The Reserve Bank of Australia (RBA) has spent much of the past year warning of a wage-price breakout.

The RBA, alongside Treasury and the business lobby, also ridiculed recent analysis by The Australia Institute (supported by MB) that it was actually companies choosing to fatten their profit margins that was driving inflation.

On Thursday, the RBA released the Minutes of its latest Monetary Policy Meeting, where it finally admitted that large companies are keeping inflation high.

“Members observed that some firms were indexing their prices, either implicitly or directly, to past inflation”, the Minutes read.

“These developments created an increased risk that high inflation would be persistent, which would make it more difficult to keep the economy on the narrow path”.

Hilariously, when workers demand that their wages grow at the same rate as inflation, they are labelled irresponsible and lambasted from pillar to post.

But when corporations lift their prices by inflation or higher, not a word of protest is muttered.

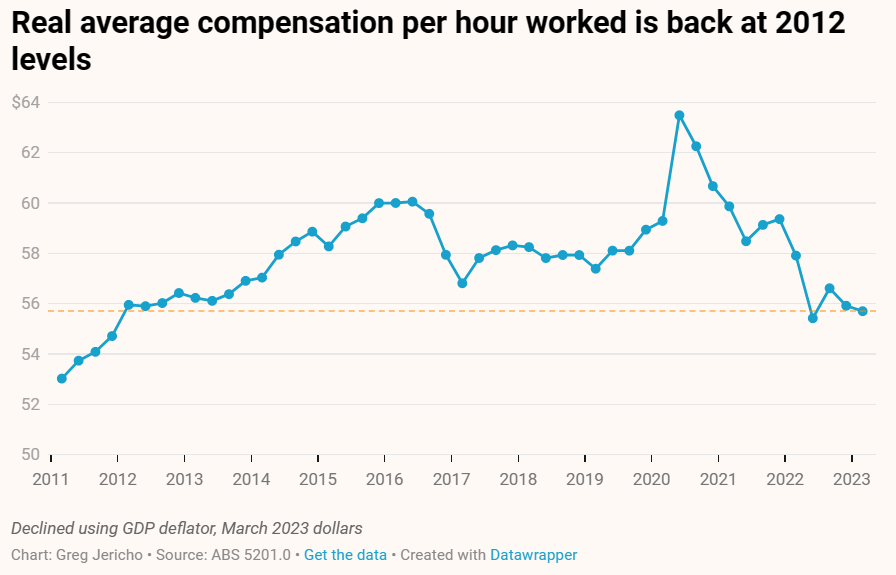

The reality is that Australian workers have actually been suppressing inflation by keeping their wage claims in check, which is why real average compensation has fallen to 2012 levels:

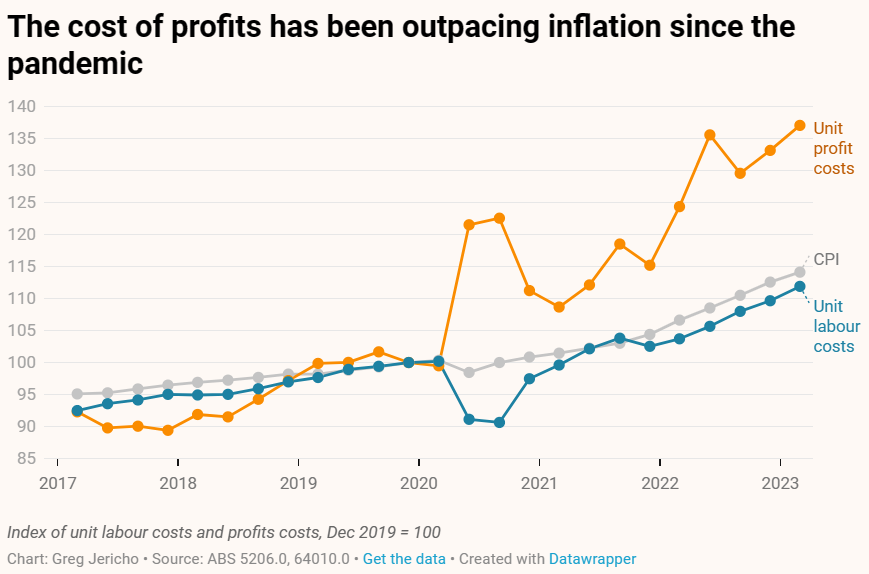

The same cannot be said for Australian corporations, who have made out like bandits:

It is profiteering by companies lifting prices to fatten their margins that is driving Australia’s inflation, not workers, who are experiencing the fastest decline in real wages on record.

It is time for the RBA, Treasury and the business media to be honest about the situation, stop blaming workers, and direct their ire at the corporations fuelling Australia’s inflation.