Financially speaking, the pandemic was a wonderful time for Australia’s baby boomer generation, which accumulated a war chest of savings.

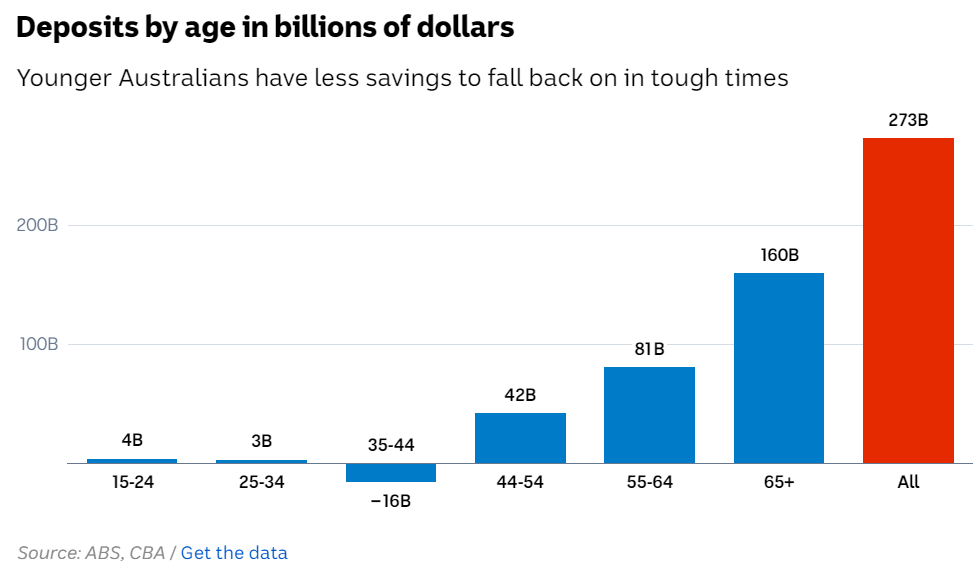

As illustrated in the next chart, Australians over 65 years of age amassed an extraordinary $160 billion of savings, while younger Australians treaded water:

Most baby boomers also own their homes outright and have been unaffected by the RBA’s aggressive interest rate hikes, nor the record surge in residential rents.

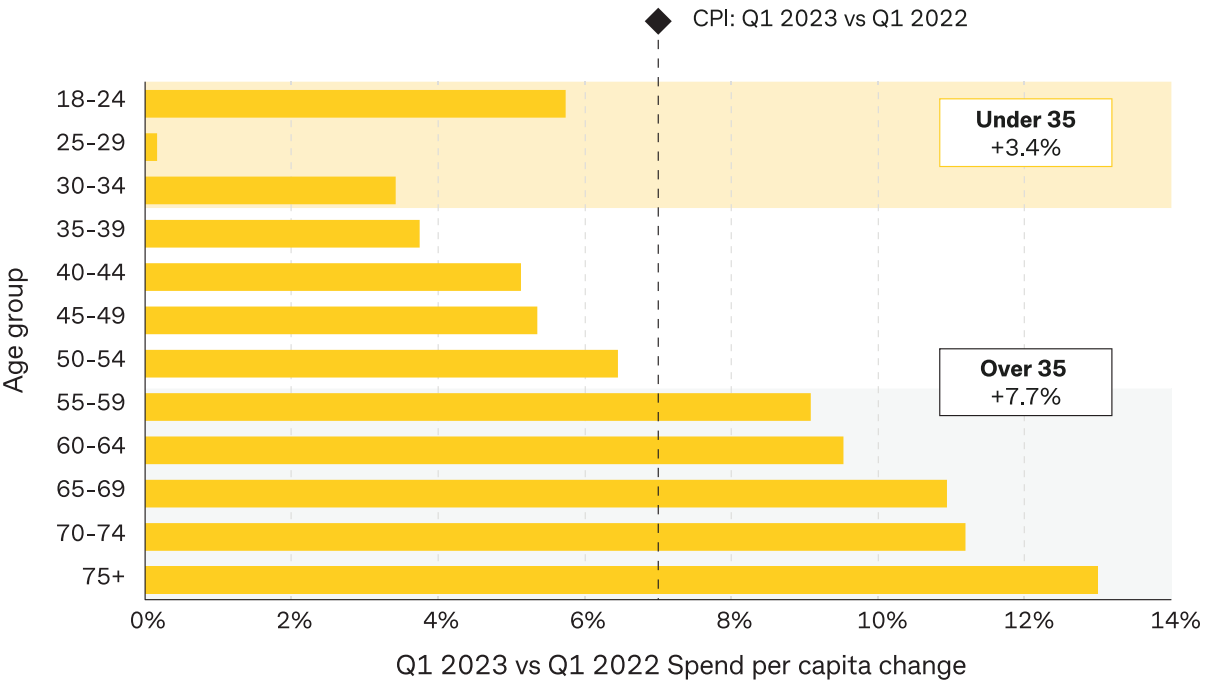

Accordingly, older Australians have spent like drunken sailors over the past year, while younger Australians have cut back hard:

While many younger Australians are struggling to afford rent and are now shut out of home ownership by the rise in mortgage rates and reduced borrowing capacity, baby boomers are buying up Aussie homes with cash.

As reported by AAP, more than a quarter of homes were purchased without a mortgage last year, implying there is a sizable cohort of Australians shielded from the RBA’s rate hikes.

Data provided by PEXA shows that almost 25% of all sales in the eastern states – both residences and land – were made without a mortgage.

The proportion of cash purchases has remained relatively consistent since before Covid-19’s arrival, but the total value has been ratchetting higher since the pandemic property boom.

In 2022, over $122.5 billion in cash-funded homes were sold, accounting for 25.6% of all residential sales in New South Wales, Queensland, and Victoria.

This was slightly less than the $124.8 billion in homes purchased without a home loan in 2021, but significantly more than the $83.6 billion reported in 2020.

According to Mike Gill, PEXA’s head of research, most cash buyers were older homeowners who had previously paid off their mortgages and were purchasing a home to retire in.

Australian home ownership was already dominated by the baby boomers. And it looks like they have tightened their stranglehold.