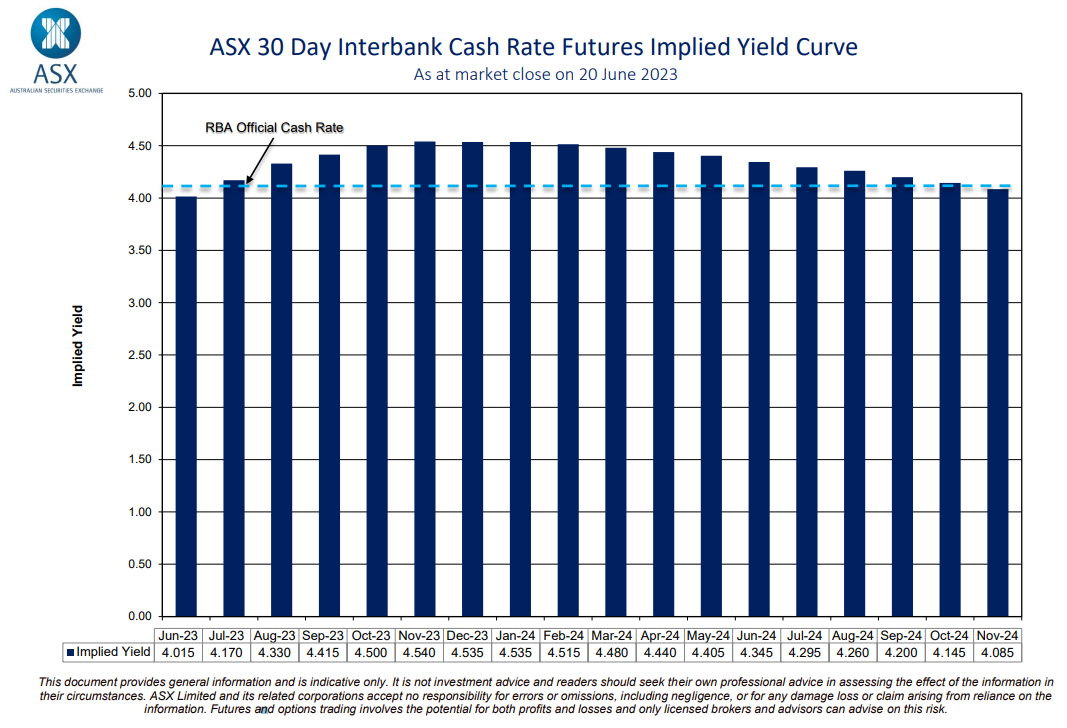

Interests rate futures are still pricing in two more interest rate hikes:

This is pretty remarkable given the number of negative signals sweeping leading economic data.

Consumer confidence is at levels only associated with catastrophe, business confidence is breaking towards it.

Signals from retailers are howling that consumption is breaking down. Business investment will follow as night follows day.

As we know, GDP growth follows consumption. Growth determines the labour market, where leading indicators are clearly falling apart. Arguably, unemployment approaching 5% is already locked in.

In short, the Aussie economy is clearly already recessionary and inflation will track it down.

Or will it? In its Minutes this week, the RBA is also still talking up interest rate hikes for a number of reasons that all point in now direction: the Alboflation that is the keeping heat on CPI. From the Minutes:

Members noted that growth in economic activity in Australia had slowed since mid-2022, as the post-pandemic recovery in spending faded and the substantial tightening in monetary policy worked its way through the economy. The national accounts, to be released the day after the meeting, were expected to show only modest growth. Members noted that the new policies announced in the Australian Government Budget had not had a material effect on the staff forecasts for economic activity and inflation.

There was growing evidence that household consumption growth had been subdued in the first half of 2023. Retail volumes had declined in the March quarter, despite strong population growth, and liaison with retailers suggested that conditions had softened further in the June quarter. Growth in spending on consumer services, including cafes and restaurants, had generally slowed but by less than other forms of consumption.

National housing prices had increased in recent months and households’ expectations for future rises in housing prices had strengthened. Members noted that, if sustained, this would imply less of a drag on consumption in the year ahead than had previously been envisaged…Members discussed the reasons for the unexpected strength in housing prices. They noted that strong population growth had supported demand for housing and that this was largely affecting the established housing market.

Members noted that the labour market remained very tight. Nonetheless, conditions had eased slightly, alongside slower growth in economic activity. Employment growth over the prior six months had been a little less than growth in the working-age population over that period. Firms in the Bank’s liaison program had reported some improvement in labour availability. Acknowledging that the monthly data are volatile, members noted that the unemployment rate had ticked up to 3.7 per cent in April and the number of people employed had been little changed.

…Members noted that there were various other considerations that created upside risk for inflation. Retail electricity prices had risen over the preceding year, but – unlike in other countries – there would be an even larger increase in the year ahead. Rent inflation had been high in April, reflecting very tight rental market conditions across the capital cities, and appeared to be drifting up further.

That is pure Alboflation:

- Immigration-fed house prices and rents.

- The failure to tackle the energy crisis.

- Pay rises for bureaucrats with no productivity gain.

Don’t blame the RBA for rate hikes now. They are all about Alboflation.