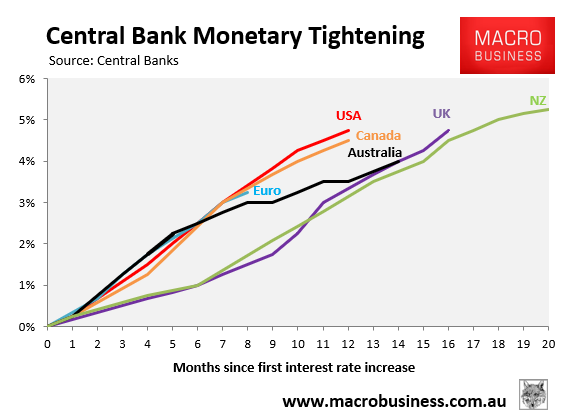

The Reserve Bank of New Zealand has delivered one of the world’s largest house price corrections by hiking interest rates further than nearly every other advanced nation:

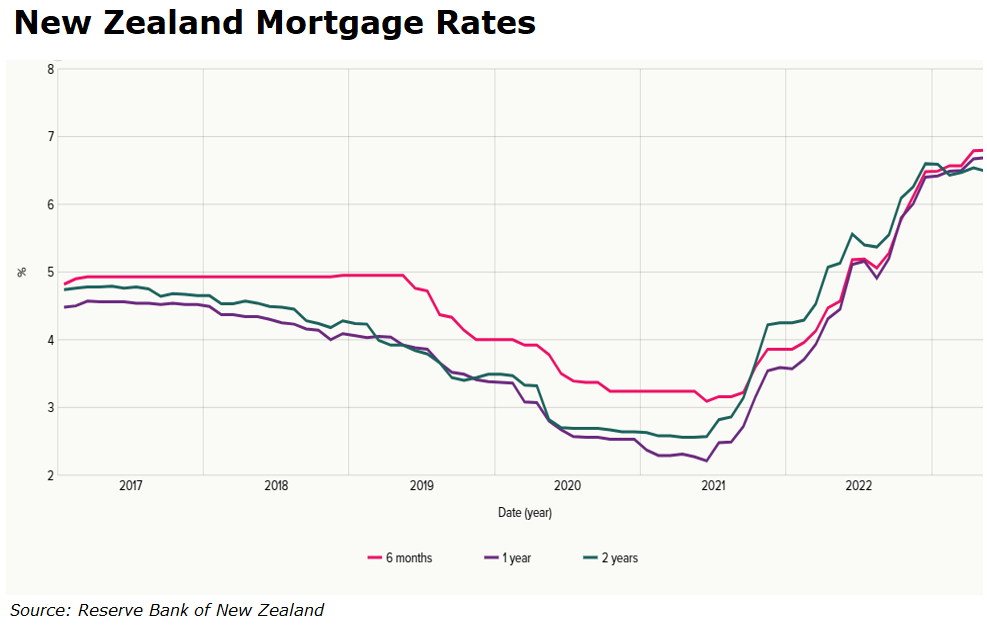

House prices across New Zealand have tanked by around 17.5% from their November 2021 peak in response to a near doubling of mortgage rates:

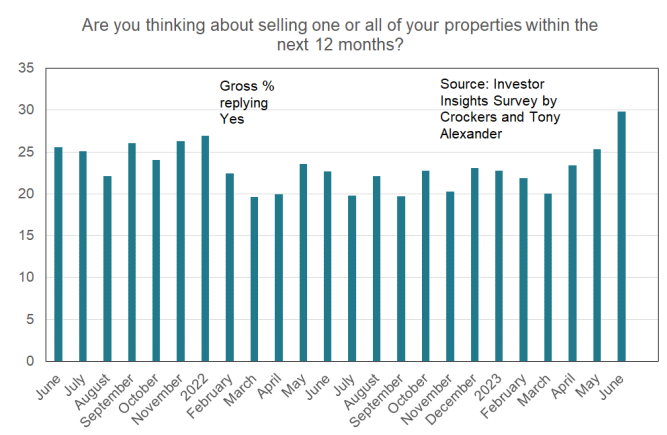

As a consequence, a record number of landlords are now considering selling their properties in the coming year, according to the latest Crockers/Tony Alexander Investor Insight report.

This figure is up from 25.3% last month, and above the survey’s average of 23.7%:

Tony Alexander explained that the increase was most likely due to rising mortgage rates alongside the additional 25% fall in the proportion of mortgage interest investors may offset against rental income that arrived with the new financial year.

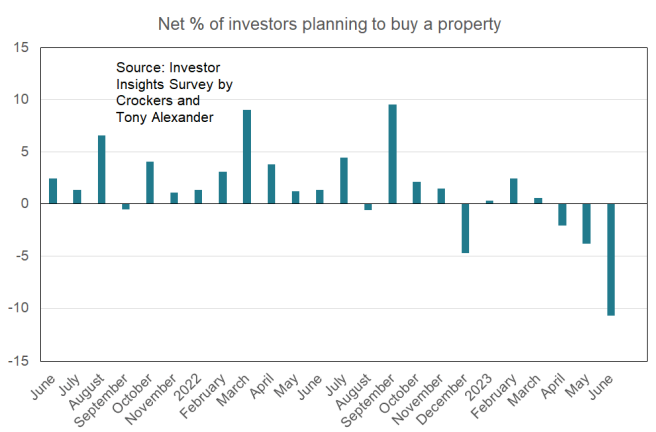

By contrast, only 19% of investors are considering buying in the next 12 months – the second lowest reading on record.

“Putting the two measures together we can calculate net buying intentions, and this can give an indication as to whether price pressures are upward or downward from the people who already own residential property investments”, Alexander wrote.

“A net 11% of investors say they will sell in the coming year. This is a record level of net selling intentions”.

The key takeaways from the survey, according to Alexander, are:

- Investors on average are increasingly thinking about selling their properties as interest rate pressures grow.

- A rising motivation for selling is concern about the loss of interest expense deductibility.

Borrowing for real estate investment makes financial sense when interest rates are low and values are growing.

When the opposite happens, as it is now in New Zealand, investing in real estate can be a financial nightmare, driving some out of the market.

That said, Tony Alexander sees brighter days ahead for property investors if National wins the upcoming election on 14 October.

If elected, National has promised to return mortgage interest deductibility and reduce the bright-line (capital gains) test from between five to ten years to only two.

Alexander also notes that “interest rates look to be peaking, we have booming net migration which boosts demand for rental accommodation, and there is talk of house prices rising over the next year”.

Therefore, Alexander doesn’t actually expect to see a wave of forced selling from investors.