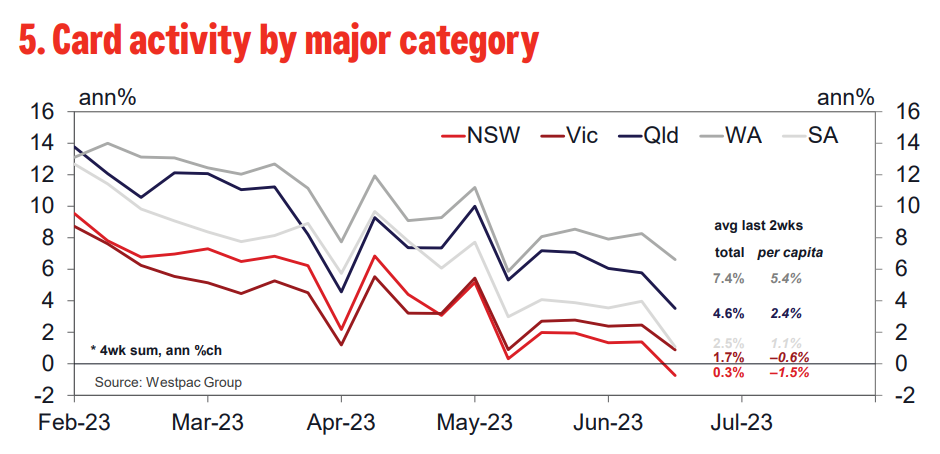

The Westpac credit card tracker continues to slump, corroborating the anecdata from retailers.

― The Westpac Card Tracker Index softened slightly over the first half of June, declining 0.9pts to 132.5. The underlying weakening trend evident since the start of the year remains firmly in place, with the quarterly growth profile continuing to highlight the risk of an outright contraction spending in Q2 following the slight gain in Q1.

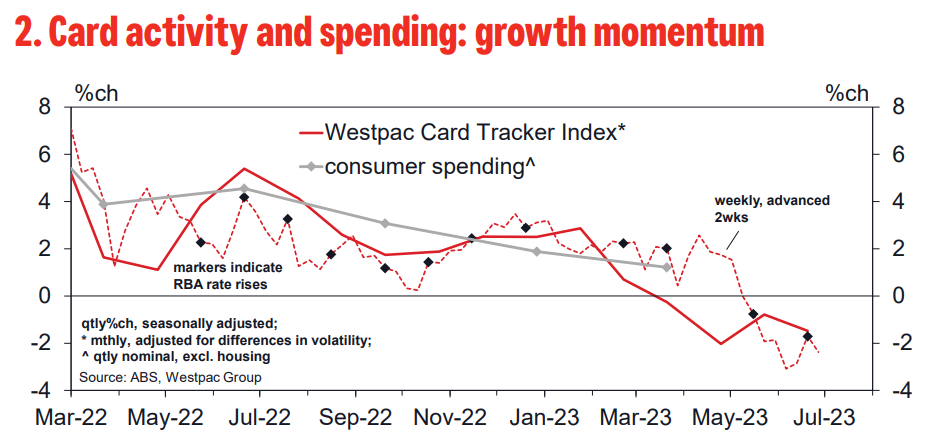

― The weakening continues to be relatively broad-based but more pronounced for discretionary categories and for goods. Annual growth is firmly negative for discretionary goods, declining at a particularly rapid 8%yr pace for housing-related items. Annual growth has also dipped into negative for essential goods, although this partly reflects last year’s spike in fuel prices. While annual growth remains positive for discretionary services, this has seen the most significant slowing since April. Essential services – which includes utilities, education and health – has been steadier.

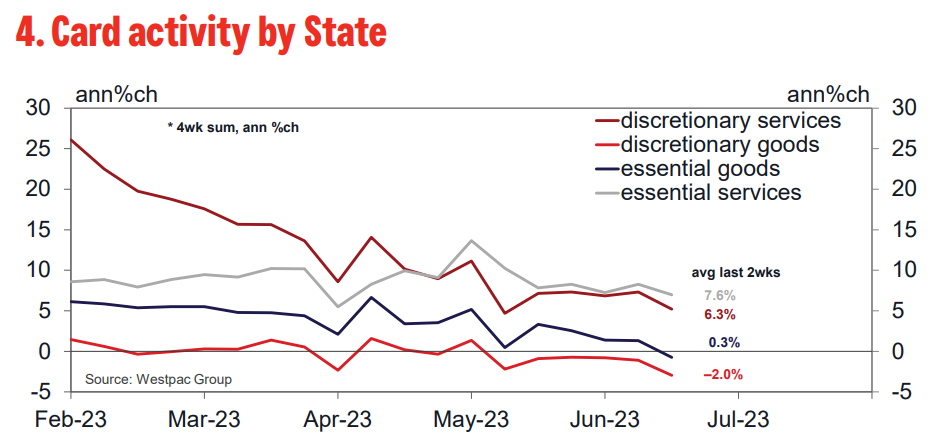

― By state, annual growth in card activity has dipped into outright negative in NSW and is now slightly negative in per capita terms in Vic. SA is recording a similar growth pace to Vic but firmer in per capita terms. Qld is now showing clearer signs of a slowdown although annual growth remains in the 3-4%yr range. WA is the only major state where growth in card activity remains firmly above 5%yr.