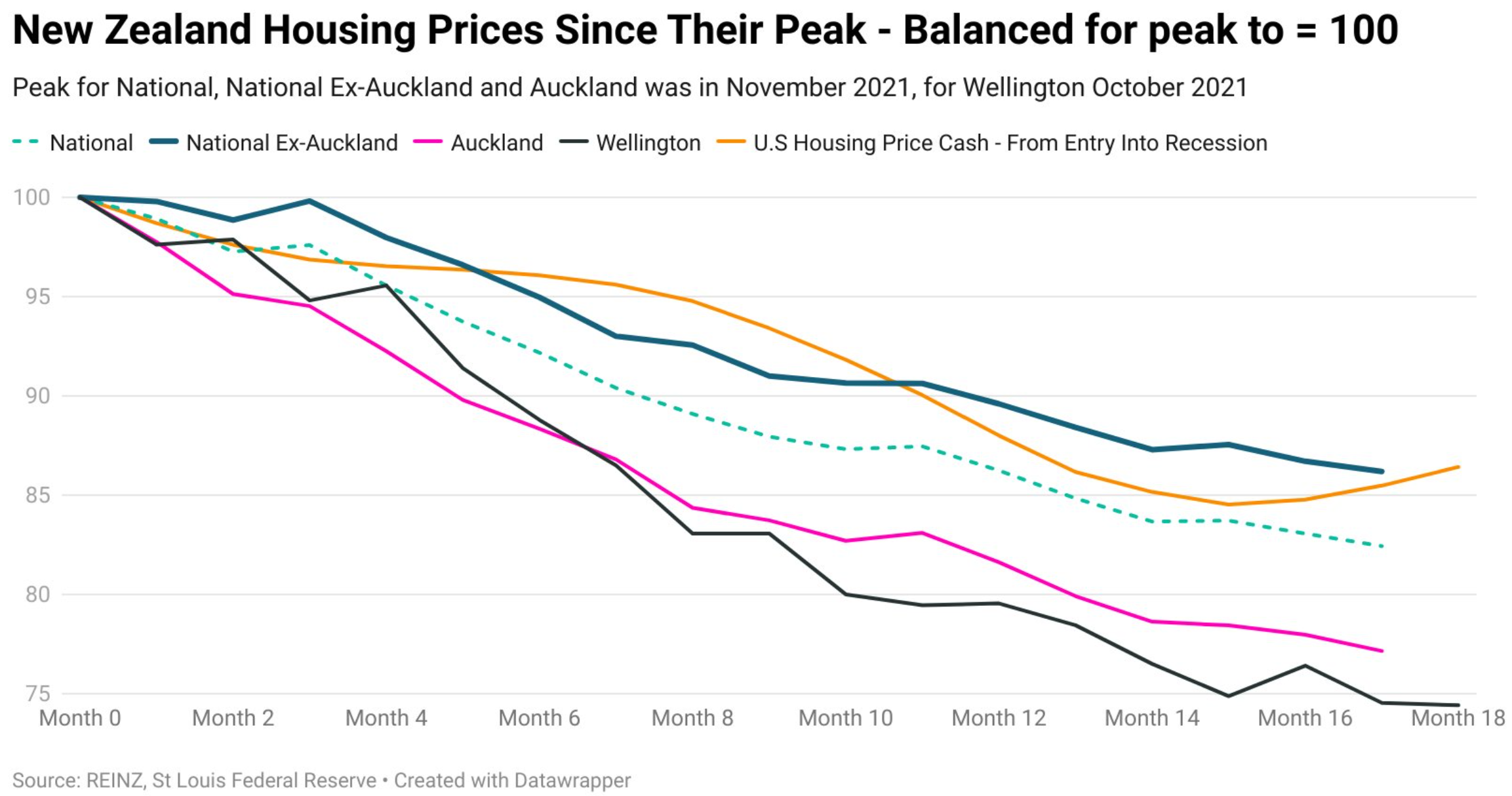

New Zealand leads the decline, with values down 17.6% from their November 2021 peak, led by Auckland (-22.8%) and Wellington (-25.6%):

Source: REINZ House Price Index (via Tarric Brooker)

Interestingly, home values across various countries (i.e. Australia, Canada, US, Germany and the UK) are seeing a stabilisation/rise in home prices as the ‘shock’ of interest rate hikes wears off.

New Zealand is the outlier, however, with prices still falling at a solid clip.

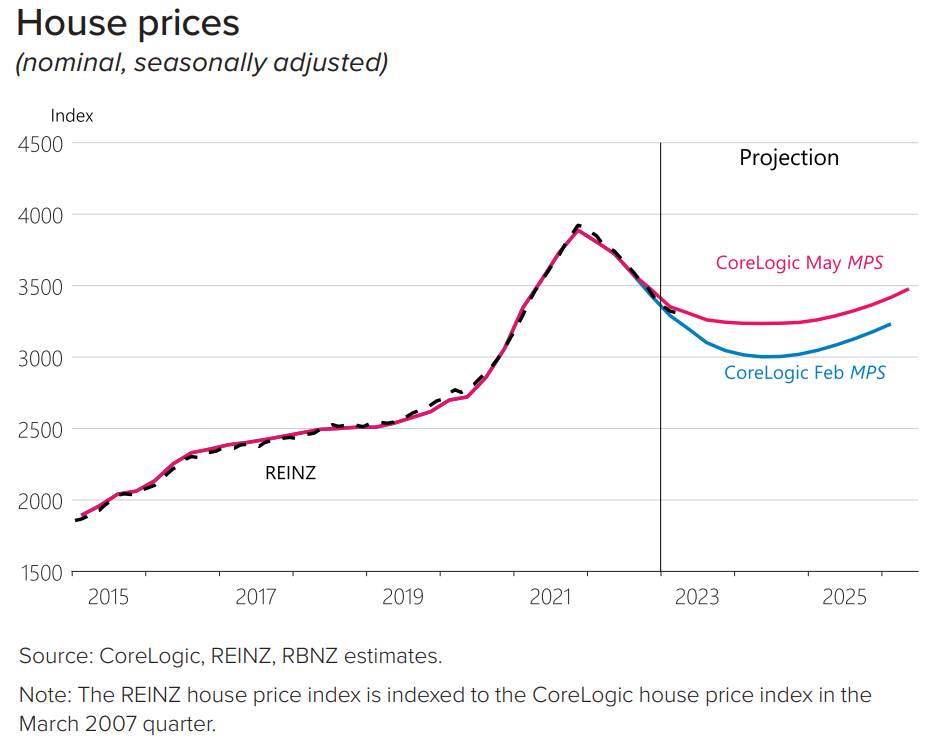

Interestingly, the Reserve Bank of New Zealand has revised its projection for home prices and now expects a significantly smaller overall decline than it projected in its previous detailed set of forecasts in February:

In February, the Reserve Bank said:

“House prices are projected to keep falling in 2023, consistent with very low sales volumes in recent months”.

“House prices are assumed to have fallen by around 23% from their peak in 2021 to their trough in mid-2024, before recovering as interest rates decline toward their neutral setting”.

But in its latest Monetary Policy Statement released this week, the Reserve Bank forecast a “less negative outlook for house prices” with “house prices are assumed to fall by less over coming quarters than assumed in the February Statement”:

“The rapid return of net immigration, an increase in the number of residents due to the one-off 2021 resident visa, strong nominal wage growth, stable mortgage interest rates, and a relatively low number of houses available for sale have contributed to a smaller decline in house prices than expected in recent months”, the Reserve Bank says.

The Reserve Bank also expects New Zealand house prices to rebound in 2024.