The Reserve Bank of Australia’s deputy governor Michele Bullock gave a speech to the Australian Industry Group on Tuesday where she said the nation’s unemployment rate will need to rise to 4.5% over the next year if inflation is to be progressively restored to the target range of 2-3%.

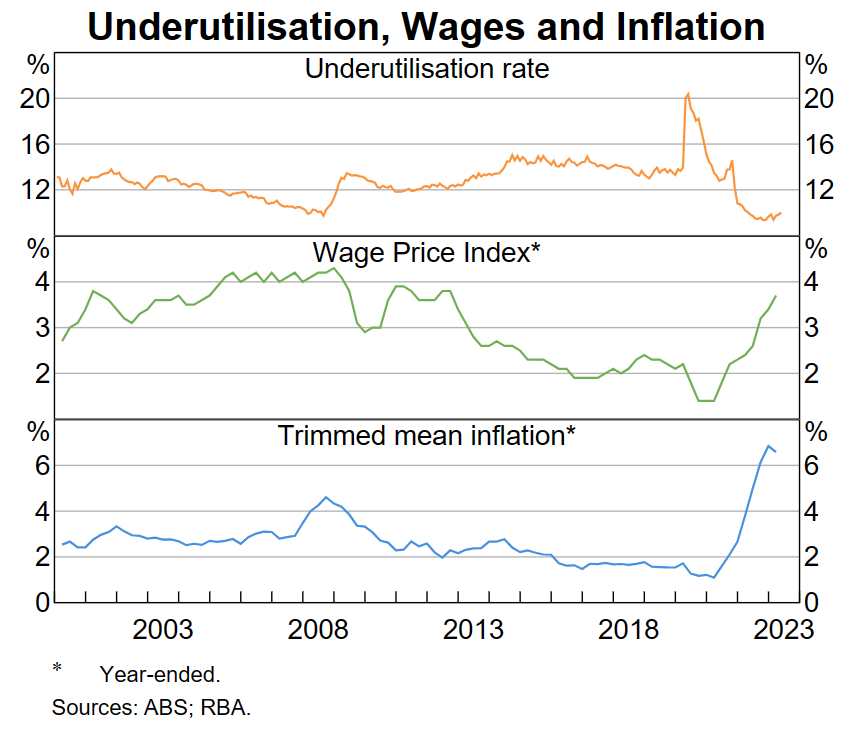

“If unemployment remains too low for too long, inflation expectations will rise, which will make it that much harder for the monetary authorities to bring inflation back down”, Bullock said.

“One of the channels through which higher interest rates work to bring down inflation is by reducing the demand for goods and services and hence overall demand for labour”.

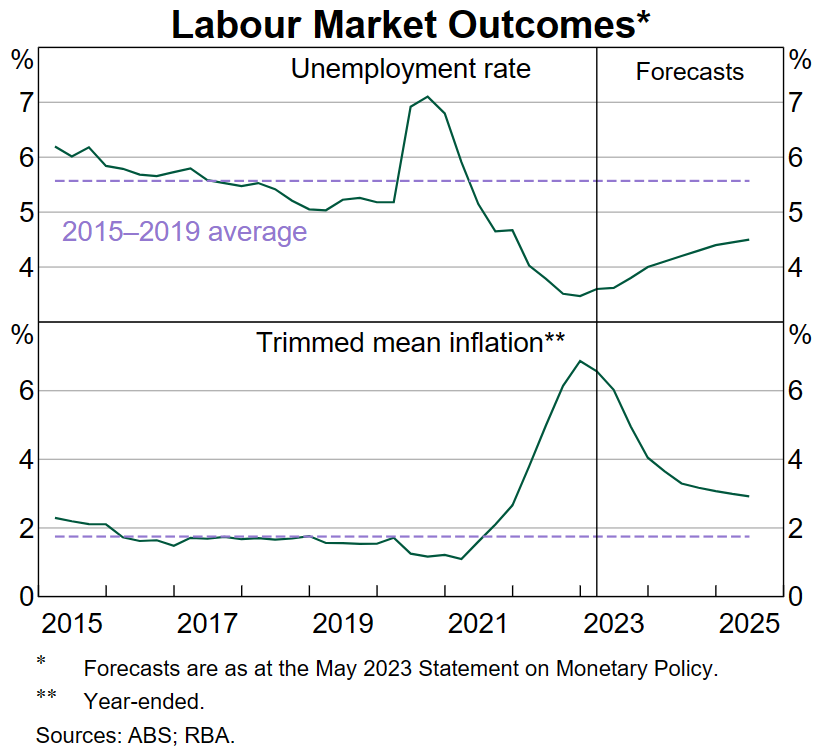

“Indeed, our most recent forecasts have inflation returning to target by mid-2025, while employment growth slows but does not contract. The unemployment rate is expected to rise to 4½ per cent by late 2024”.

“While 4½ per cent is higher than the current rate, this outcome would still leave us below where it was pre-pandemic and not far off some estimates of where the NAIRU might currently be. In other words, the economy would be closer to a sustainable balance point”.

Bullock added that failure to bring inflation under control would most likely result in a “deep and long-lasting recession”.

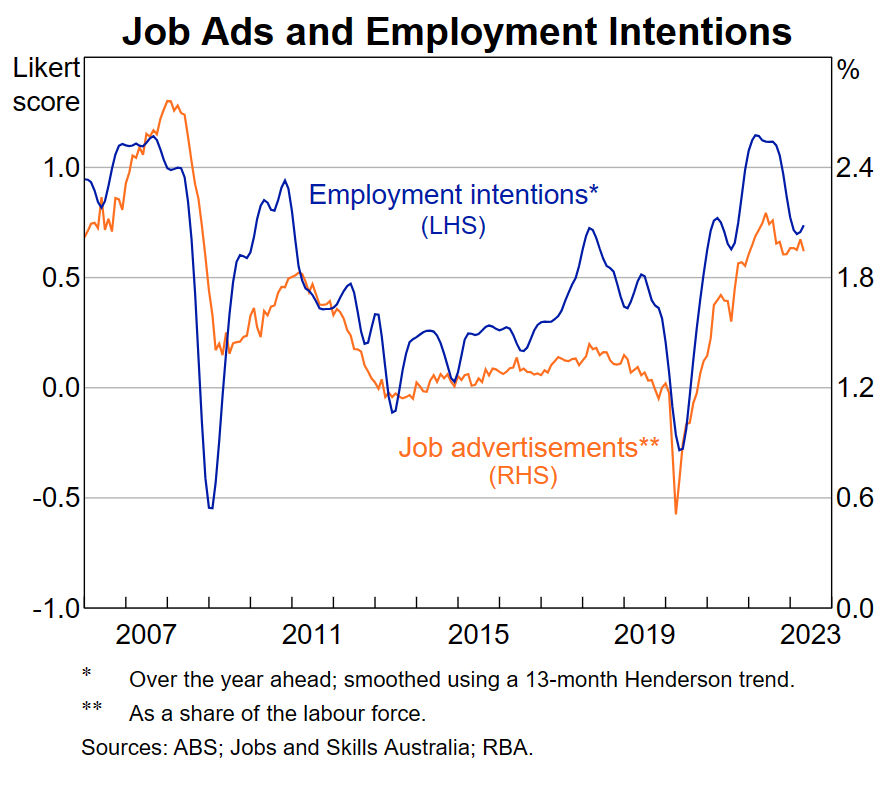

Bullock also noted that the labour market is loosening courtesy of strong immigration amid the softening economy.

“The balance between labour demand and supply has improved somewhat as the sharp increase in net arrivals from overseas may have helped to alleviate shortages in some areas and labour demand has moderated as the post-pandemic recovery has run its course”:

Bullock’s comments have been criticised by union leaders, with CFMEU national secretary Zach Smith saying it is shameful for a top central banker to state that unemployment needs to rise.

He contends that tens of thousands of livelihoods would be at risk from such an “irresponsible economic approach”, and adds that corporate profits are the main driver of the high inflation rate.

Smith said workers had been “pummelled by the RBA with a dozen rate rises, yet it seems this out-of-touch ho bed of neoliberal economics isn’t finished (in) its quest to dish out more pain”.

“For a top central banker to suggest unemployment needs to rise is shameful”.

“Why is it always working people who need to pay when we know corporate profits are fuelling this inflationary storm?”

“These aren’t just numbers on a page. What we’re talking about here is tens of thousands of livelihoods at risk from this irresponsible economic approach.”

Electrical Trades Union acting national secretary Michael Wright said “it would be really refreshing to see the Reserve Bank propose a policy that didn’t ask Australia’s poorest to take it in the teeth”.

The union movement isn’t wrong. The RBA’s latest monetary policy minutes explicitly admitted that corporations are driving the nation’s inflation.

“Members observed that some firms were indexing their prices, either implicitly or directly, to past inflation”, the Minutes read.

“These developments created an increased risk that high inflation would be persistent, which would make it more difficult to keep the economy on the narrow path”.

However, the RBA only has one blunt tool – interest rates – and the impact of rate hikes inevitably falls on workers, especially the most vulnerable.

Still, it would be nice for the RBA, Treasury and the business media to be honest about the situation, stop blaming workers, and direct their ire at corporations fuelling Australia’s inflation.

They should also demand that the Albanese Government smash the east coast gas cartel into oblivion to lower energy prices and inflation.