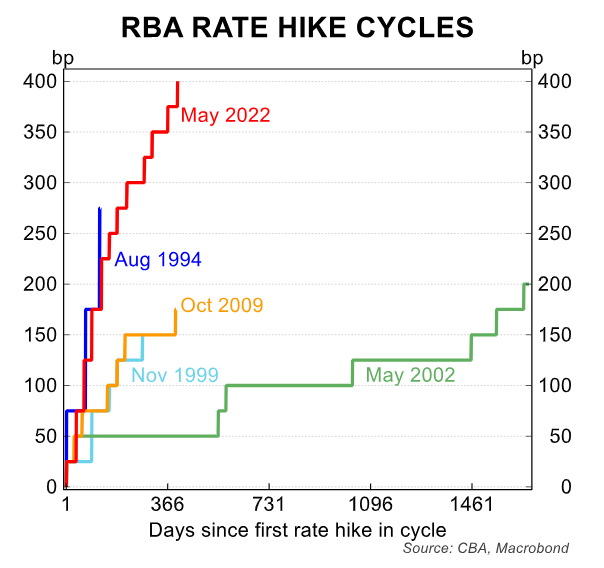

The latest Reserve Bank of Australia (RBA) interest rate tightening cycle has been the steepest and largest in modern history, with the official cash rate (OCR) soaring 4.0% in only 13 calendar months:

Because most Australians are on variable rate mortgages, the increase in average mortgage rates has also been far higher in Australia than most other developed nations:

Australian mortgage borrowers had incurred around 200 basis points of mortgage tightening as at the end of 2022, which was significantly higher than other English-speaking countries.

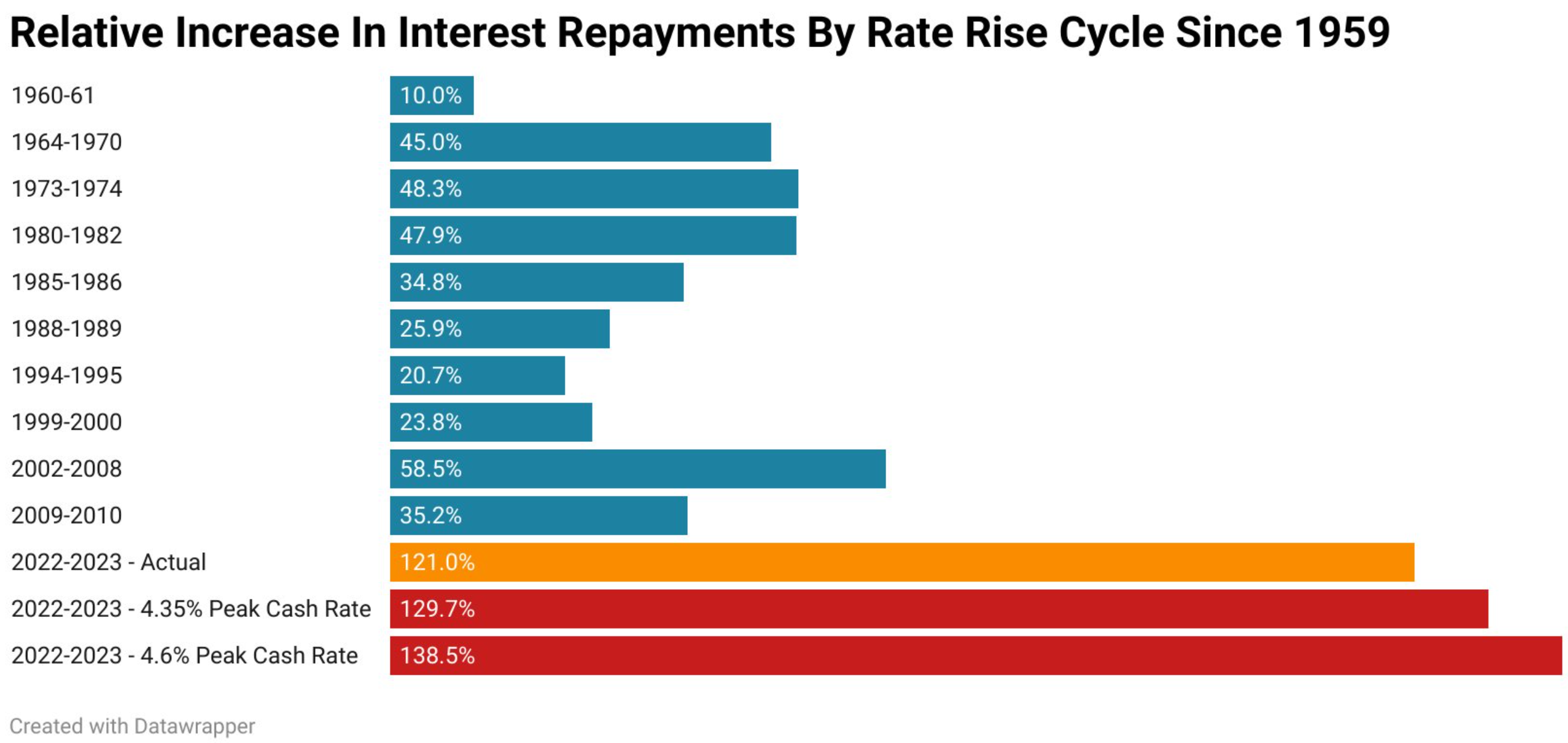

Independent Economist Tarric Brooker posted the below chart on Twitter showing the relative increase in interest repayments by rate rise cycles since 1959:

Source: Tarric Brooker

So far this cycle, mortgage interest repayments have soared by 121%, dwarfing the second-highest 58.5% rise recorded over the 2002 to 2008 cycle.

Moreover, if the RBA was to hike one more time, then mortgage interest repayments will rise to 129.7%, whereas they will lift even higher to 138.5% if the RBA hikes twice more.

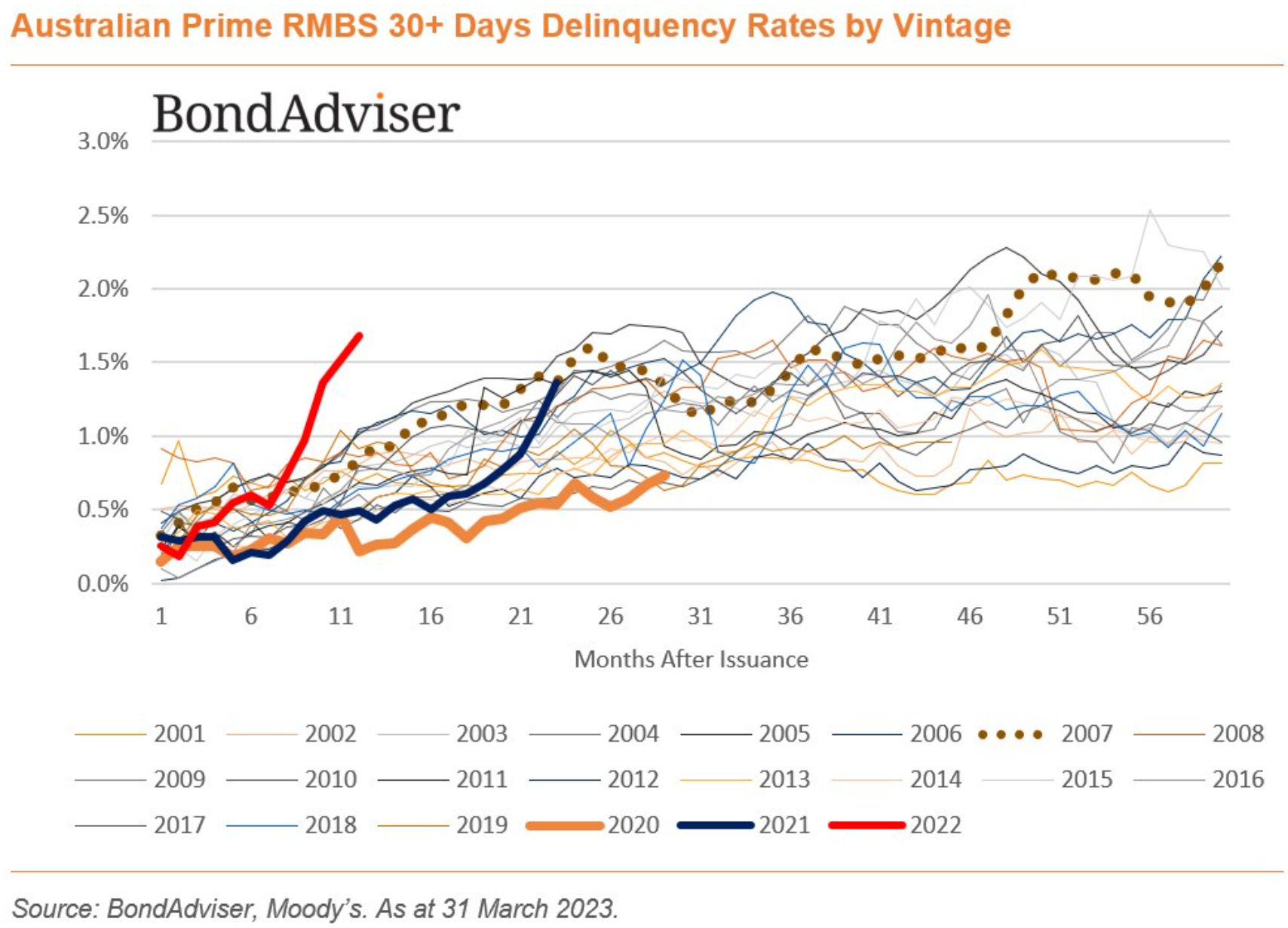

The dramatic increase in repayments has sent mortgage delinquencies soaring, with 30-plus day arrears on 2022 vintage prime residential mortgage-backed securities (RMBS) rocketing, according to Moody’s (red line below):

Arrears on 2021 vintage prime RMBS have also surged higher (dark blue line above).

The situation will only worsen from here.

First, the RBA is expected to hike further over coming months.

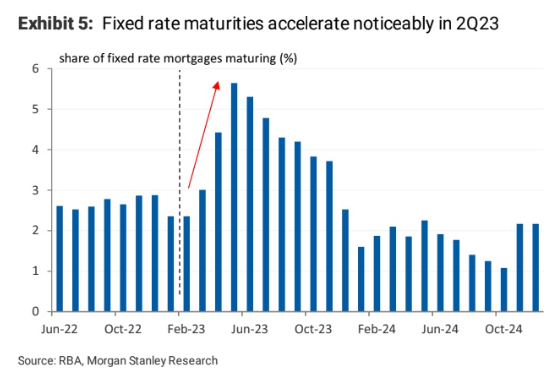

Second, there are still nearly 500,000 fixed rate mortgages that will expire over the remainder of this year, which will see borrowers reset from mortgage rates of around 2% to variable rates approaching 7% (higher if the RBA continues to hike):

We don’t know when the ‘tipping point’ will arrive for Australian mortgage holders, if it hasn’t already.

However, the RBA is tempting fate by continuing to hike when monetary conditions are already tightening owing to the fixed rate mortgage cliff.