Reserve Bank of Australia (RBA) governor Phil Lowe fronted Senate Estimates Committee this morning, where he warned that residential rental growth is expected to hit a three decade high, which will continue to stoke inflation.

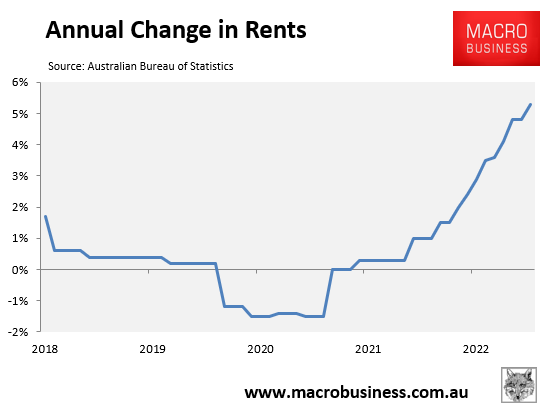

Lowe noted that the rental measure used in the Consumer Price Index (CPI) is currently growing by around 5%.

However, it is accelerating rapidly due to rock-bottom vacancy rates and will likely hit 10%, which would be its highest rate since June 1989.

Rents comprise around 6% of the CPI basket.

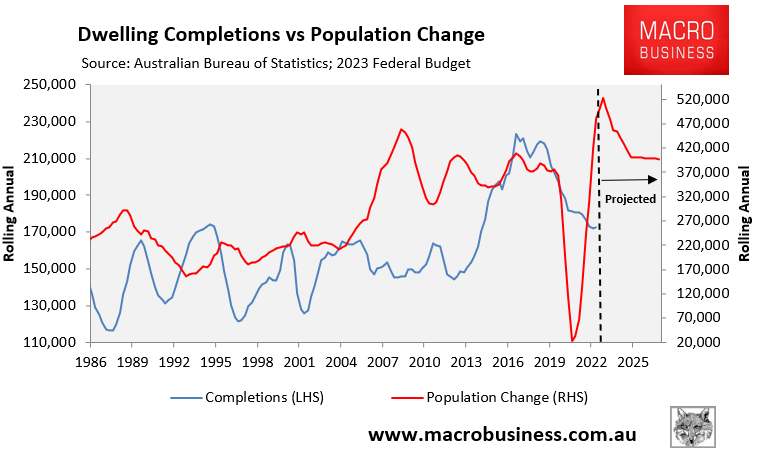

Lowe also warned that rent inflation would stay high for a long-time given Australia’s population is growing strongly, with rental demand far outpacing supply.

“It’s really hurting some people. The underlying issue here is supply and demand in the rental market. The vacancy rates in many cities are very low”, Lowe told the Committee.

“There are a few things that have contributed to that”.

“During the pandemic, the average number of people living in each household declined and people wanted more space”.

“And the other thing that’s now happening is a big increase in population”.

Lowe noted that Australia’s population will grow by 2% this year, but the nation’s housing stock was not increasing by 2%.

Lowe’s concerns surrounding rents are justified.

CPI rents grew by 5.3% in the year to March:

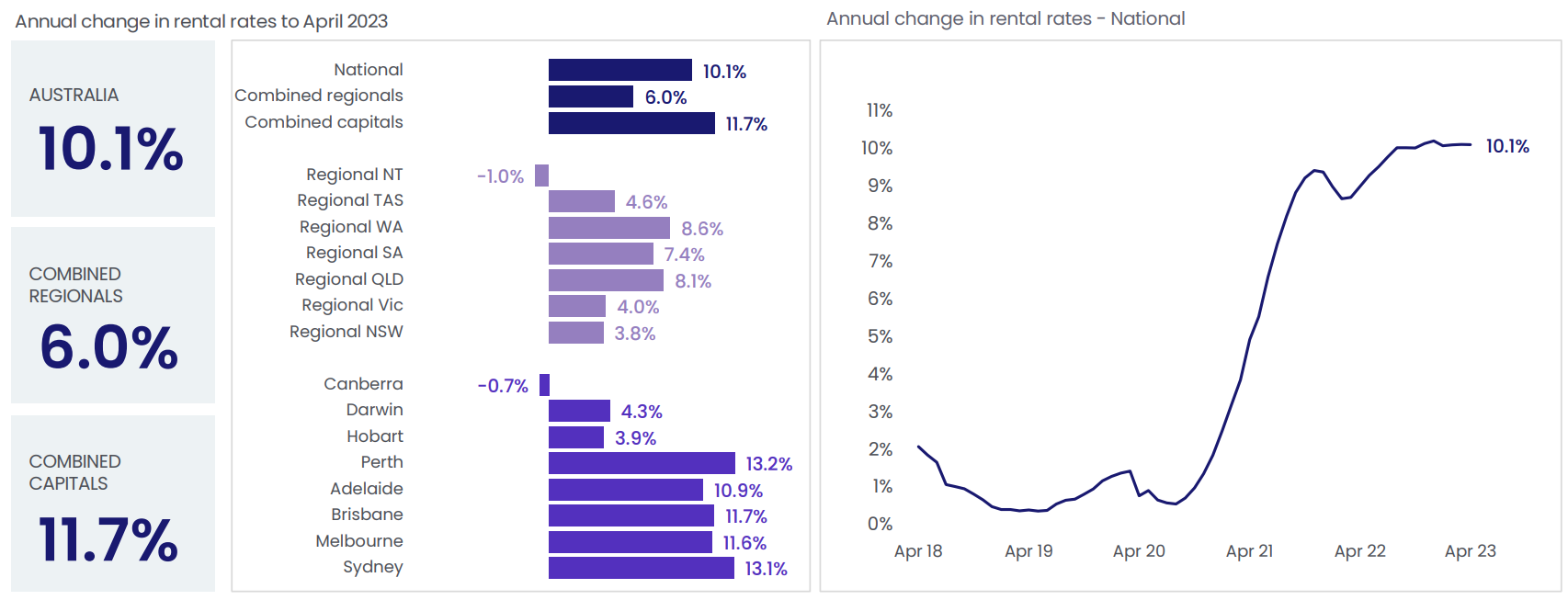

This is around half the pace of asking rents:

Source: CoreLogic

Meanwhile, Australia’s population is projected to grow at a record pace while the rate of dwelling construction is collapsing:

There is only one outcome from this equation: further tightening in the rental market and ongoing strong rental inflation.