Oil bomb or yawn? Goldman says grenade:

Today’s OPEC+ meeting was moderately bullish, on net, with three main developments. First, Saudi Arabia pledged to deliver an additional 1mb/d unilateral “extendible” output cut in July (bullish). Second, the voluntary cuts from the 9 OPEC+ countries are scheduled to extend until December 2024, from December 2023 previously (somewhat bullish). Third, output baselines will be redistributed in 2024 from countries struggling to reach their targets to those with ample spare capacity (somewhat bearish output effect, but bullish cohesion). It is important to put these decisions in the context of sentiment and positioning, which remain very weak and short. While the extra Saudi cut is worth +$1-6/bbl in terms of fundamentals, depending on whether the cut lasts 1-6 months, and strength in physical markets (borrowing a recession) should eventually boost positioning and prices, the delivery of Saudi’s first production cut within three months of a prior cut with stocks as low as today and the Saudi Energy Minister’s “whatever is necessary” (Draghi-like) quote signal the group’s commitment to continue to lean against the shorts and preemptively leverage its unusually high pricing power. Overall, today’s moderately bullish meeting partly offsets some bearish downside risks to our December 2023 price forecast of $95/bbl, including supply beats in Russia, Iran, and Venezuela, and downside risks to China demand.

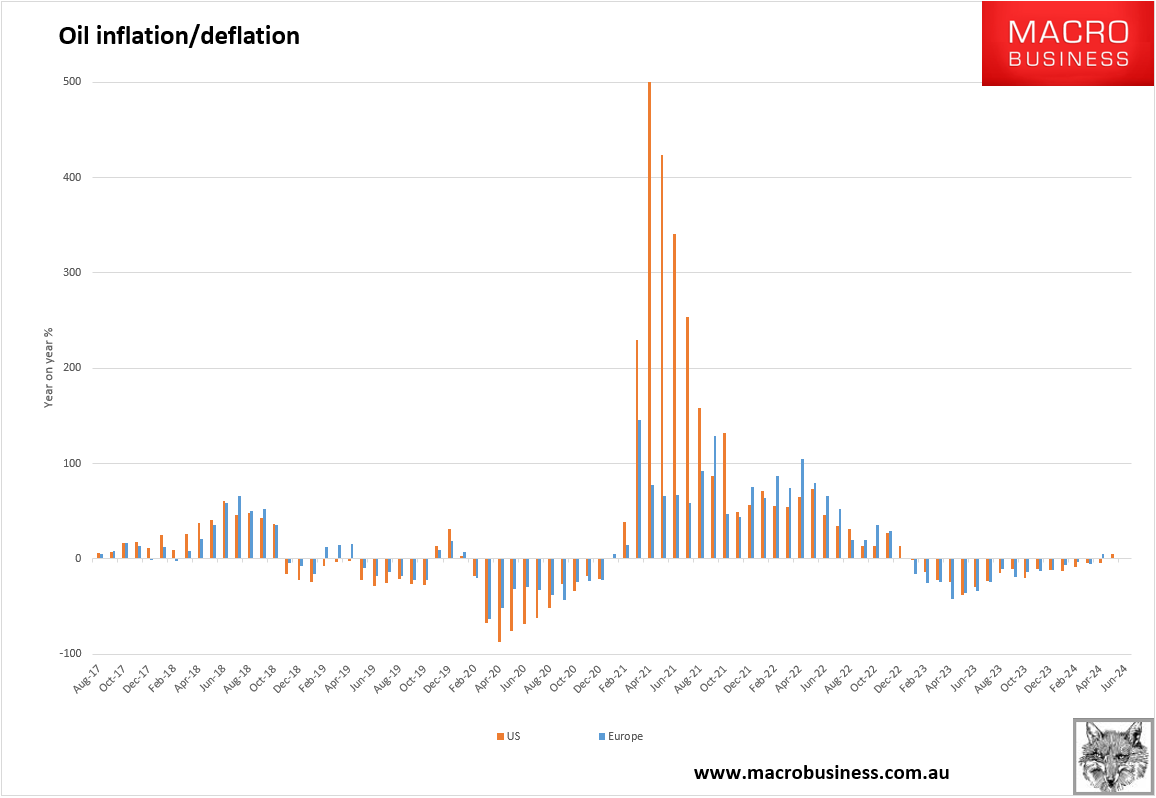

Meh. Oil prices are still deflationary for another year or so in developed economies: