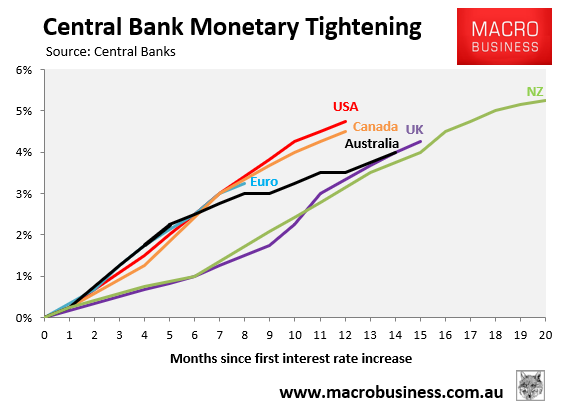

The Reserve Bank of Australia’s (RBA) February’s Statement of Monetary Policy included the following chart showing the rise in mortgage rates across key advanced nations since central banks began hiking interest rates:

As at the end of 2022, Australian mortgage holders had experienced approximately 200 basis points of tightening, which was far more than other English-speaking countries.

Since then, the RBA has hiked rates another 100 basis points; albeit by less than most other developed nations:

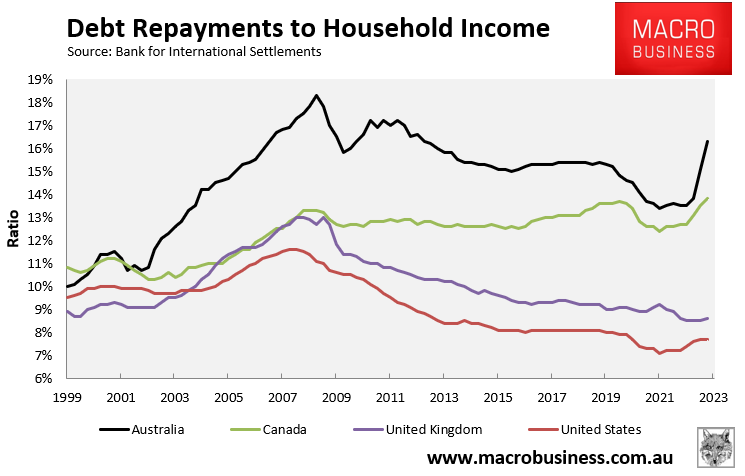

The latest debt repayments data has been released by the Bank for International Settlements (BIS), which is current to the December quarter of 2022.

According to the BIS, principal and debt repayments as a share of aggregate household disposable income soared to 16.3% at the end of 2022, up from 13.5% in the March quarter before the RBA’s first rate hike:

The rise in debt repayments in Australia has also dwarfed the other English-speaking nations.

The reasons why Australia’s household debt burden is much higher than other nations is because:

- Australia’s stock of household debt relative to GDP is the second highest in the world (behind Switzerland); and

- Australia has a much higher share of variable rate mortgages than most other nations, as well as more short-term fixed rates. This means interest rate hikes are passed on more quickly to Australian borrowers than elsewhere.

The official Australian cash rate was 3.10% as at December 2022.

Accordingly, the above chart does not include an additional 1.00% of increases in the official cash rate, which has increased debt repayments much further but is not reflected above.

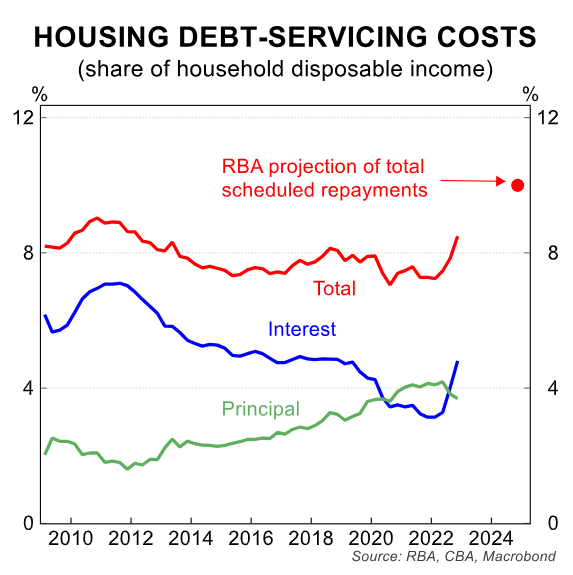

To add further insult to injury, scheduled mortgage repayments will lift to an all-time high share of household income in 2024 after the fixed rate mortgage reset has run its course:

No wonder Australian mortgage holders are screaming in pain.

Even in the unlikely event that the RBA doesn’t hike any further, there is significant tightening ‘built-in’ to monetary settings in Australia owing to the huge volumes of cheap fixed rate mortgages expiring.