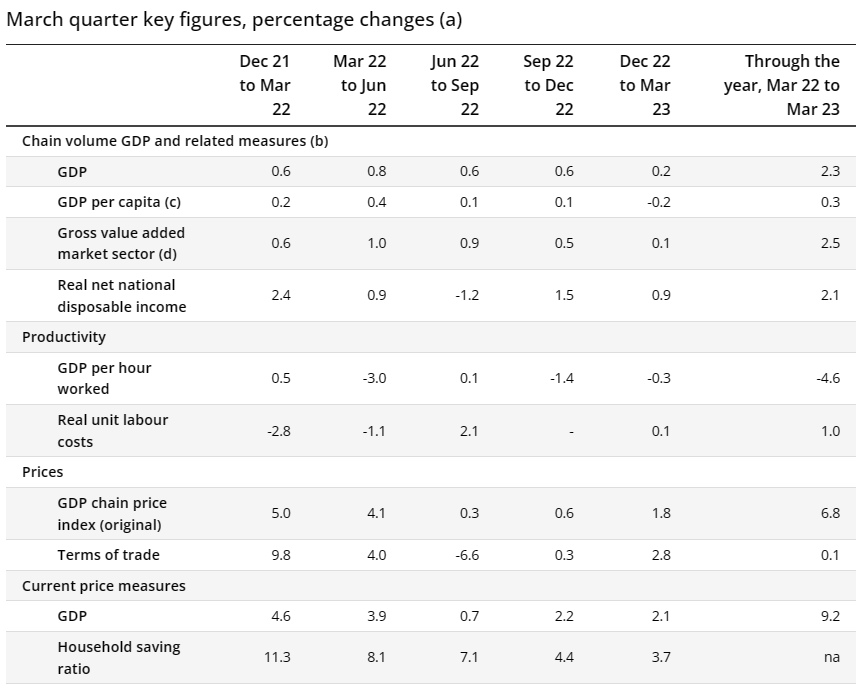

Australia’s Q1 GDP missed analysts expectations, with overall real GDP growing only 0.2% over the quarter (versus 0.3% expected):

Because of ongoing strong population growth (immigration), per capita GDP fell 0.2%.

Labour productivity (GDP per hour worked) fell 0.3%, with real unit labour costs (ULCs) rising 0.1% over the quarter.

This decline in productivity and slight increase in real ULCs will have the wage-price spiral inflationistas going into hyper drive.

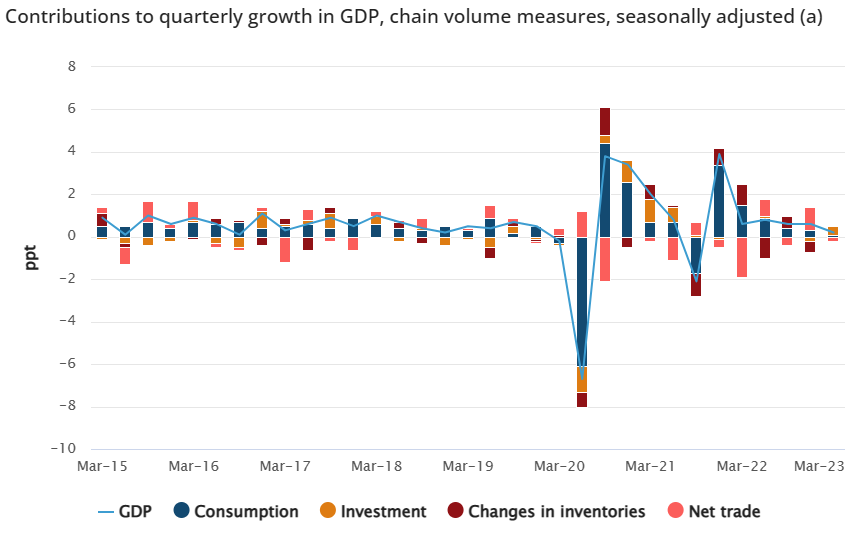

Importantly for the RBA, “consumption expenditure by households and government were subdued, with a combined contribution of 0.1 percentage points to GDP”.

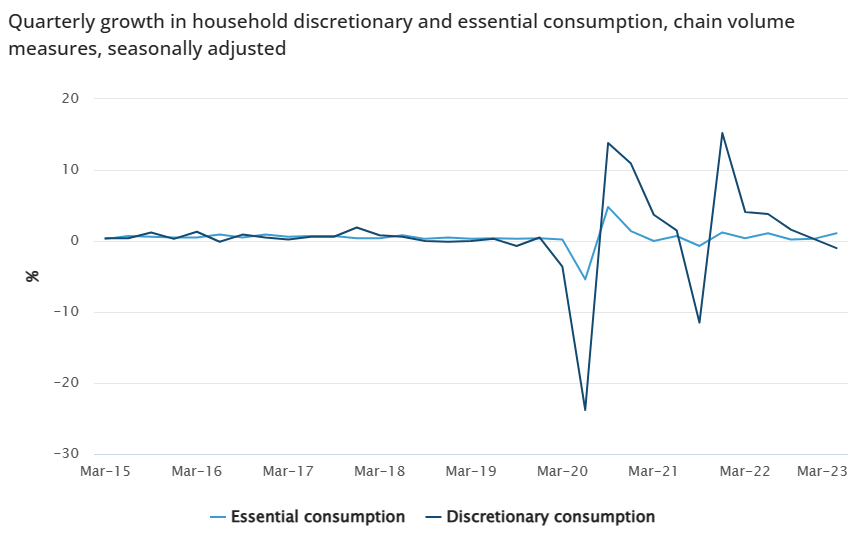

“Household consumption (+0.2%) slowed as discretionary spending fell below essential spending for the first time since the Delta-variant lockdowns. Government expenditure grew 0.1%”:

Thus, household consumption per capita was negative in Q1.

Specifically on household consumption, the ABS notes “household spending rose 0.2%, the weakest quarterly result since the fall recorded during the COVID-19 Delta-variant lockdowns in September 2021”. “

“Growth in essential spending increased (+1.1%), while discretionary spending (-1.0%) fell, as cost of living pressures exhausted residual post-lockdown demand”.

“Essential spending was led by electricity, gas and other fuel (+5.2%) due to the ending of Queensland’s Cost of Living Rebate, which saw increased government consumption on behalf of households in the December quarter”.

Thus, households are spending more on things they need (essentials), while cutting back on things they want (discretionary items).

Viewed in isolation, this result should prompt the RBA to pause rate hikes.

However, this data is obviously backward-looking, and house prices have bounced hard since the end of March.