DXY was stable last night:

AUD flamed out:

Commodities are trading on weak China hope:

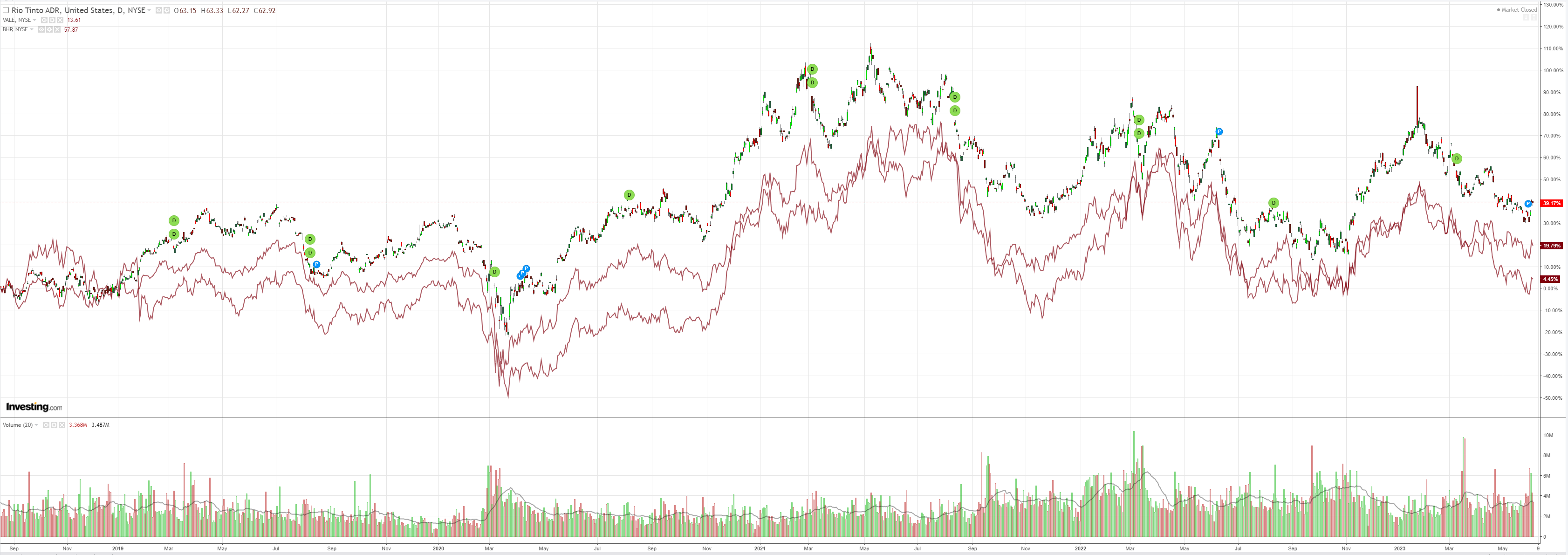

Big miners faded it:

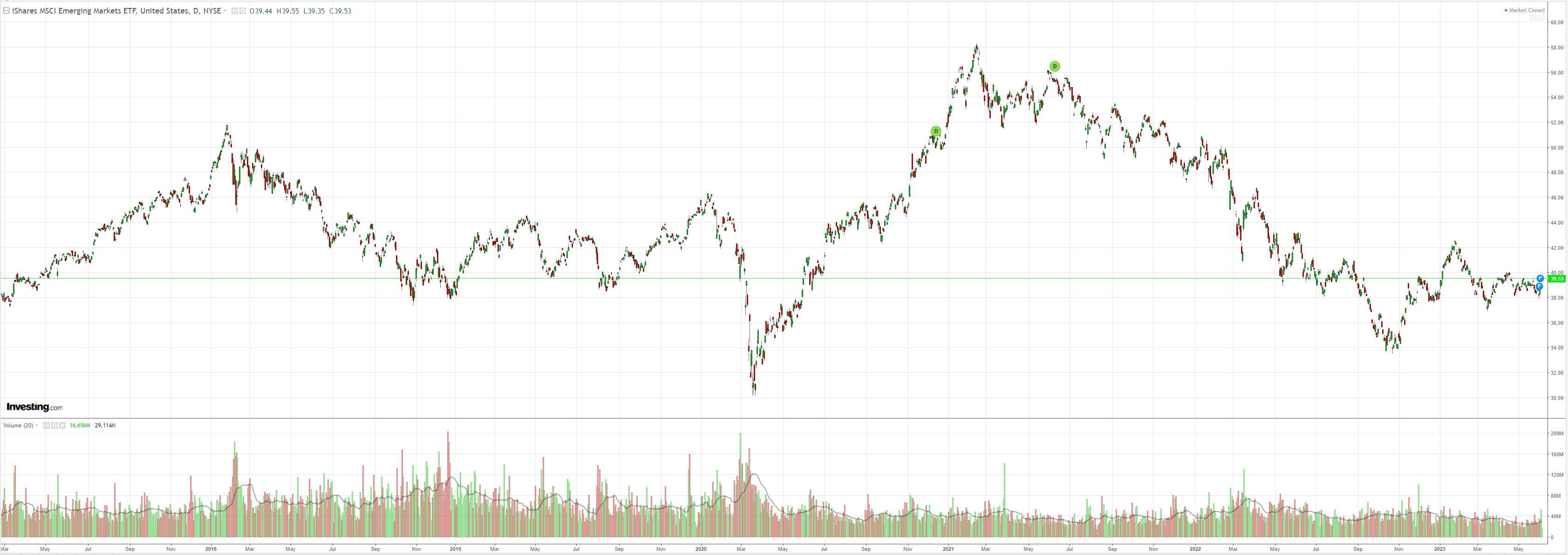

EMs stocks are going nowhere:

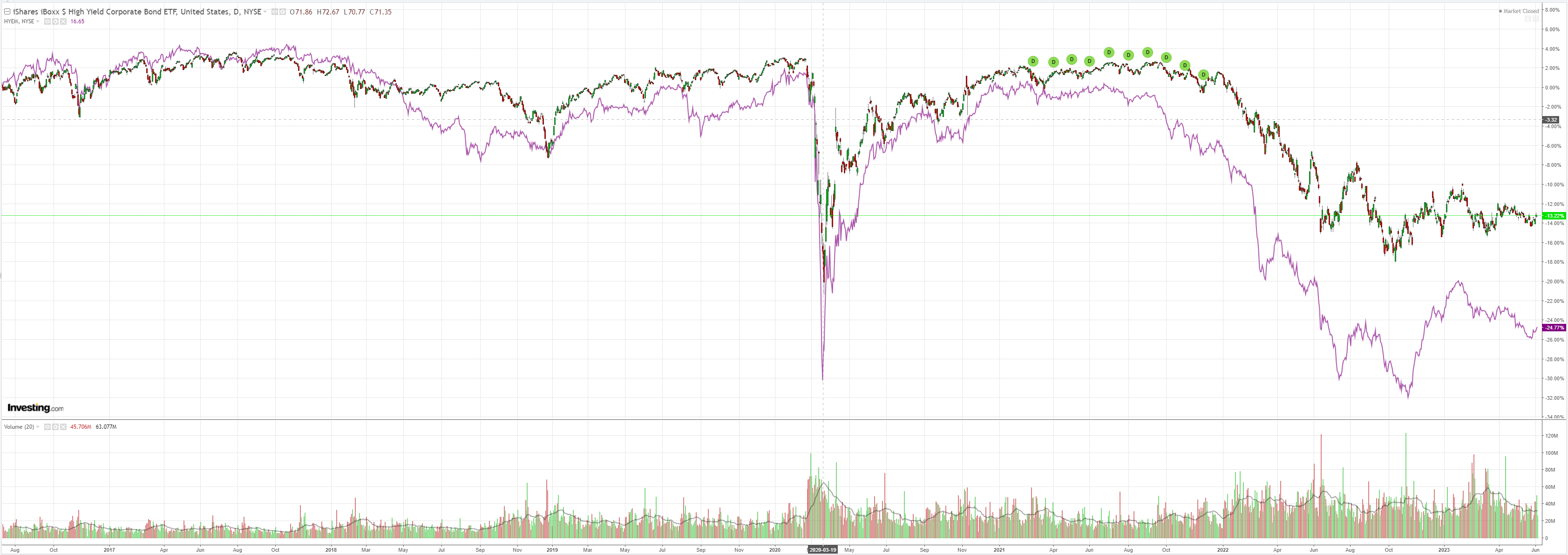

Junk is giving Chinese developers a chance:

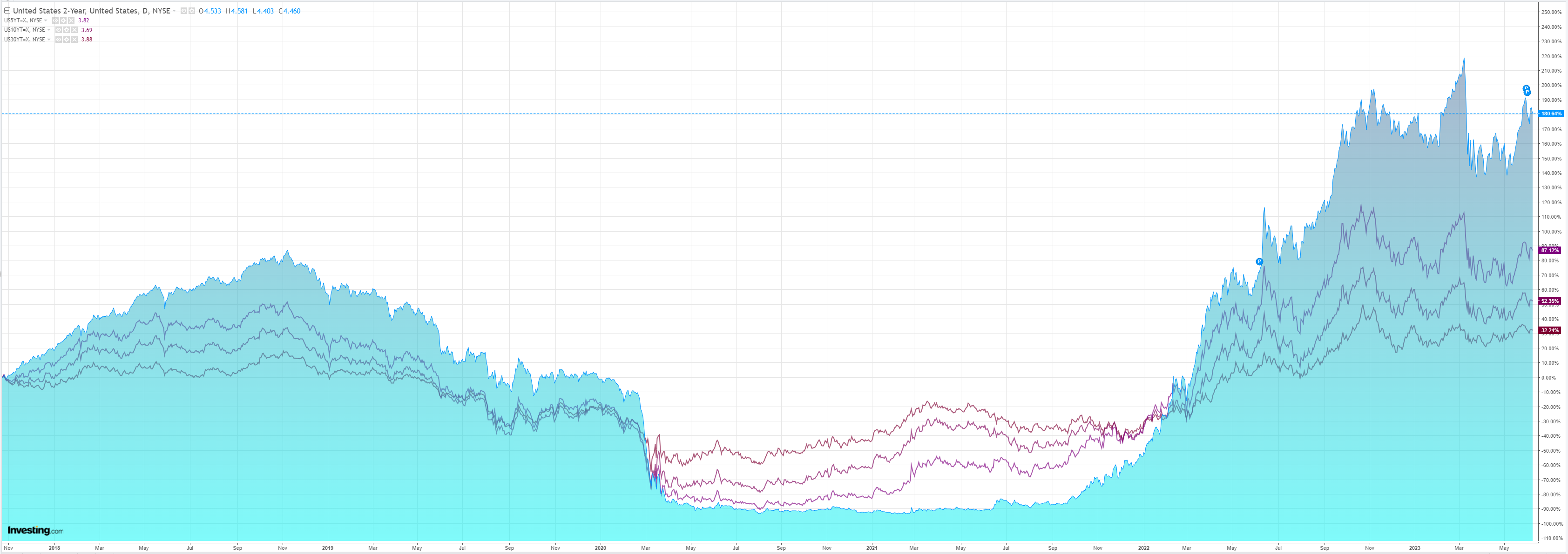

The Treasury curve flattened:

Stocks took a breather:

AS we wait for what I expect will be insufficient Chinese stimulus, Europe is taking the lead to downside for AUD.

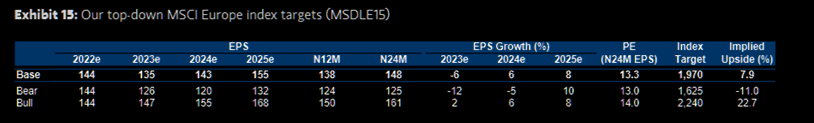

EU Equity Strategist, Graham Secker, sees short term pain ahead for the region:

“We expect a 10% correction over the summer months as growth slows and liquidity deteriorates. EPS risks remain to downside. We still prefer defensives > cyclicals and growth > value. Downgrade Financials to neutral. Europe’s relative performance looks vulnerable near term, but brighter thereafter.”

EU Equity Strategist, Graham Secker, sees short term pain ahead for the region:

“We expect a 10% correction over the summer months as growth slows and liquidity deteriorates. EPS risks remain to downside. We still prefer defensives > cyclicals and growth > value. Downgrade Financials to neutral. Europe’s relative performance looks vulnerable near term, but brighter thereafter.”

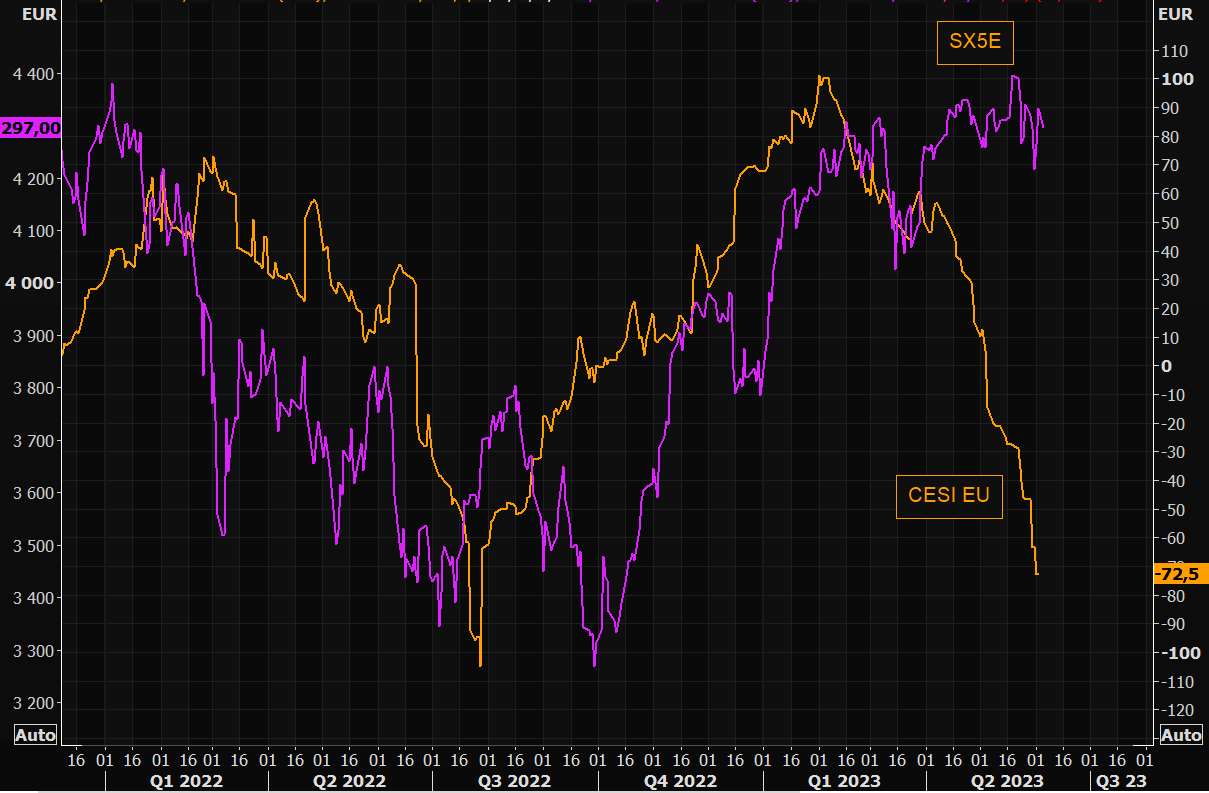

The EUR and Europea assets are hugely overbought and overvalued relative to the economic surprise index:

Unless whatever China cooks up for property is big enough to lift Europe then it must adjust to the reality of a failing reopening pulse in its largest export growth market. I have my doubts!

If right, that will add more pressure to the AUD.