The Reserve Bank of Australia’s (RBA) latest 0.25% interest rate hike has yet to dampen Australian house prices, with CoreLogic’s daily dwelling values index rising 0.35% in the week ended 15 June.

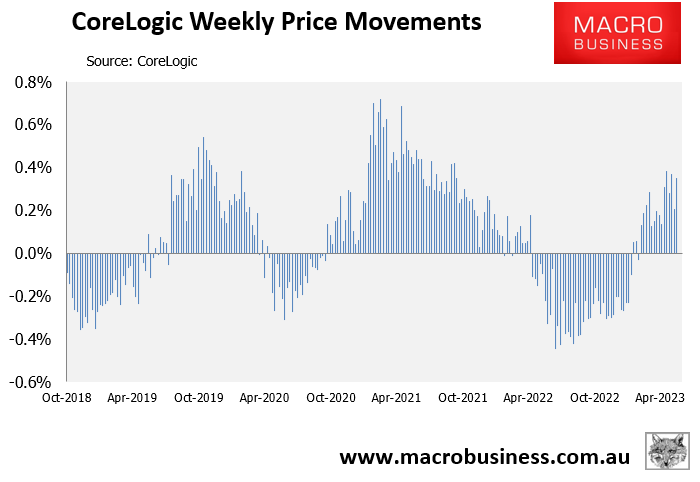

It was the 15th consecutive weekly increase in values and the equal second strongest rise over that period:

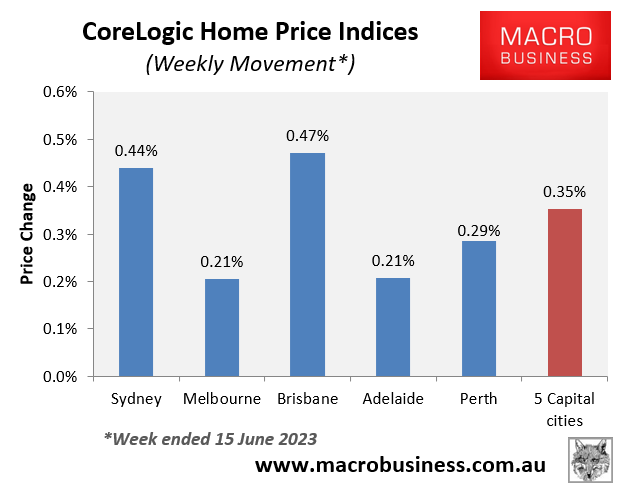

The increase in values was broad-based, with all five major capital city markets recording increases:

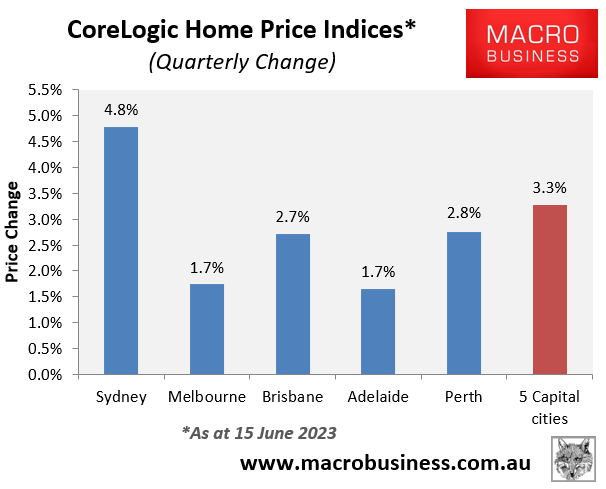

Values have risen a strong 3.3% over the quarter at the 5-city aggregate level, led by turbo-charged growth in Sydney (+4.8%):

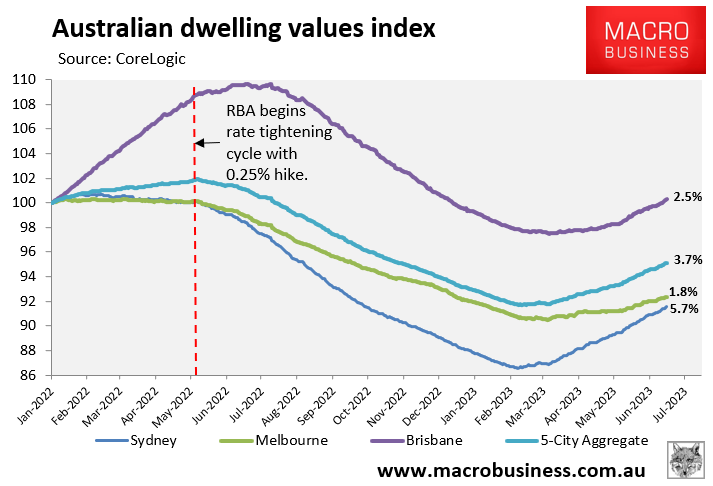

Dwelling values have now risen by 3.7% at the 5-city aggregate level since bottoming on 7 February.

Sydney has led the rise with home values soaring 5.7% over that period:

Several real estate pundits, including Louis Christopher, Chris Joye and auctioneer Tom Panos, have warned that Australia could experience a ‘double-dip’ housing correction following the RBA’s latest rate hike.

But for now, we are yet to see a price impact.

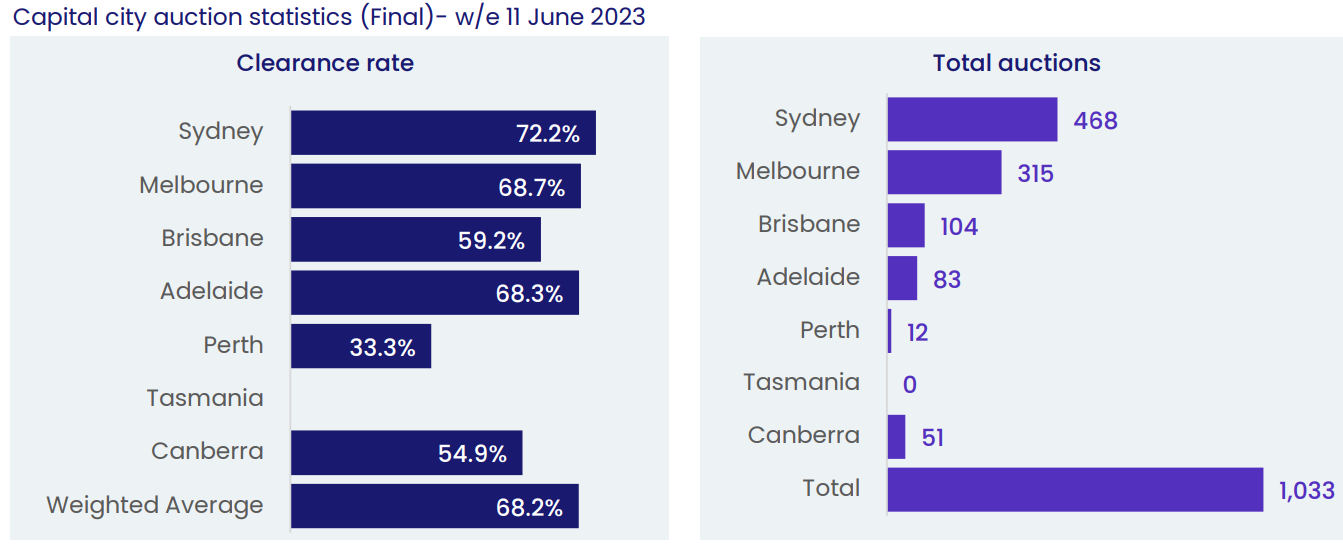

That said, CoreLogic did record its worst final auction results for six weeks, with the combined capital city clearance rate falling to 68.2%:

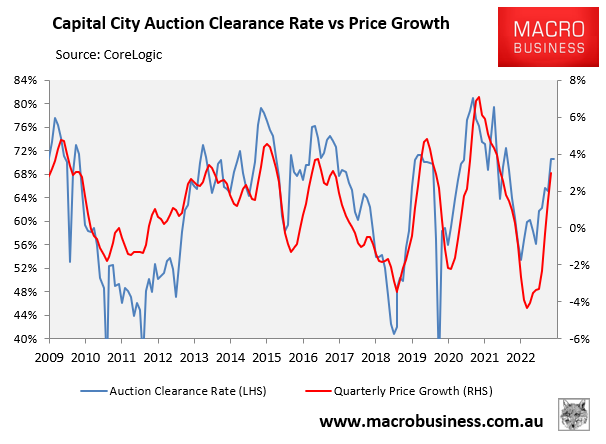

As shown in the next chart, auction clearance rates have traditionally been a key leading indicator for house prices, so we will need to watch the next few weekend’s auction results closely to see if we have reached a turning point:

Other commentators have played down the prospects of a ‘double dip’ price correction.

HSBC’s chief economist Paul Bloxham says factors such as rising interest rates and a slowing economy may affect the pace of growth in house prices but are unlikely to see the market retreat.

“We think there’s going to be enough upward momentum and enough support from the strong population growth to offset the impact of higher interest rates, so we’re not expecting to see another substantial leg down in house prices”, Bloxham said.

Similarly, ANZ Bank’s senior economist Felicity Emmett notes that factors such as limited supply and strong demand due to immigration is putting upward pressure on housing prices, and this is likely to continue in short and medium terms.

“At present, the combination of low supply and strong demand from immigration is putting upward pressure on housing prices”, said Emmett.

“We see upward pressure on housing prices continuing in the medium term given the current shortage and the lack of new supply coming on as developers face a difficult combination of rising costs and rising interest rates”.

The counter point is that this price rebound has been atypical given it has arisen amid falling sales volumes and rising mortgage rates.

At some point, the gravity of higher borrowing costs, reduced borrowing capacity and falling real incomes should pull down the market.

Only time will tell who’s right and who’s wrong. A lot will depend on whether the RBA tightens further.