In April, CoreLogic released analysis showing how property investors are incurring heavy losses from the Reserve Bank of Australia’s (RBA) aggressive interest rate tightening.

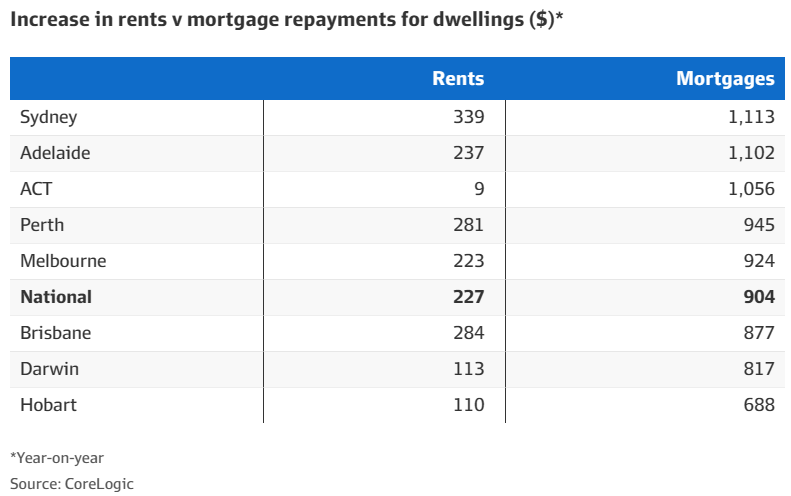

CoreLogic showed that rents had increased nationwide by $227 per month as at March 2023, but monthly mortgage payments had increased by a far higher $904 per month:

Accordingly, every suburb with house rental markets and more than 97% of suburbs with unit markets in Melbourne and Sydney were now cashflow negative.

The picture since then has darkened with the RBA lifting the official cash rate another 0.5% following hikes in May and June.

In turn, Australia’s army of negatively geared property investors are facing further losses.

Indeed, CoreLogic Head of Research, Eliza Owen, on Thursday released data showing that investors across Sydney, Melbourne and Perth are dumping their homes on the market amid soaring loan repayments.

“In three capital cities – Sydney, Melbourne and Perth – investor listings for May were actually higher than the previous decade average”, Owen wrote.

“Not only is the portion of investor listings high, the volume of new investment listings through May were 19% higher than the previous decade average”.

“At a more granular level the proportion of investor listings on the market in May has shot up in inner city areas, traditional hot spots for multiple property owners”.

“For example, the SA3 market ‘City and Inner South’ in Sydney has a historic 10-year average of 38% of new listings coming to market from investors. In May it topped the list of regions with the highest proportion of investment listings, surging to 57%”.

“This really signifies that investor selling activity is persisting in an environment where owner occupier selling decisions are waning”.

“There are of course a few things that might be prompting the sales”, Owen explains.

“The first driver might be higher interest costs over the course of the year”.

“Based on average interest rates for investors, we estimate mortgage costs on a $500,000 loan will have increased $860 per month, to $3,213”.

“While rents have risen at a record pace over the past few years, they generally have not risen as much as mortgage costs on a new loan”.

“If the interest burden is becoming too high amid an already high inflationary environment, investors may be looking to offload their investment”.

“Another key driver might be capital growth”.

Borrowing to invest in real estate makes financial sense when interest rates are low and values are rising.

When the contrary occurs, as it has recently, investing in real estate can turn into a financial disaster.

However, the environment for real estate investing should improve next year.

The RBA will most likely begin decreasing interest rates, lowering mortgage payments and increasing the value of housing.

Rental growth should also remain high given record net overseas migration and plummeting new housing development.

So, while 2023 will be difficult for property investors, 2024 should be considerably brighter.

Sadly, this also means that tenants will continue to face rising rents in the face of record-low supply.