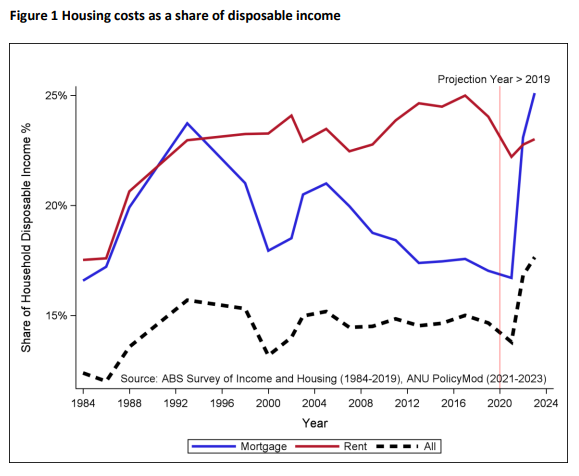

New modelling from ANU’s Centre for Social Research and Methods predicts the Reserve Bank of Australia’s (RBA) most recent 0.25% rate hike will make Australia’s mortgage repayment burden the heaviest in history.

Home owners will, on average, be forced to stump up a quarter of take-home pay towards mortgage repayments.

Last week’s rate hike means that mortgage holders will be paying on average 50% more than they did pre-pandemic.

ANU Associate Professor, Ben Phillips, said that “mortgage costs as a share of income are at their highest since 1984”, despite mortgage holders coming off “a few years of very low interest rates”.

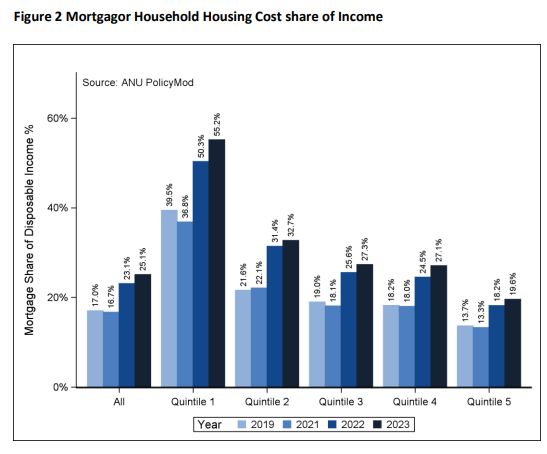

Mortgage costs have risen most aggressively for lower income households:

There has been a very large increase in debt servicing costs over the past year due to the combination of 4.0% of interest rate hikes by the RBA and rising average debt levels.

Ben Phillips says that his modelling is a “conservative” estimate and only factors in one additional interest rate hike from the RBA.

Phillips warns that “for some households such increases [in mortgage costs] are likely to mean significant financial stress or the need to rearrange household expenditure priorities”.

The modelling comes amid predictions that Australian house prices will experience a ‘double-dip’ price correction.

TCorp Chief Economist Brian Redican believes that unless interest rates begin to fall, house prices could reverse in the next six months.

“The rate increases, including as recently as May, are still running through the system”.

“So people will be facing higher mortgage rates over the next couple of months, including those that are coming off their fixed rate loans”.

Redican believes that the property market is “very much driven by sentiment at the moment”.

“But the thing about those kinds of sentiment indicators or animal spirits is that they can turn quite quickly, particularly when we look ahead at those affordability issues, which are likely to get worse rather than better”.

The next few weekends of auction results will be the litmus test and should indicate whether the RBA has broken the will of home buyers, which could lead to a possible double-dip correction.