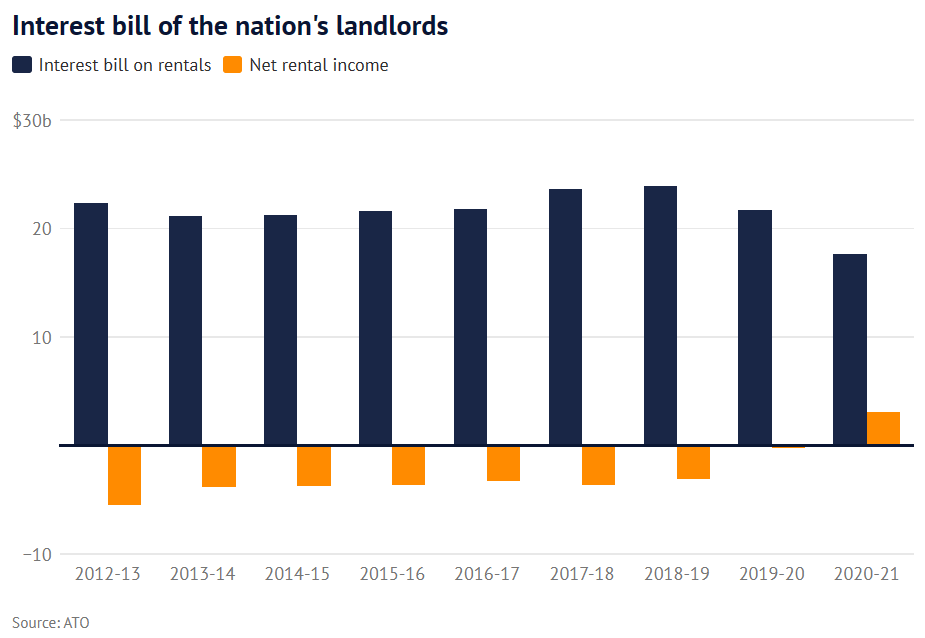

Data released by the Australian Taxation Office (ATO) shows that Australia had a record 2.2 million landlords in 2020-21 when the Reserve Bank of Australia (RBA) cut interest rates to 0.1%.

Of that number, 1.2 million either made a profit or did not lose money while one million lost money, making it the lowest number of negatively geared landlords since 2005-06.

It was the first time since the Howard government implemented a 50% capital gains tax break for assets owned for more than a year that more landlords made a profit than a loss.

Landlords made a collective profit of $3.4 billion on their properties in 2020-21, compared to a loss of $240 million in the previous year, according to the ATO.

In 2007-08, the share of negatively geared landlords reached over 70%. The RBA had raised the official cash rate to 7.25%, right before the start of the Global Financial Crisis (GFC).

The situation has obviously changed markedly since 2020-21.

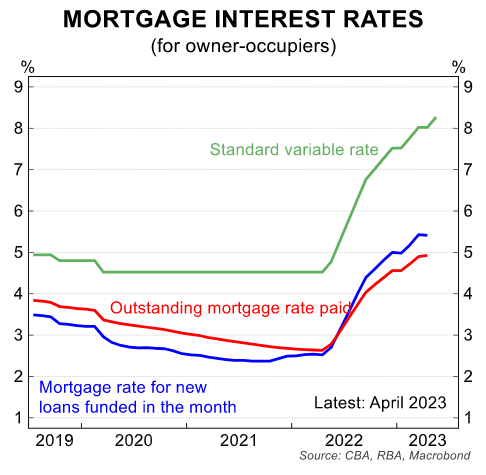

The RBA has hiked the official cash rate (OCR) by 4.0% in only 13 months, which has sent mortgage rates soaring:

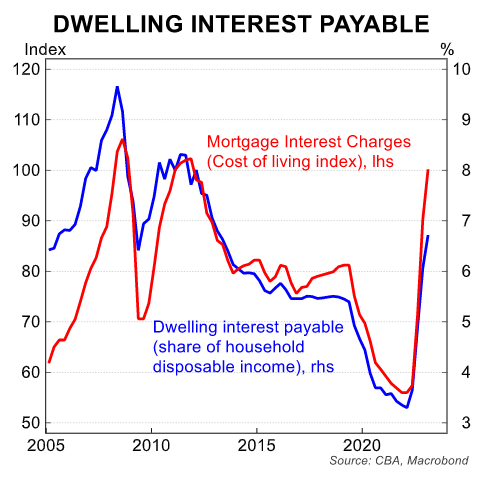

Mortgage interest payments are fast approaching those GFC highs:

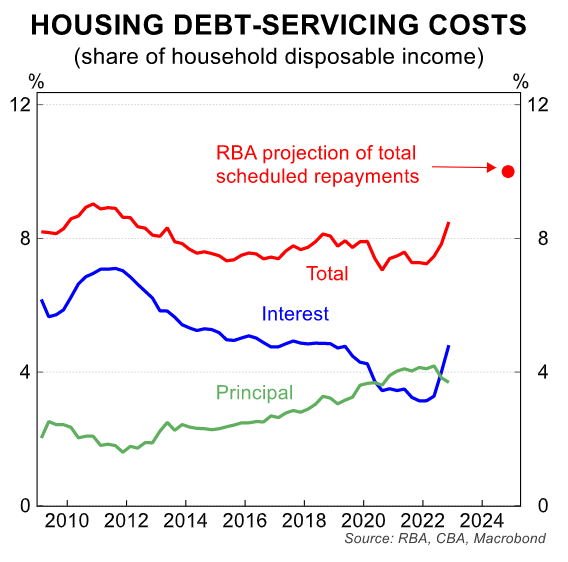

And once the fixed rate mortgage reset runs its course, mortgage repayments will soar to an all-time high share of Australian household disposable income:

This means property investors will bleed losses, since mortgage interest repayments will have risen much faster than the growth in rents.

The increase in rental losses also has implications for the federal budget.

The Australian Treasury’s annual Tax Benchmarks and Variations Statement projected $102 billion worth of negative gearing tax deductions over the next four years:

That is up from $73 billion over the prior four years.

However, that forecast was made in February, before the last three 0.25% interest rate hikes from the RBA.

The federal budget is, therefore, looking at large negative gearing losses as Australia’s army of landlords deducts their net rental losses from their personal taxable income.