Westpac with the note.

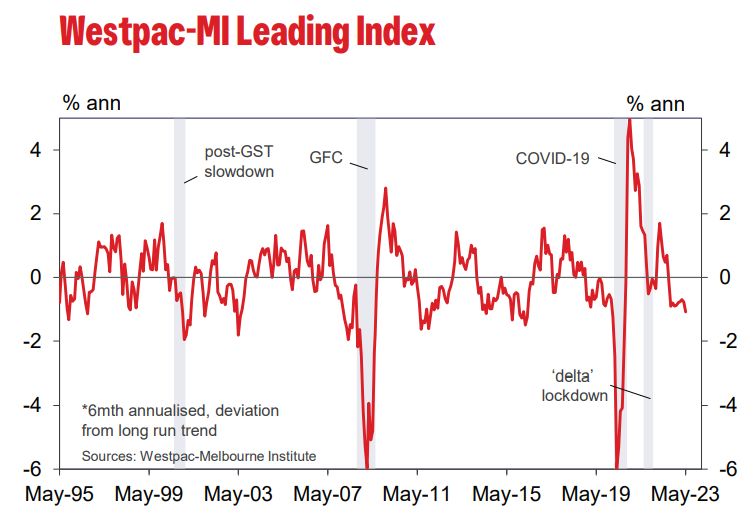

The six-month annualised growth rate in the WestpacMelbourne Institute Leading Index, which indicates the likely pace of economic activity relative to trend three to nine months into the future, declined to -1.09% in May from -0.78% in April.

This is the lowest read of the growth rate of the Leading Index since the pandemic.

It continues the run of negative growth rates which began last August and is entirely consistent with the disappointing growth rates which have been reported for the December and March quarters (0.5% and 0.2% respectively).

The negative Index growth rates point to below-trend economic growth. The most recent quarters certainly fall into that category and Westpac expects the weakness to extend through 2023 and into 2024.

We recently revised down our growth forecasts for 2023 and 2024, from 1% and 1.5% to 0.6% and 1.0% respectively. This weakness in the economy is centred around the consumer but also reflects a slowing global economy; a downturn in dwelling construction; and a progressive weakening in the labour market.

These aspects of the slowdown are all captured in the nine components of the Leading Index.

Indeed, the sharp slowdown in the growth rate of the Index in May is attributed to weaker reads on components with a global perspective (the S&P/ ASX200; commodity prices; and US industrial production); ongoing very weak reads on consumer confidence; a further sharp pull-back in dwelling approvals and a slowdown in the labour market (captured by both unemployment expectations and total hours worked).

Stepping back from the very latest month, the weaker Index growth since late last year is due to several factors. The Leading Index growth rate has declined from -0.89% in November to the current -1.09%.

The three main components driving this deterioration have been: dwelling approvals (taking an extra 0.25ppts off the headline growth rate); monthly hours worked (-0.1ppts); commodity prices in AUD terms (-0.1ppts); and the S&P/ASX 200 (-0.07ppts).

These added drags have been partially offset by a stabilisation in the yield spread as markets have started to anticipate an end to the monetary tightening cycle (+0.27ppts).

The Reserve Bank Board next meets on July 4. We expect it will decide to raise the cash rate by a further 0.25%.

Despite the disturbing outlook for the domestic economy, inflation remains too high and progress in bringing it back down has been mixed.

Labour markets are tight and the unemployment rate remains well below the Bank’s measure of full employment.

Developments around wages have also surprised to the upside and are unnerving the Board with concerns that wage expectations are lifting and could boost wages growth above previous estimates.

In addition, house prices are rising again despite recent increases in interest rates.

As we saw at the June Board meeting, we expect that the July meeting will see these considerations of inflation risks again overriding concerns about the poor growth outlook.