Tuesday’s 0.25% interest rate hike by the Reserve Bank of Australia (RBA) has raised doubts about the sustainability of the nation’s housing market rebound:

In a media release following the RBA’s decision, Managing Director of SQM Research, Louis Christopher, warned that the housing rebound could represent a “false dawn”, with Christopher stating “the probabilities of a double dip downturn in the Australian housing market now move to higher than 60%”.

“We can now expect distressed activity to rise based on a new round of forced and panicky selling starting sometime the 2nd half of this year”, added Christopher.

“This will particularly be the case if unemployment rises towards 5%. Naturally, the higher the unemployment rate, the more forced selling we will see”.

Christopher advises market participants “to be prepared for a new round of housing price falls starting in the second half of 2023”.

“The price falls may not immediately occur, but the expectation is the spring selling season will be a tough one for sellers”.

Christopher likewise believes “buyers need to be very cautious in this environment, especially for regional areas which were already weakening”.

“But I doubt our larger cities will be spared much given the massive mortgage debts outstanding”.

“As a potential buyer, spending some time on the sidelines, researching the market, isn’t a bad idea, right now”.

Christopher also believes that making forecasts in the current environment is futile, given there “are too many X factors at play including an emergency rate cut if the RBA realizes they have risen too hard”.

“Never forget in all this, that once confidence really cracks (due to recession) it can stay that way, even with rate cuts”.

“The recession of 1990 to 1992 taught us that confidence in the economy, in housing can take a very long time to recover”, concluded Christopher.

Westpac’s latest Housing Pulse, released last week, also questioned whether the current price-led rebound amid falling volumes was sustainable.

“Housing recoveries typically only emerge once the RBA is actively cutting rates or is very clearly poised to do so”, Westpac noted.

“Price gains also tend to follow a sustained lift in turnover, not vice-versa”.

“The positives in play – migration, construction costs and limited supply – tend to be marginal and gradual drivers of price gains”.

“Overall, the history suggests ‘price-led’ upturns are rare and relatively hard to sustain”, Westpac concluded.

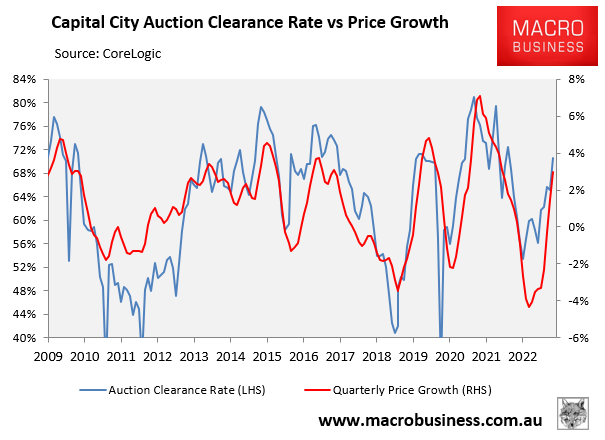

The next few weeks auction results will be interesting and will tell us whether the RBA has broken the back of the housing market, which could lead to a possible double-dip correction.

Pass the popcorn.