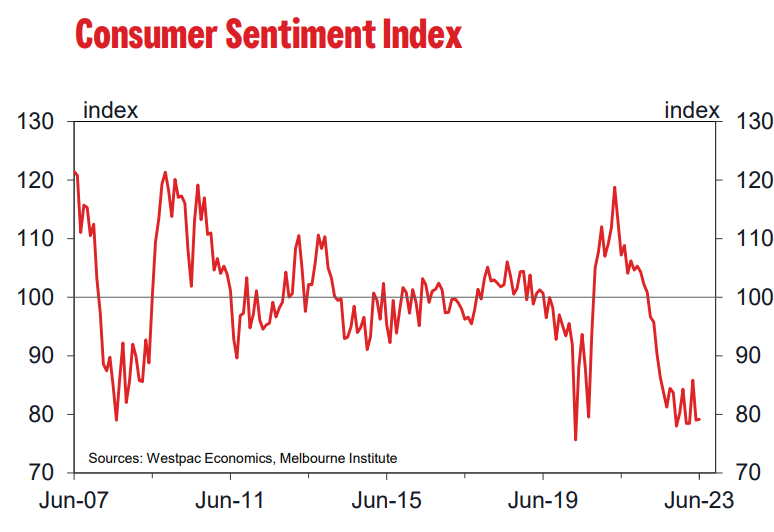

On Tuesday, Westpac released its latest consumer confidence survey, which “held around levels we have not seen on a sustained basis since the deep recession of the late 1980s/early 1990s”:

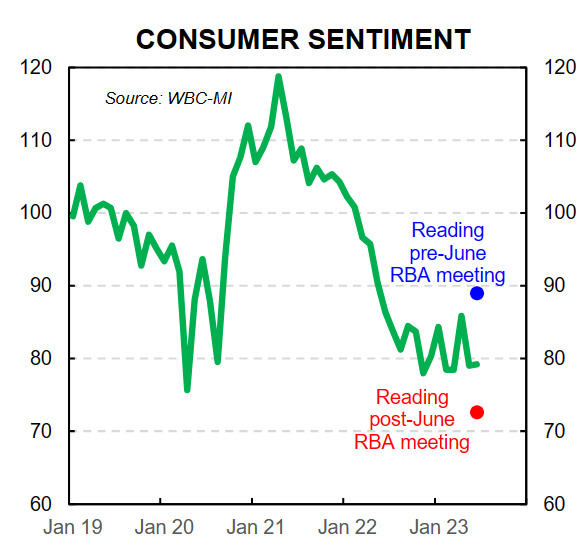

The survey was undertaken over the period 5-9 June, which covered the RBA’s decision to lift the cash rate by 0.25% from 3.85% to 4.1%.

“While the full survey showed little net change in sentiment, responses within the survey week show a big rate rise impact”, Westpac Chief Economist Bill Evans noted.

“Prior to the announcement of the rate hike decision confidence had lifted sharply from 79.0 in May to 89.0. But following the announcement it tumbled to an extremely low 72.6”.

The next chart from CBA economists Stephen Wu and Harry Ottley shows the clear difference in consumer sentiment readings before and after the RBA’s rates decision:

“Westpac notes that those surveyed prior to the rate hike decision were more optimistic than in May, with sentiment for this cohort increasing to 89pts”, the CBA economists note.

“In sharp contrast, those surveyed post-RBA Board meeting were deeply pessimistic, with a reading of just 72.6pts”.

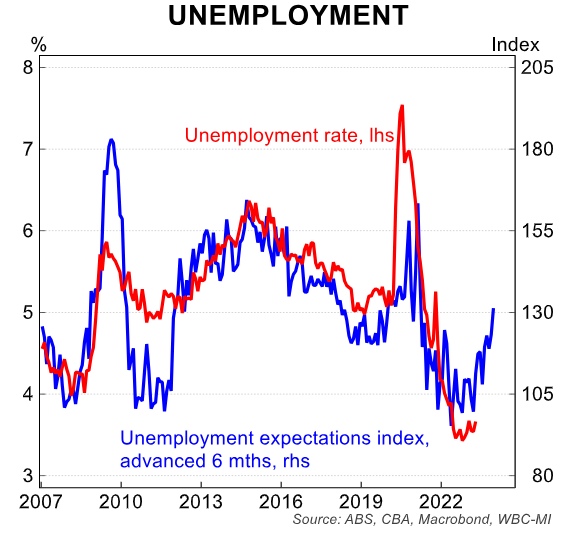

“Worryingly, survey respondents’ expectations for unemployment shot up in June, up by 6.6% in the month”.

“The index has increased sharply over the past year as the RBA began its rate hike cycle and points to further lifts in the unemployment rate over the rest of 2023”.

“The June 2023 figure for unemployment expectations has risen to now be around its mid 2019 levels, when the unemployment rate was above 5%”.

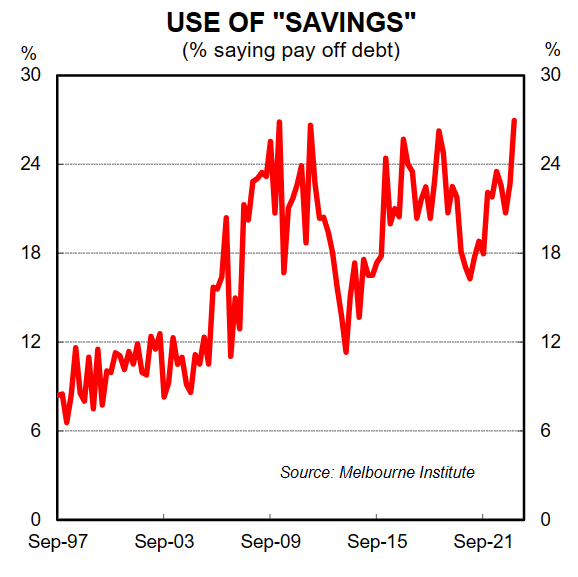

Interestingly, Westpac’s survey also shows that the highest share of respondents in history are now using savings to pay down debt:

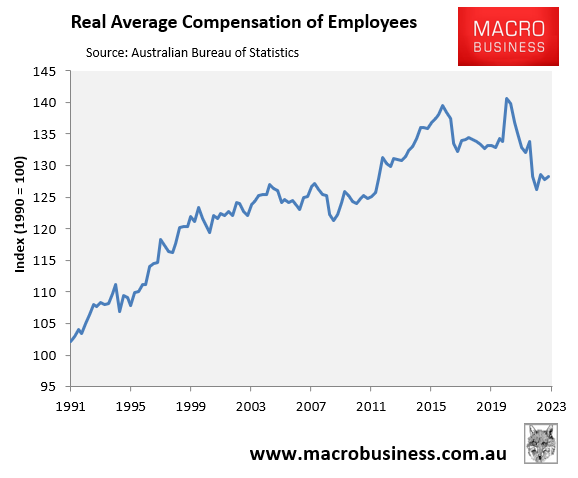

Consumer pessimism is understandable given households are experiencing their sharpest decline in real wages on record:

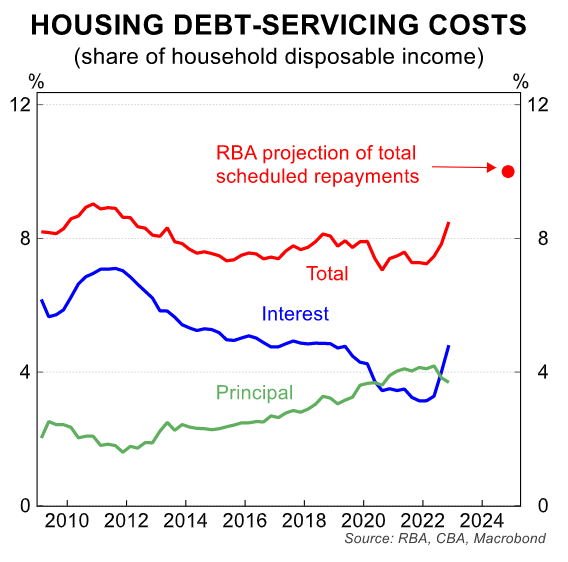

Household debt repayments are also forecast to rise to a record share of household disposable income once the RBA’s rate hikes filter through and the fixed rate mortgage reset runs its course:

2023 is turning out to be a calamitous year for Aussie households – especially for the one-third whom are paying off a mortgage.