The Reserve Bank of Australia’s (RBA) aggressive interest rate hikes, which have seen the official cash rate soar by 3.75% in only 12 months, continues to drive a mortgage refinancing boom.

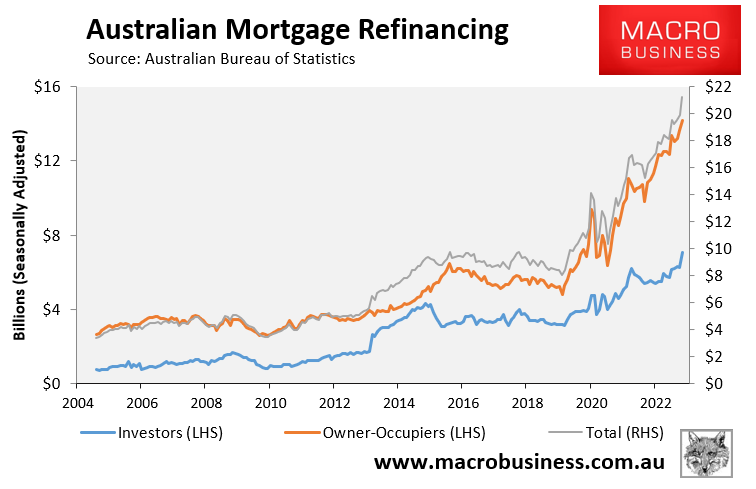

Friday’s housing finance data from the Australian Bureau of Statistics (ABS) showed that a record $21.2 billion dollars worth of loans were refinanced in March.

Owner-occupiers refinanced a record $14.2 billion worth of mortgages, whereas investors refinanced a record $7.0 billion worth of mortgages:

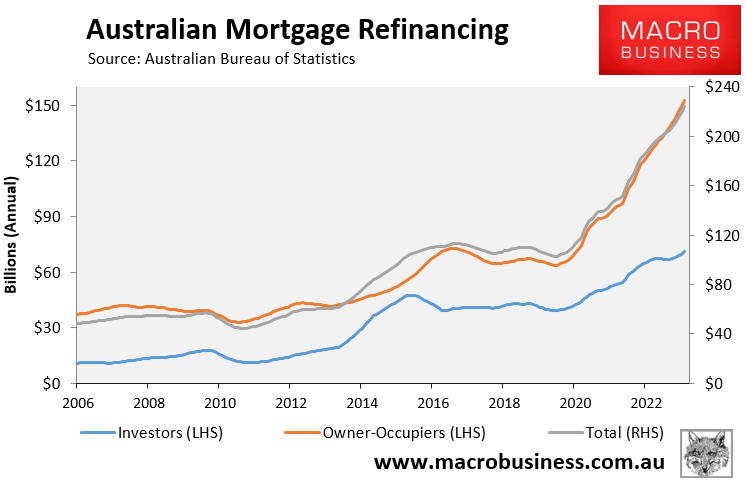

In the year to March 2023, a record $223.6 billion worth of mortgages were refinanced.

Owner-occupiers refinanced $152.5 billion worth of mortgages over the year, whereas investors refinanced $71.2 billion worth of mortgages:

The refinancing boom comes amid research from Roy Morgan showing that mortgage stress has risen to its highest since 2011.

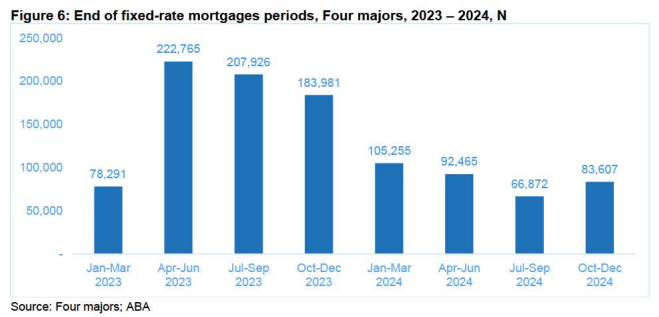

Even if the RBA maintains the cash rate at its current level of 3.85%, borrowers will face rising stress due to the fixed rate “mortgage cliff”.

According to an Australian Bankers Association estimate of the Big Four Banks, more than 600,000 borrowers were scheduled to transfer from rates around 2% to rates between 5% and 6% between April and December:

Mortgage rates have already increased above the 3 percentage point serviceability buffer required by APRA in determining whether someone can repay their debt.

As a result, as fixed-rate mortgages expire, a large number of borrowers may find themselves deeply underwater.

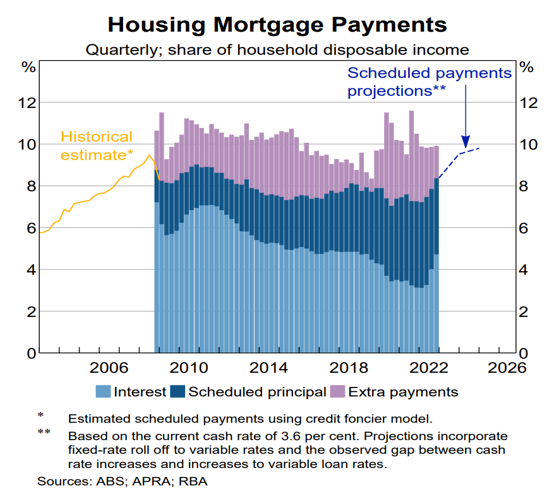

The impact of the fixed-rate “mortgage cliff” is depicted in the following chart from the RBA Financial Stability Review:

It demonstrates that once the fixed rate mortgage reset is completed, scheduled mortgage repayments will reach an all-time high share of household income.

Thus, the fixed rate “mortgage cliff” will result in significant additional tightening, with Australian homeowners facing a record increase in debt obligations.

No wonder mortgage refinancing is booming as Aussies seek to mitigate the rise in mortgage costs.

If you are looking to save thousands of dollars in mortgage repayments, try the Compare n Save mortgage comparison tool. It takes less than a minute. And if you wish to refinance, the process is easy.