Albo’s too many jobs crisis is all but over. Unemployment expectations have a good record of leading higher unemployment. Westpac with the note.

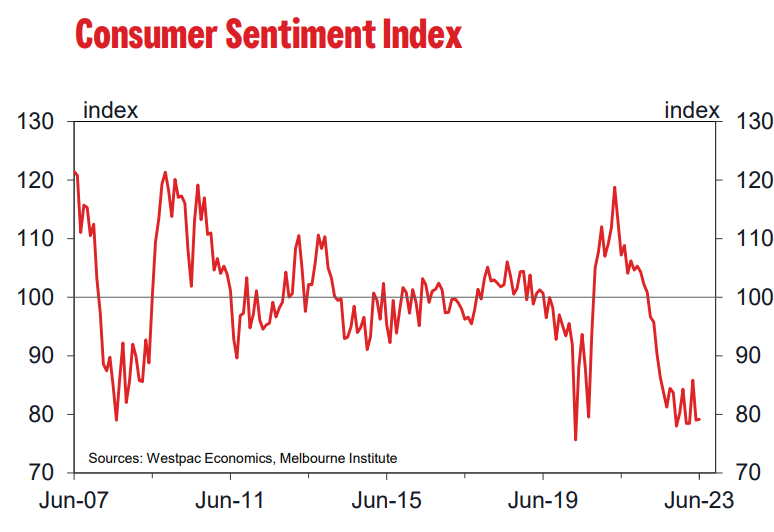

The Melbourne Institute of Consumer Sentiment index rose 0.2%, from 79.0 in May to 79.2 in June.

For the last year the Index has held around levels we have not seen on a sustained basis since the deep recession of the late 1980s/early 1990s.

The survey was taken over the period 5-9 June. That period covered the announcement of the decision by the Reserve Bank to lift the cash rate by 0.25% from 3.85% to 4.1%.

While the full survey showed little net change in sentiment, responses within the survey week show a big rate rise impact.

Prior to the announcement of the rate hike decision confidence had lifted sharply from 79.0 in May to 89.0. But following the announcement it tumbled to an extremely low 72.6.

However, overall, interest rates are not the most troubling issue for all households. Recall that that only about a third of households carry a mortgage.

When asked about the news items that resonated the most in June, the topics with the highest recall amongst consumers more generally were: inflation (62%), budget and taxation (43%); economic conditions (40%); employment (32%); and interest rates (27.6%).

As discussed, the Index has now held at ‘recession lows’ for the last year – a period in which inflation has consistently been the dominant news story.

News on these topics continues to be assessed as more negative than positive.

News on inflation is assessed as by far the most negative issue; followed by interest rates; while assessments of economic conditions; employment and the Budget show significant improvements relative to the last read on consumer news recall back in March.

Most consumers continue to expect further rate rises. Amongst those surveyed after the RBA decision, 78% expect rates to rise over the next year with 48% expecting a rise of 1ppt or more – up slightly from 74% and 45% respectively in May.

The component sub–indexes showed mixed results in June.

The ‘family finances vs a year ago’ sub-index rose 3.7% but remained in deeply negative territory at 65.4. The detail shows better gains for consumers on lower incomes, those who rent and younger age-groups.

The Fair Work Commission’s decision to increase the Federal minimum wage and awards by 5.75%, which was announced on the Friday before the survey, looks to have provided some support.

Assessments remain understandably weaker amongst consumers with a mortgage, the index read across this sub-group printed 58.5.

The ‘economic outlook, next five years’ sub-index posted the biggest monthly gain, a solid 6.3% rise to 92.7, but followed a sharp 9.2% fall in May.

Stepping back from the recent swings, this component has held up much better than others through the current weakness.

The latest monthly read is a touch above the long run average of 92 and comfortably above the six month average prior to the onset of the COVID pandemic.

Consumers are bracing for a further deterioration in conditions near term.

The ‘family finances, next 12 months’ sub-index declined 2.1% to 84.0, while the ‘economic outlook, next 12 months’ sub-index was essentially unchanged at a very weak 77.2. These sub-indexes had already fallen by 9-10% in May.

Expectations are particularly weak amongst older age-groups and across the mortgage belt.

Attitudes towards major purchases soured again in June, falling back to near the extreme lows seen in February and March. The ‘time to buy a major household item’ sub-index fell 6.5% to just 76.4.

Buyer sentiment is extremely weak across the mortgage belt (72), amongst women (65.9) and those aged over 45 (69.4).

Of most concern is confidence around jobs – which has been the single bright spot in otherwise bleak consumer surveys over the last year.

This now looks to be fading fast. The Westpac-Melbourne Institute Unemployment Expectations Index rose 6.6% in June to 131.3 (recall that higher index reads mean more consumers expect unemployment to rise in the year ahead).

The index has now surged 32% since the interest rate tightening cycle began in May last year with June marking the first weaker-than-average read in the cycle to date.

The latest monthly deterioration was led by those working in the education and hospitality sectors.

The combination of higher interest rates and dwelling prices is driving a sharp fall in homebuyer sentiment. The ‘time to buy a dwelling’ index fell 5.7% to 72, unwinding most of last month’s 7.4% rise and continuing to hold near historical lows.

While these are not the weakest index reads on record, the sixteen month run since March is easily the most prolonged period of very weak buyer sentiment we have seen since the survey began in 1974.

However, despite the unexpected increase in the cash rate, expectations for house prices remained firmly positive. Indeed, there was no significant change in the Index in the samples before and after the rate increase decision was announced (146.2 and 147.1 respectively).

Over the whole survey, the Westpac Melbourne Institute House Price Expectations Index was up 1.7% on May. At 146.7 the index is still well above the long run average of 125.8.

Over 60% of consumers expect prices to rise over the next 12 months. Price expectations posted a particularly strong gain in WA (+24%) and was somewhat firmer in NSW (+3.6%)

Consumer risk aversion hit new record highs in June. Updates on our ‘wisest place for savings’ questions, run every three months, show safe-havens and paying down debt are very heavily favoured.

Well over half of all consumers nominate either ‘bank deposits’ (32%) or ‘pay down debt’ (27%) as the wisest place for savings.

The proportion nominating ‘pay down debt’ was the highest since this option was included in 1997.

Conversely, very few consumers favour riskier options. Just 5% nominate ‘real estate’ (near all-time record lows) and 8% nominate shares.

The Reserve Bank Board next meets on July 4. We expect the Board will decide to raise the cash rate by 0.25% to 4.35%.

In his Statement following the surprise move to raise the cash rate in June the Governor noted concerns about a potential lift in inflation expectations contributing to a wage-price spiral amid already sharp increases in unit labour costs. He emphasised that upside risks to the inflation outlook have increased.

The tone of the Statement indicated a marked concern around upside inflation risks and a clear preference for a tighter policy stance.

Given that little further information will be available on expectations and unit labour costs in the near term it seems logical that delaying the tightening for another month, to assess more data, seems unnecessary and may just exacerbate the expectations risks. For these reasons we expect that the Board will choose to move next month.