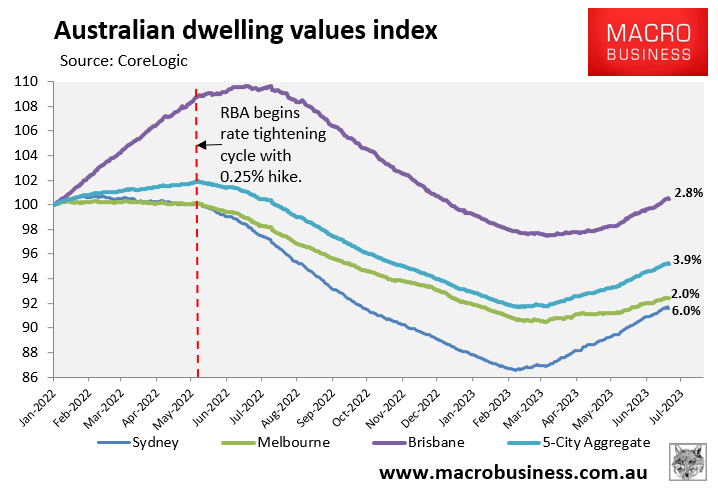

Australia’s housing market continues to laugh in the face of the Reserve Bank of Australia’s (RBA) interest rate hikes.

In addition to the ongoing strong growth in dwelling values, as measured by CoreLogic:

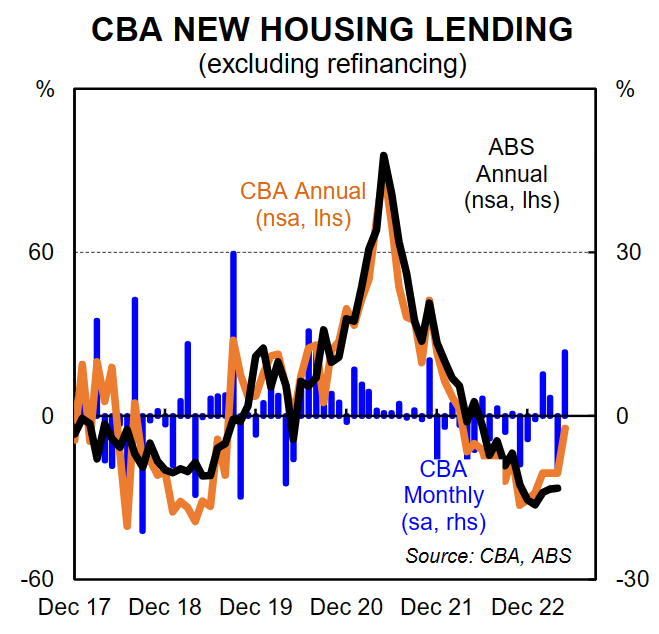

CBA’s internal data shows that mortgage lending bounced in May, driven by a sharp increase from investors:

According to the CBA, “the average loan size for investors rose sharply in the month. The lift in the annual rate reflected improvement in lending to purchase existing dwellings”.

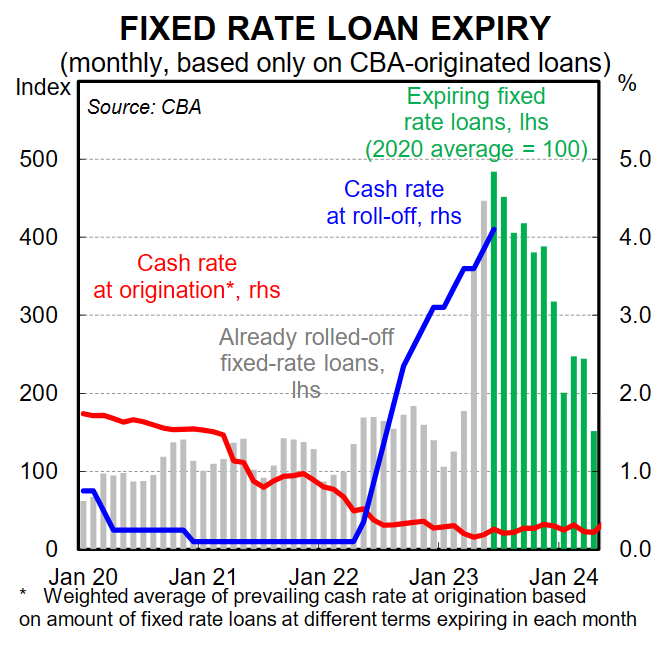

CBA also noted that “the ramp up in the number and value of fixed rate loans rolling off low fixed rates on the CBA book began in April”.

“The gap between the cash rate when these borrowers took out their loan and the current cash rate continues to widen”:

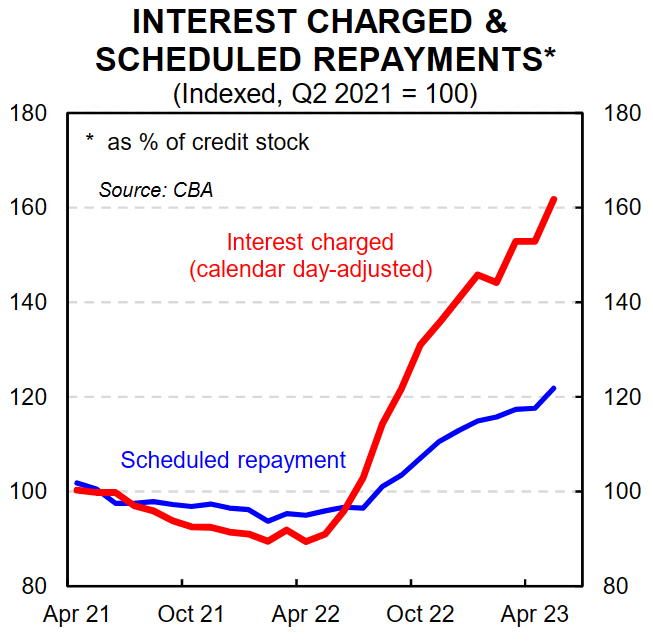

Meanwhile, “there is on average a 3-month lag for variable rate borrowers. There are also lags for fixed-rate borrowers, of up to a few months. Some of this upwards reset to repayments is showing in the May data”:

Of the 400 basis point increase in the cash rate so far, it is likely that around 350 basis points will have been passed on to outstanding variable mortgage holders by the end of June.

Using the example of a $750,000 mortgage, this will take repayments up by around $1,550 per month.

Additionally, as shown above, the bulk of fixed-term home loans taken on during the pandemic are still to expire, which will expose hundreds of thousands more households to a spike in repayments.

Given these factors, it is highly unusual that mortgage demand has lifted higher.

Presumably, the record 500,000 increase in Australia’s population over the past year is having a big impact.

The Albanese Government has one foot planted firmly on the accelerator with its record immigration program, while the RBA has one foot jammed on the brake with its aggressive interest rate hikes.