Wednesday’s Q1 national accounts release from the Australian Bureau of Statistics (ABS) was an absolute shocker for Australian households.

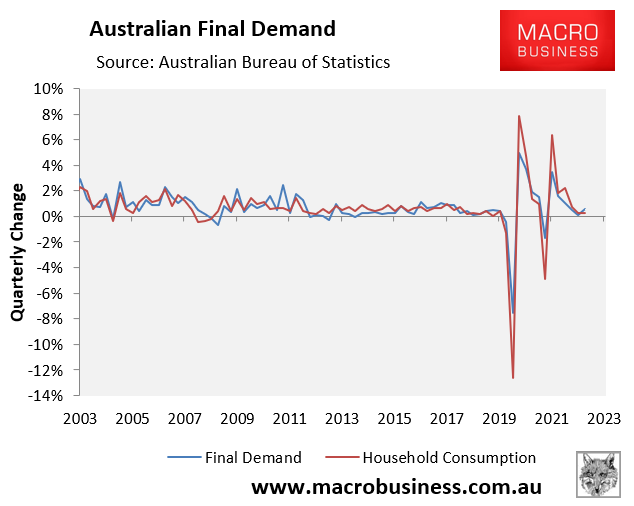

While overall domestic final demand (DFD), which gauges domestic activity by stripping away the impact of net exports, rose by 0.6% in the March quarter.

Household consumption grew by only 0.2% in the March quarter, and actually fell by 0.2% in per capita terms.

Household consumption is the main driver of the Australian economy and where it goes the economy typically follows:

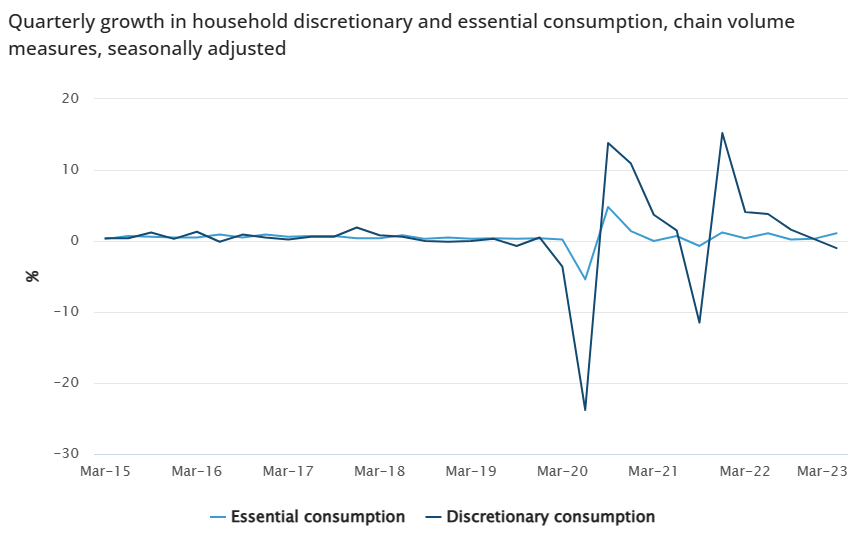

Growth in essential spending increased (+1.1%), driven by soaring energy costs, while discretionary spending (-1.0%) fell:

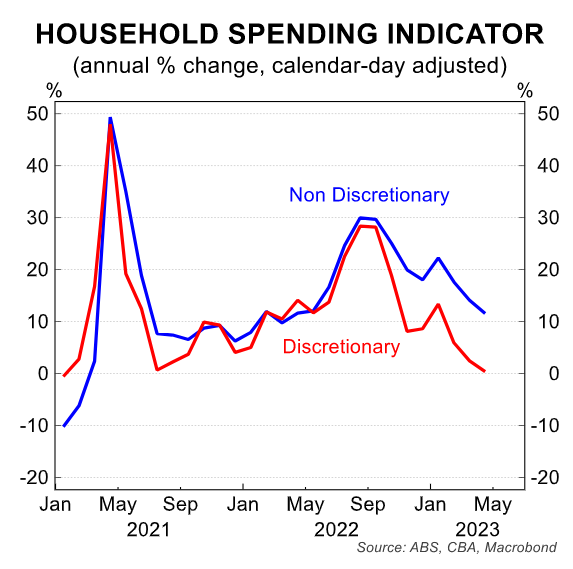

The ABS’ household spending indicator shows similar trends:

Thus, households are spending more on things they need (essentials), while cutting back on things they want (discretionary items).

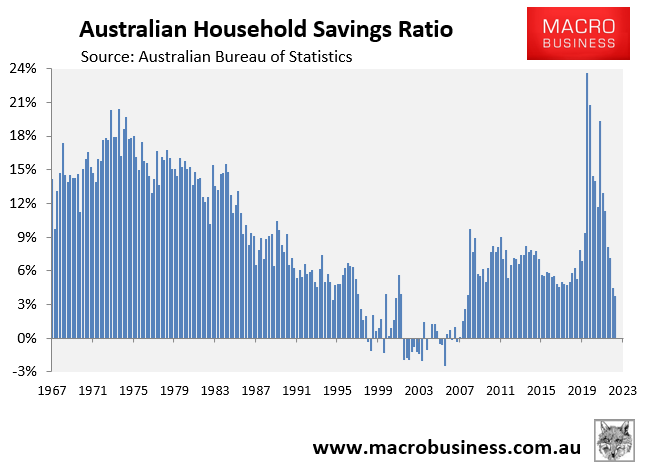

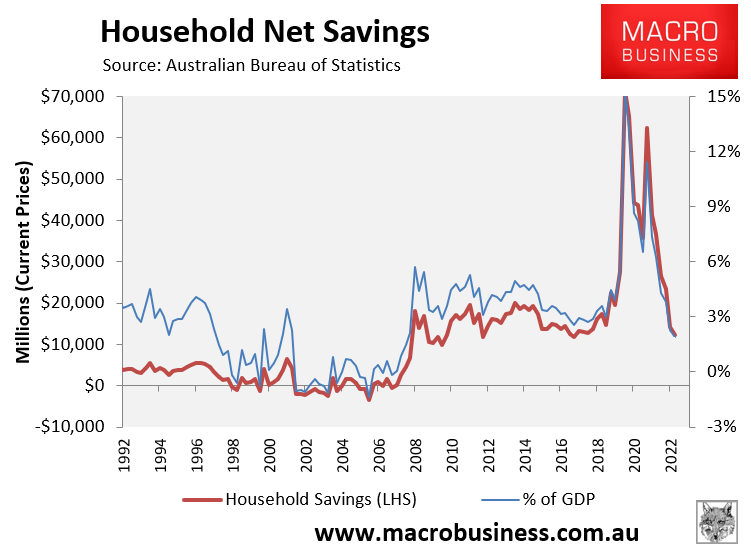

The overall slowdown in household consumption occurred despite a dramatic drop in the savings rate to 3.7% in the March quarter, down from 11.3% a year earlier:

This was the lowest savings rate since Q2 2008.

Indeed, after accumulating record amounts of savings over the pandemic, savings levels have normalised:

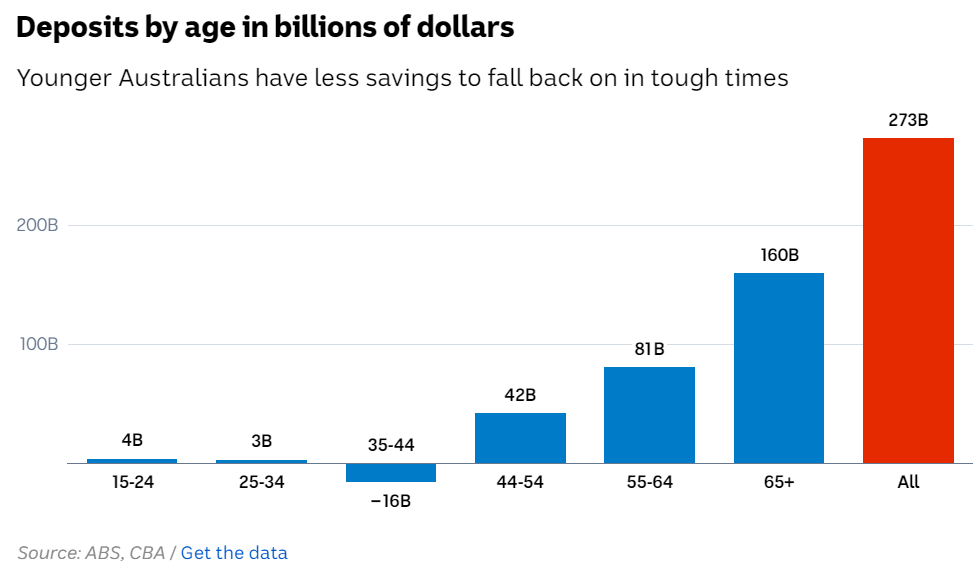

However, most of these savings have gone to the older generations, who are largely inoculated from the rise in interest rates and rents:

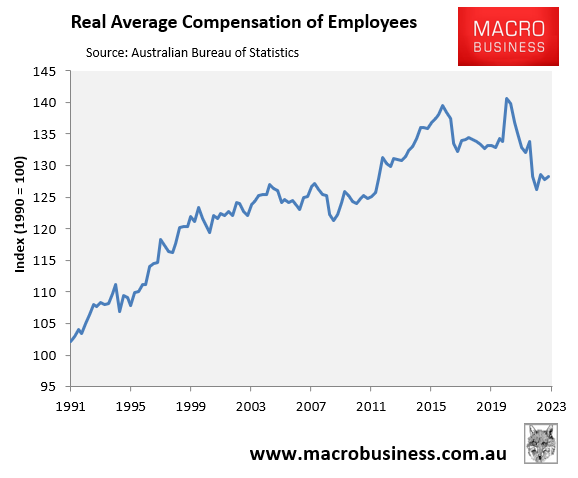

Meanwhile, the real average compensation of employees remains in the toilet:

While real average compensation rose by 0.4% over the March quarter, it was dead flat (0.0%) year-on-year and has fallen 8.8% from the June 2020 peak.

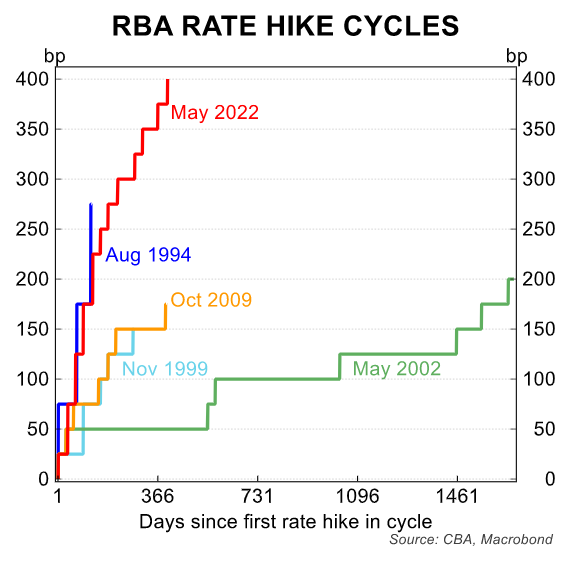

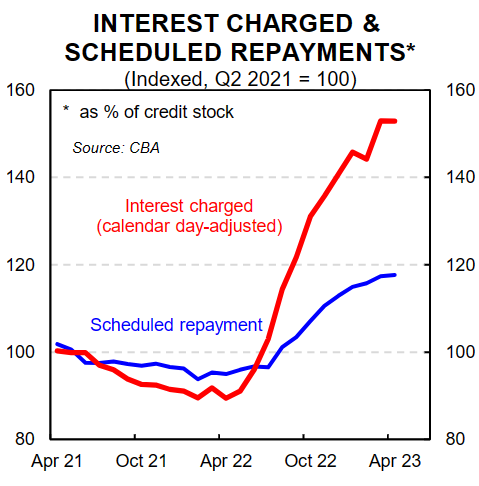

CBA economist Harry Ottley delved deeper into Tuesday’s national accounts and presented data showing that the situation facing Australian households will worsen in the face of the steepest lift in interest rates on record:

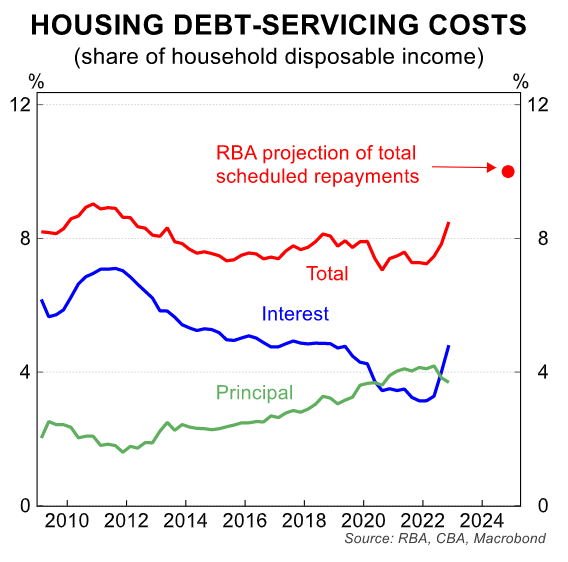

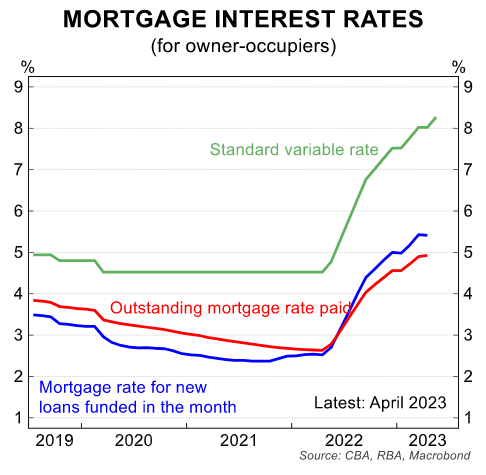

“The impact on the consumer will continue to build from here as further hikes are passed through to variable rate mortgage holders, and as fixed rate mortgages are reset to much higher rates”, notes Ottley.

“This will take housing debt servicing costs as a share of income to record highs later this year”.

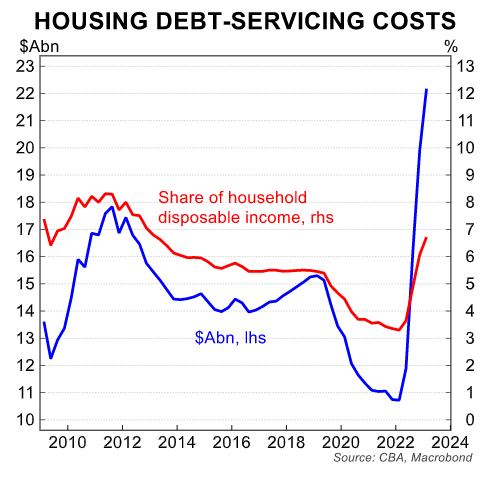

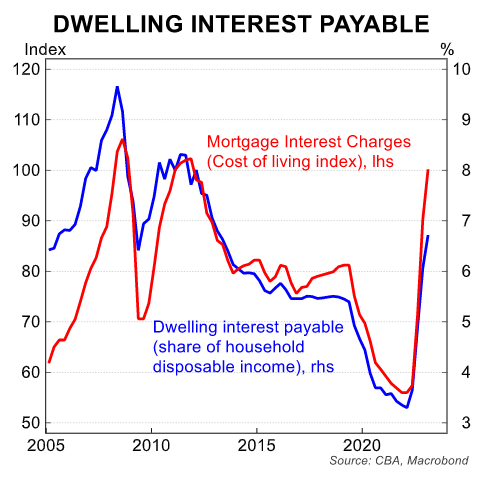

“Housing debt servicing costs lifted by a very large 11.5% in Q1 23. It has more than doubled over the past year as the RBA has taken the cash rate from 0.1% to 4.1%”, wrote Ottley.

“As a share of disposable income the increase was smaller given the still tight labour market and rising wages growth. At 6.7% of household disposable income, it is the highest in a decade”.

“While interest costs rose substantially over Q1 23, mortgage repayments have yet to fully reset higher. There is a lag of around a few months before scheduled repayments shift higher in response to higher interest rates delivered over Q1 23”.

“The RBA has raised the cash rate a further 50bps over Q2 23. Debt servicing costs will continue to rise, putting additional pressure on household budgets. They will reach record highs later this year”, noted Ottley.

That’s a scary outlook for the one-third of Australians with mortgages who have little in the way of savings, have seen their real incomes collapse, and will soon face record interest repayments.