The Reserve Bank of New Zealand’s ultra aggressive interest rate hikes continue to hammer the nation’s housing market.

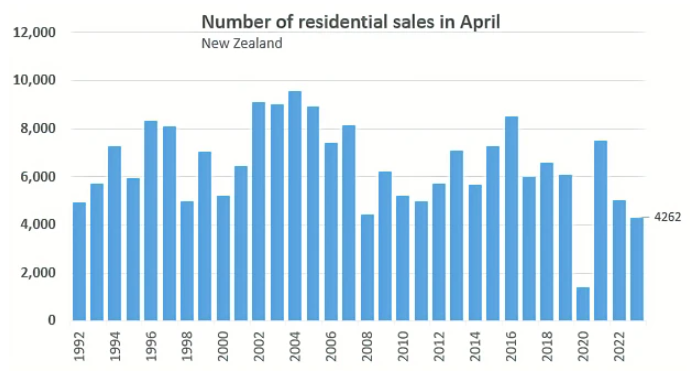

The Real Estate Institute of New Zealand (REINZ) registered just 4262 residential property transactions in April, a 15.3% decrease from the previous year.

Except for April 2020, when the market was in near total lockdown due to pandemic restrictions, this was the lowest amount of sales reported in the month of April since the REINZ began reporting sales in their current format in 1992 (chart from Interest.co.nz):

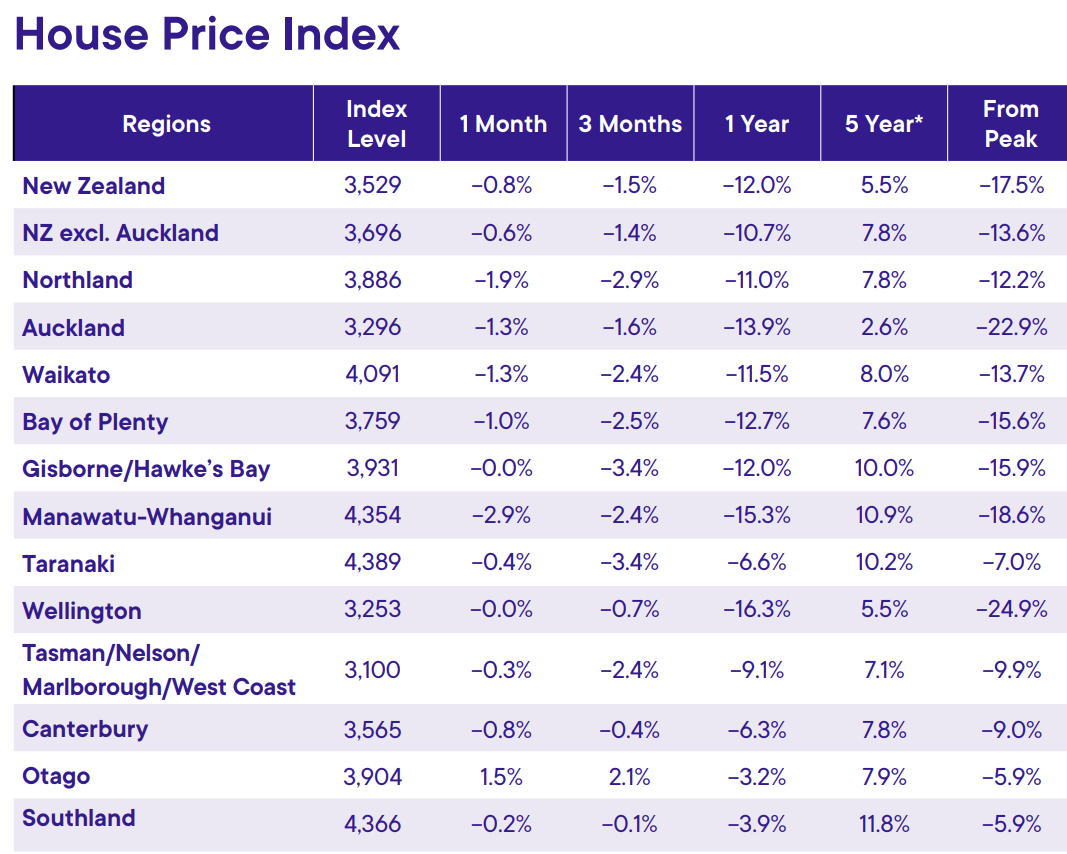

The REINZ House Price Index (HPI), which adjusts for differences in the mix of properties sold each month, also continues to fall.

It fell another 0.8% in April, and is now down 17.5% from its November 2021 peak.

The next table shows the price changes across the various regions and shows that Wellington (-24.9%) and Auckland (-22.9%) are leading the nation’s price correction:

Auckland (-23.0% year-on-year) is also leading the nation’s sales decline.

Commenting on the results, REINZ Chief Executive Jen Baird said that year-on-year inventory levels “are still showing an increase with the current pressure on mortgage rates supressing buyer activity”.

“New Zealanders are waiting for the peak of inflation, a settling in interest rates and some clarity around the outcome of this year’s election”.

“This is what is keeping activity low”.

Given the Reserve Bank is likely to maintain a hawkish stance for the foreseeable future, and that the New Zealand election is not scheduled until 14 October, the nation’s housing market is poised to remain in a hole.

Indeed, in this month’s Financial Stability Report, the Reserve Bank said house prices should “continue to soften, given the level of interest rates, the ongoing completion of houses currently under construction, and weak market activity and sentiment”.

The Reserve bank also cautioned that “there remains the risk of house prices declining significantly below our assessment of their sustainable level, particularly if the number of distressed sales picks up, generating self-reinforcing negative feedback effects”.