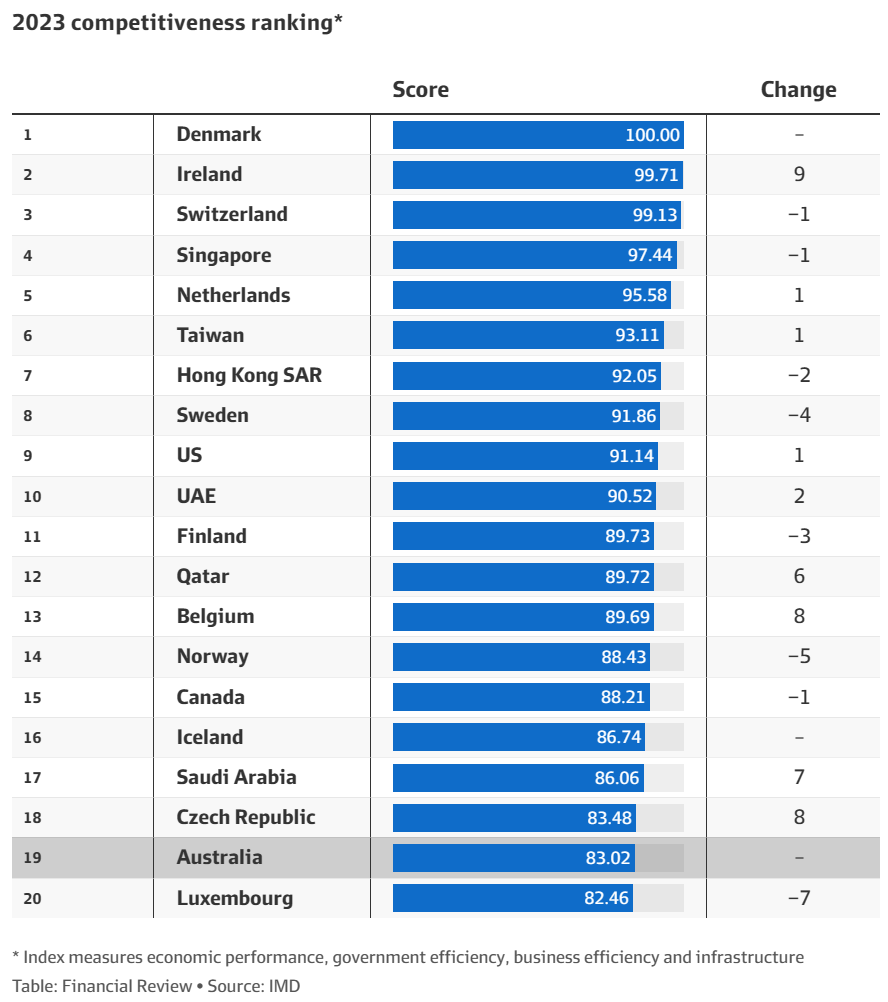

Australia has ranked 19th out of 64 countries in the latest edition of the World Competitiveness Yearbook report, which is compiled by the International Institute for Management Development.

Australia ranks third on life expectancy and health coverage, but it is now in 62nd place in terms of entrepreneurship and 46th with regard to productivity.

World Competitiveness Centre director Arturo Bris contends that while resources-rich countries such as Australia tend to be more productive, they can learn a lot from countries such as Switzerland and Singapore, which lack natural resources but have built highly productive economic models.

“Resource-rich countries – and Australia is one of them – are naturally more productive”, Professor Bris said.

“However, the challenge for resource-based economies is how to translate such efficiency into prosperity, for example, how to make people’s lives better”.

“This requires good policies and good institutions. At the same time, Australia needs to learn from countries that lack natural resources but that have built highly productive economic models, such as Switzerland and Singapore”.

Committee for Economic Development of Australia chief economist Cassandra Winzar said that Australia’s economy needs to diversify.

“Strong commodity prices and a healthy jobs market continue to drive Australia’s competitiveness, but we cannot keep relying on our traditional trade strengths”.

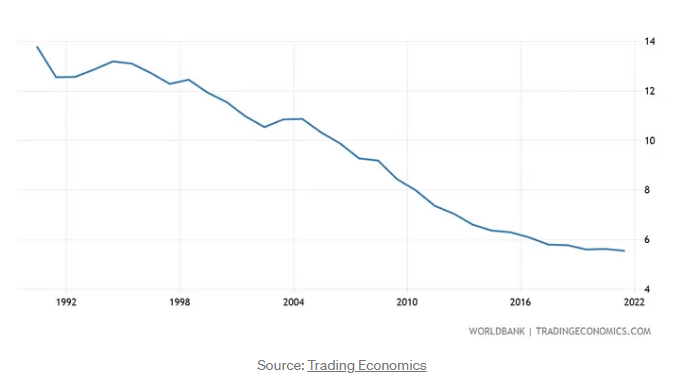

“We must redouble our efforts to deepen the complexity of our economy amid an ongoing slump in productivity”.

Australia’s relatively poor ranking is understandable given our entire economic model revolves around digging stuff up from the ground, as well as importing hordes of consumers from overseas to build houses for and sell coffees and other services to.

Freelancer CEO, Matt Barrie, beautifully described this model in his Opening Keynote Address for Sydney Morning Herald Sydney 2050 Summit:

“Harvard ranks us 91st in the world for economic complexity, a measure of how unique and sophisticated our industry is, behind Kazakhstan, Guatemala and Laos”.

“It’s fallen 40 places since 1995, a year when Australia made things like cars, for which we’re still taxed $1.5 billion a year, to protect an industry that no longer exists”.

“Australia’ manufacturing’s share of GDP is 5.5%, on par with a tax haven like Luxembourg, but worse than Botswana, which sells diamonds and where you can see cheetahs”.

“Those four commodities: dirt, dead trees, gas from dead trees and gold, along with 34% of everything we produce, we put on a boat to China- a country we are now totally dependent upon, and that we have totally pissed off. In return we take 2% of theirs”.

“Our fifth biggest export is “educational related travel services”, or a visa factory at our local university, vocational, “business” or English college. The educational quality at the latter is worse than you’d get binge watching cat videos on Tiktok”.

“ccording to the Home Affairs Minister, we created ‘an underclass of low-paid and exploited workers, leaving international students in limbo and failing to meet the current and future economic challenges faced by the nation’. In the same breath, O’Neil announced all these workers can be permanent residents, a statement that does not logically follow”.

“This is the big, uncomfortable secret about Australia’s ‘easy, relentless’ growth”.

“The ‘easy, relentless growth’ politicians have chosen to take is to blow a property bubble on a scale like no other, one that has driven Australian houses up 8,570% (86x!) over 61 years”.

“The US uses quantitative easing to drive ‘easy, relentless’ growth”.

“Australia uses quantitative peopling”.

“In the year to March, Australia grew by a record of 523,000, following which Albanese added 500 staff and $42m to clear a 600,000 visa backlog”.

“This is not about ‘growth’ but inflating demand for housing. It’s not about the ‘economy’ but inflating GDP. But population growth does not increase GDP per capita”.

“As they say in public policy, the dildo of consequences rarely arrives lubed”.

“With mass immigration driving out of control inflation, property costs, infrastructure demands, construction collapses, business insolvencies, debt and the greatest erosion of Australian living standards on record, one would think that something might break”.

That’s Australia’s economy in a nutshell.